Lack of skilled U.S. workers leads TSMC to delay opening its first Arizona fab

The Wall Street Journal reports today that TSMC, the contract foundry that produces all of Apple's chips and also counts Qualcomm, Nvidia, MediaTek, and other fabless chip designers as customers, will report a 10% decline in revenue this year. In addition, the U.S. factory in Arizona that was supposed to go online next year will have to delay the start of production at the facility.

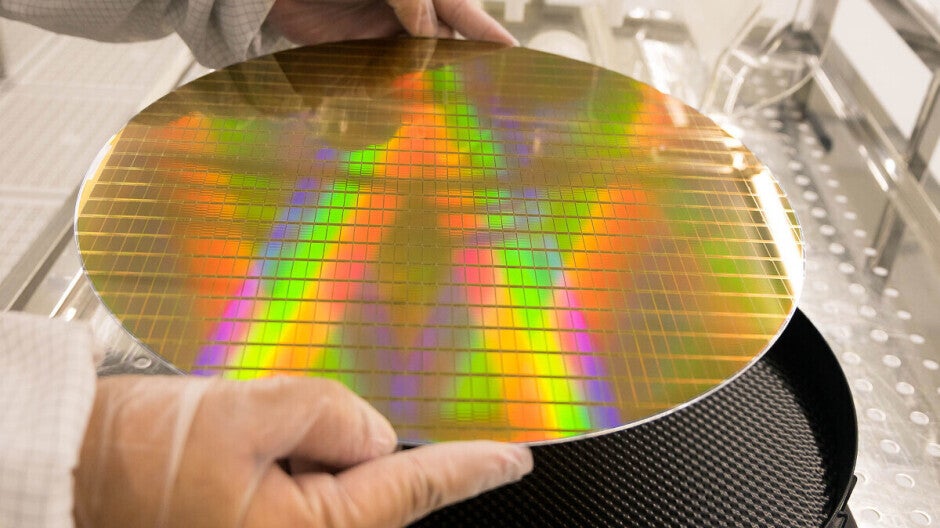

Announced during the Trump administration and supported by the Biden administration, the facility ties in with the desire of the U.S. government and tech leaders to make the country self-sufficient when it comes to semiconductor production. Plans called for the factory to start producing 4nm chips in 2024 with a second facility scheduled to open in 2026 to manufacture 3nm chips. With the delay, the first factory won't mass-produce 4nm chips until 2025.

TSMC expects to invest $40 billion in Arizona and blames the delay on a shortage of skilled workers in the U.S. Company Chairman, Mark Liu said, "We are now entering a critical phase of handling and installing the most advanced and dedicated equipment. However, we are encountering certain challenges." TSMC is waiting for the U.S. to give it a final decision on subsidies and tax credits that it will provide to TSMC. For the first five years of the plant's operations, TSMC is counting on those funds to make up the difference in the expenses it will pay to produce chips in the States and the lower costs it would have incurred producing the chips in Taiwan.

TSMC's first Arizona fab has delayed the start of 4nm mass production until 2025

As for the forecast revenue decline, a 10% drop in gross would take the foundry's top line figure from $76 billion reported for 2022 to under $69 billion this year For the April-June quarter, the company also announced its first year-over-decline in profits in four years. For the quarter, TSMC's profits declined 23% to just under $5.9 billion. Soft consumer demand was cited as one of the reasons for the revenue and profit decline.

In addition, despite all the fanfare about the start of 3nm mass production this year, the high prices for the silicon wafers that the dies are built on (approximately $20,000 per wafer) have deterred many clients from ordering 3nm production this year. Apple is expected to account for 90% of TSMC's 3nm production in 2023 as the new A17 Bionic chipset is produced. That chip will be used to power the iPhone 15 Pro and iPhone 15 Pro Max. Those two models could be the only globally sold handsets with 3nm silicon this year. TSMC will shift to a less costly 3nm process node, N3E, next year.

Follow us on Google News

![A new Android bug is making it impossible to install new apps. Are you affected? [UPDATE]](https://m-cdn.phonearena.com/images/article/176703-wide-two_350/A-new-Android-bug-is-making-it-impossible-to-install-new-apps.-Are-you-affected-UPDATE.webp)

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: