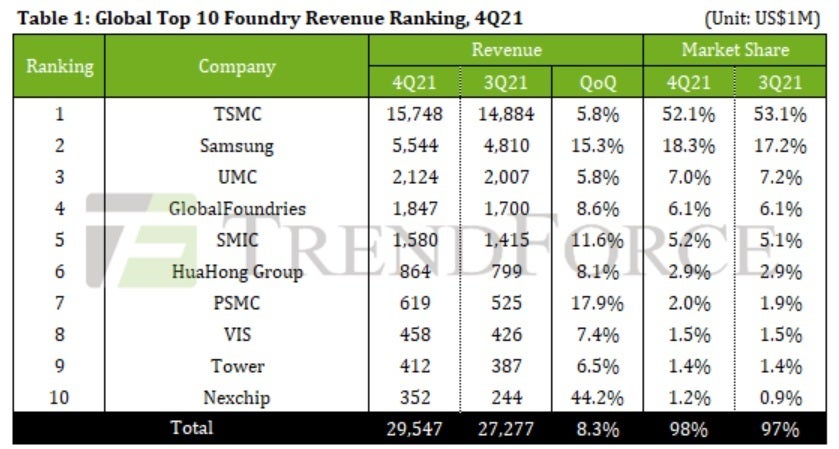

TSMC continues to dominate the global foundry business with Samsung a distant second

According to Trend Force, TSMC's market share during the fourth quarter of last year was 52.1% based on its revenue of $15.7 billion during the three-month period. That was down from the 53.1% share of gross that the foundry had during the previous quarter, but was still well ahead of the next name on the list.

Behind TSMC was its biggest rival in the industry (at least for now), Samsung Foundry. The latter had 18.3% of industry revenue at the end of the last quarter of 2021. Even with strong 15.3% growth in its top-line on a quarter-over-quarter basis, Samsung's gross for the period from October through December was only 35% of TSMC's.

TSMC keeps its large lead in global market share over Samsung Foundry

And things are about to get worse for Samsung. Low yields on the production of some Application Processors (AP) by Samsung, about half the yield rate achieved by TSMC, has led Qualcomm to move over production of some of its most powerful Snapdragon chipsets to TSMC from Samsung. Additionally, Samsung is investigating the disappearance of funds that the foundry unit had supposedly set aside to improve chip production yields.

TSMC maintains its global market share above 50%

Trend Force notes that while Samsung Foundry is showing strong revenue growth, the bottom line has not been able to stay in gear as "the slower ramp-up of advanced process capacity continues to erode overall profitability."

TSMC's results for the quarter were bolstered by strong growth in revenue connected to the production of 5nm chipsets for the iPhone 13 series. The only TSMC process node that showed a drop in the top line for the fourth quarter was the 7nm/6nm unit which was impacted by a weak smartphone market in China. Samsung's strong 15.3% hike in sequential revenue came about from the completion of its 5nm/4nm advanced process node capacity.

After the well-known pair of TSMC and Samsung, Taiwan's United Microelectronics Corporation (UMC) was next as its Q4 revenue comprised 7% of the industry's revenue for the three months. For the quarter, it garnered $2.12 billion in gross, up 5.8% from its third-quarter revenue. In fourth place, GlobalFoundries kept the 6.1% share of global foundry revenue that it earned during Q3. At number five was China's largest foundry, SMIC, with a market share of 5.2% and Q4 revenue of $1.58 billion.

What holds back SMIC is its inability to compete at the current cutting-edge process nodes of 5nm/4nm with both TSMC and Samsung knocking at the door of 3nm. Like the U.S., China is desperately looking to become self-sufficient in semiconductors, and its failure to do so worries experts who fear that China could use TSMC's success as a reason to take over Taiwan and capture control of the world's largest contract foundry.

For every $100 in revenue collected by TSMC, $26 of that total comes from Apple

The industry is far from balanced in terms of revenue with the top five foundries controlling 90% of global foundry market share. That is understandable though when you consider that TSMC and Samsung are the leaders in advanced process nodes.

The remaining foundries making up 6-10 on the list and their Q4 market shares include HuaHong Group (2.9%), PSMC (2%), VIS (1.5%), Tower (1.4%), and Nexchip (1.2%). The latter might have reported the lowest market share of global foundry revenue for Q4, but it did show the largest growth rate in revenue quarter-over-quarter at 44.2%.

For the fourth quarter, global foundry revenue came in at $29.55 billion, up 8.3% from the third quarter.

One of the reasons for TSMC's success is its long working relationship with Apple. For every $100 in revenue collected by the foundry, $26 comes from Apple. Just last week Apple announced that by combining a pair of its M1 Max SoCs, it created the M1 Ultra which contains a whopping 114 billion transistors inside.

Things that are NOT allowed: