With its 5G plans on track, Verizon reports a small Q1 decline in postpaid smarphone customers

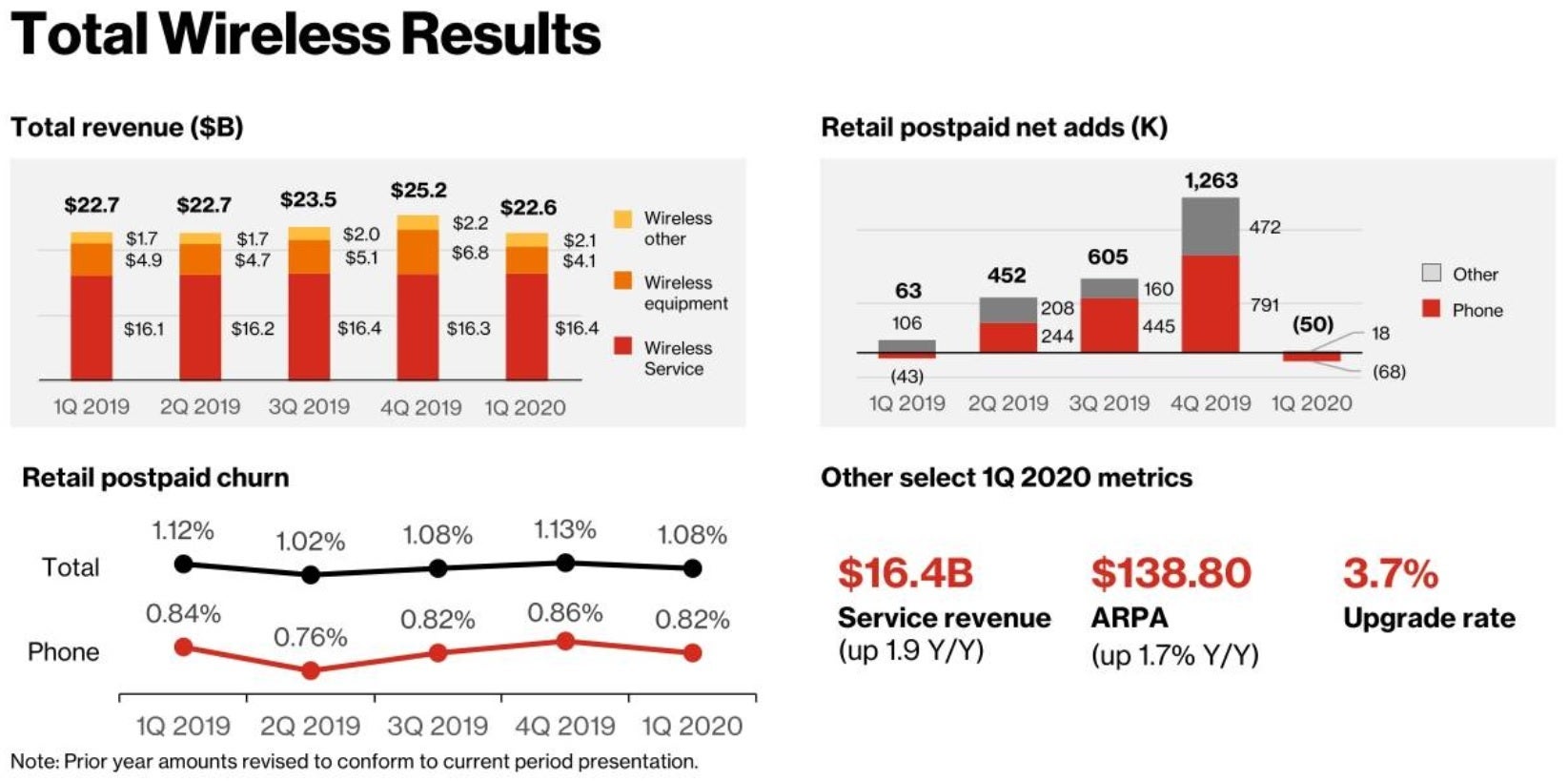

On Friday, Verizon announced its first-quarter earnings results for 2020. The carrier closed 70% of its company-owned retail locations and those still open had reduced hours thanks to the COVID-19 outbreak. Including both its business and consumer retail customers, Verizon lost 68,000 postpaid smartphone subscribers during the three months that ended at the end of March. That is 58% more than the 43,000 it lost during the first quarter last year. Retail postpaid phone churn was .82%, slightly improved from the churn of .84% it reported for the same quarter last year, and the .86% registered during the fourth quarter of 2019.

During the quarter, Verizon launched the exclusive Motorola razr priced at $1499.99

For the quarter, revenue generated by the wireless unit amounted to $22.6 billion. Service revenue was $16.4 billion, up 1.9% year-over-year. The average service revenue per account was up 1.7% on an annual basis to $138.80. Equipment sales were $4.1 billion, a drop of 16.3% from the year earlier, and a 40% decline from the fourth quarter of 2019. Operating income for the wireless segment was $7.3 billion, a gain of .4% from the same quarter in 2019.

Verizon lost 68,000 prepaid smartphone customers during the first quarter of 2020

So how did the COVID-19 outbreak affect Verizon in the period? Between March 15th and April 15th, a period that includes two weeks from Q1 and two weeks of Q2, consumer postpaid gross additions were down 49% and postpaid device activations dropped 44%. The small and medium business segment over the same time period had 24% fewer gross postpaid additions and 33% fewer activations. During the first quarter, Verizon exclusively launched the Motorola razr, the Android-powered smartphone version of one of the most popular feature phones of all time. The phone is priced at $1,499.99 or 24 monthly payments of $42.

Verizon Chairman and CEO Hans Vestberg said, "In an unprecedented time, Verizon took decisive and balanced actions that will serve our stakeholders in the long term, including protecting our employees, maintaining our network quality and reliability, serving our customers, and supporting our communities. We will emerge from this crisis stronger, knowing we provided critical connectivity to our customers, and especially our first responders, while maintaining our commitment to investing in our 5G and Fiber strategies. We are particularly proud of our employees who continue to deliver essential services to our customers and those on the front lines so they can serve others."

Verizon feels confident about its ability to execute in the near and long-term

T-Mobile started out using its low-band 600MHz spectrum to build out the first nationwide 5G network in the U.S. However, until T-Mobile finishes integrating the 2.5GHz mid-band airwaves it just recently acquired in the Sprint merger, its 5G download data speeds are not much better than 4G LTE. The low-band spectrum used by T-Mobile can travel farther and penetrate buildings better than high-band spectrum. However, the capacity is smaller and the data speeds are slower.

Verizon is taking a different tact to build out its network. It is using high-band mmWave spectrum which delivers download data speeds of 1Gbps and higher. But since these signals don't travel far, it will take Verizon some time to finish its coast-to-coast 5G network. As for T-Mobile, it says that in a few years its 5G signals will be eight times faster than current 4G LTE and 15 times faster after the next six years. Which carrier is building out its 5G network the best way? That is a question that can't be answered just yet. At the end of this year, Verizon hopes to have 5G available in 60 cities. Meanwhile, some analysts see T-Mobile's nationwide 5G network maturing into the fastest 5G network in the future.

At the end of the first quarter, the nation's largest wireless provider had 89.9 million postpaid subscribers and 4 million prepaid subscribers for a total of 93.9 million. That is down slightly from the 94.1 million wireless customers it had during the same quarter last year, and down from the 94.5 million it had after the fourth quarter of 2019.

Things that are NOT allowed: