TSMC's founder says Intel will not escape the Taiwan-based foundry's shadow

A couple of years ago, Intel CEO Pat Gelsinger said that Intel would recapture process leadership from TSMC and Samsung Foundry by 2025. Intel said that it would start to produce chips using its 18A node during the second half of 2024. This node is equivalent to 1.8nm and it should be noted that TSMC and Samsung Foundry are expected to start mass-production of 2nm in 2025.

Intel's A18 chipset will be equivalent to 1.8nm and feature Gate-All-Around and Backside Power Delivery

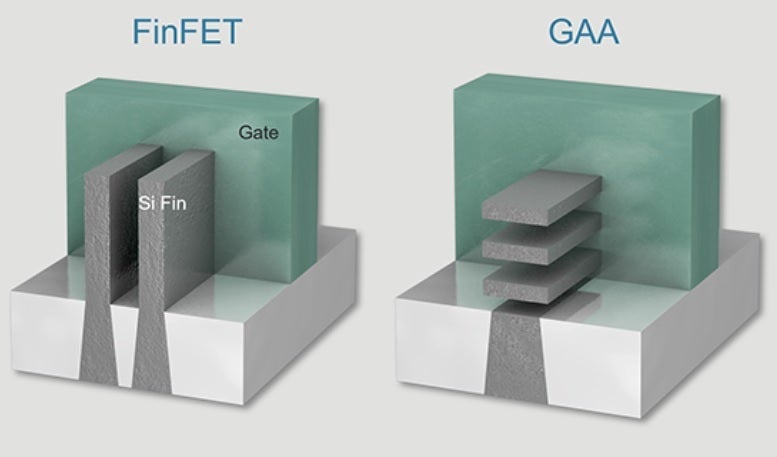

Intel's 18A chips will match TSMC and Samsung Foundry's 2nm chips by using Gate-All-Around (GAA) transistors that use vertically placed horizontal nanosheets allowing the gate to come into contact with the channel on all four sides. This resulots in less current leakage and a larger drive current. Intel will also match TSMC and Samsung at 2nm by using backside power delivery with the 18A node.

FinFET transistor on the left, Gate-All-Around on the right

With backside power delivery, the back side of the silicon wafer used to build a chip will distribute power instead of using the front side which is the typical method. With backside power delivery, shorter, wider lines can deliver power with less resistance and there is less congestion than the current frontside power delivery method used.

Even though it sounds like Intel, TSMC, and Samsung Foundry will be pretty close on paper, issues like yield, thermal performance, and other factors can make a big difference to chip designers when determining which foundry to contract with.

The current global leader is TSMC and the founder of the foundry, Morris Chang, does not feel that Intel is a major threat to his company even though the U.S. is supporting the firm. Per money.UDN (via Tom'sHardware), Chang says that even if Intel gets its operations all fixed up and achieves high yield rates and low pricing, and Intel Foundry Services is successful, Intel will still be in TSMC's shadow.

Having said that, Chang did note that other foundries are using geopolitical fears (such as the concern that China will invade Taiwan) to try and take business away from TSMC. While he says that this makes the near term a challenging period for the world's largest foundry, he states that the best thing that TSMC can do is continue investing in both production capacity and process technology.

Chang, who is estimated to be worth $2.3 billion, probably feels secure having Apple as TSMC's largest customer but even inside the offices in Cupertino, in the back of Tim Cook's mind, there has to be concern about how Apple can secure the heavy supply of chips it receives over the course of a year. TSMC's U.S. fabs are delayed and when they do start production, they will be behind in terms of process technology.

All things being equal, we can't imagine that Apple would leave TSMC

Apple used to have a relationship with Samsung Foundry for the iPhone's application processor (AP), but that ended with the A8 chip when Apple wanted to stop having to rely so much on parts from Samsung to build the iPhone. That leaves Intel and if you recall, when Apple and Qualcomm were fighting, Apple turned to Intel to produce 5G modem chips for the iPhone, a project that failed so miserably that Apple felt compelled to get on its hands and knees and throw bags of money at Qualcomm to make up with the chipmaker so that it could supply it with 5G Snapdragon modem chips.

Apple went on to buy Intel's smartphone modem chip operation for $1 billion in hopes of producing its own but so far it has failed in that endeavor. The point is, Apple and Intel's relationship isn't so hot either especially since Apple Silicon took Intel's Mac business away.

It's a complex parlor game that doesn't cost any money to play. Will Intel grab process leadership from Samsung Foundry and TSMC? On paper, 1.8nm beats out 2nm but you can't run smartphones on paper; thus a lower process node might not translate into better performance. Will the geopolitical issues that TSMC faces actually happen? Will Apple turn to Samsung Foundry if it needs to? The answers to these questions lie in the future and only then we can look back to properly discuss what happened.

Things that are NOT allowed: