Apple paying TSMC special rate for 3nm A17 Bionic, M3 production as yield rates hit 55%

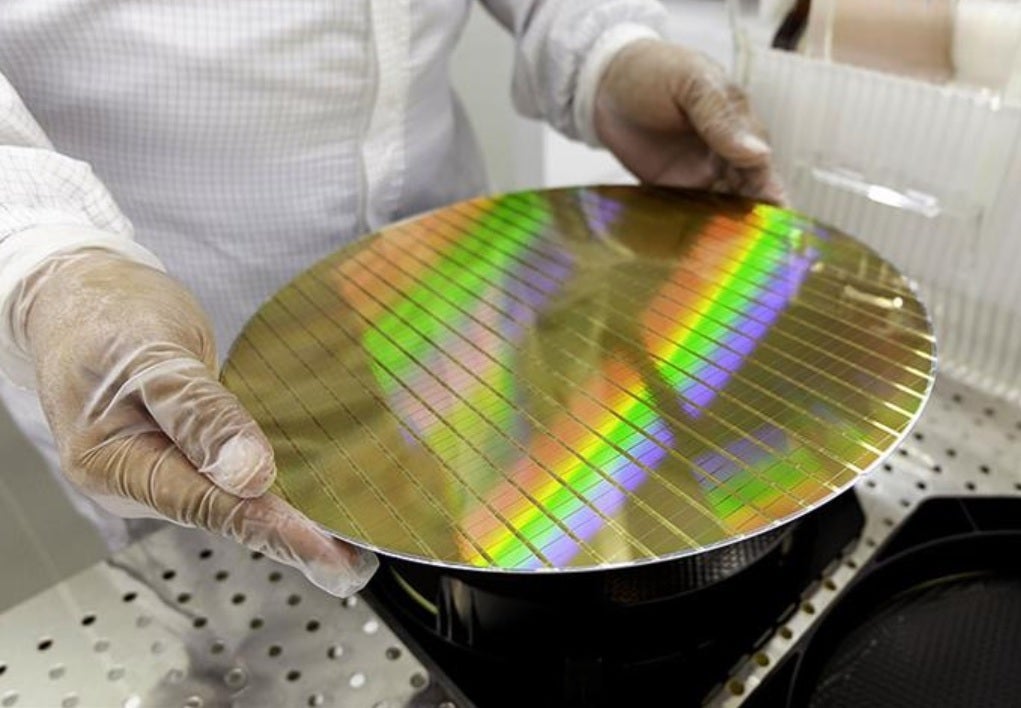

TSMC's yield rate on its 3nm production is said to be at 55% according to EE Times (via Wfcctech). At that rate, a bit less than half of the silicon wafers used to produce Apple's A17 Bionic and M3 chips are frisbees or extra-large drink coasters. Remember, the iPhone 15 Pro and iPhone 15 Pro Max will be the only smartphones powered by a 3nm chipset this year due to the high price of the wafers.

But Apple reportedly has worked out a deal with TSMC and will pay only for known good die rather than the $17,000 per wafer price. But Brett Simpson, senior analyst at Arete Research, provided EE Times with a report in which he said that once yields get to 70%, TSMC will put its most lucrative client back on standard wafer prices.

Apple will return to standard pricing once 3nm yields get to 70%

Simpson wrote, "We think TSMC will move to normal wafer-based pricing on N3 with Apple during the first half of 2024, at around $16-17K average selling prices. At present, we believe N3 yields at TSMC for A17 and M3 processors are at around 55% [a healthy level at this stage in N3 development], and TSMC looks on schedule to boost yields by around 5+ points each quarter."

TSMC's yield on 3nm production is at 55% currently

The report from Arete Research says that the A17 Bionic requires 82 mask layers and with a die size in the range of 100-110 square mm, each wafer can yield 620 chips with a wafer cycle time of four months. That's the time it takes a wafer lot (usually 25 wafers) to move from start to finish in a fab. The report added that the M3 chip is likely to be around 135-150 mm square die size and yield up to 450 chips per wafer.

The first generation 3nm chips from the foundry are using the N3B process node for the A17 Bionic. In 2024, Apple might switch to the N3E node for the A17 Bionic which will have lower production costs and higher yields. The only downside, according to one tipster, is that it supposedly delivers less of a performance increase than the N3B node delivers.

This is a rumor, but even so, it isn't clear whether Apple would stick with the N3B node to manufacture the A17 Bionic and M3, or switch to the less-expensive but slightly less impressive N3E node. If Apple decides to go with the N3E node, you might see prospective iPhone 15 Pro and iPhone 15 Pro Max buyers trying to figure out which variant of the A17 Bionic SoC is inside the phone they are about to buy.

TSMC CEO C.C. Wei said during a conference call with analysts, "Our 3-nm technology is the first in the semiconductor industry to high-volume production with good yield. As our customers' demand for N3 (3nm) exceeds our ability to supply, we expect N3 to be fully utilized in 2023, supported by both HPC and smartphone applications. Sizable N3 revenue contribution is expected to start in the third quarter, and N3 will contribute a mid-single–digit percentage of our total wafer revenue in 2023."

TSMC will start 2nm production in 2025

Mehdi Hosseini, senior equity research analyst with Susquehanna International Group, says that in the battle between TSMC and Samsung Foundry, TSMC remains on top. "TSMC, in our view, remains the preferred foundry choice for leading-edge nodes as Samsung Foundry has yet to demonstrate a stable leading-edge process technology, all while IFS [Intel Foundry Services] is years away from offering a competitive solution," he wrote in a note obtained by EE Times.

In the foundry business, you don't get a second to look back at your accomplishments. TSMC says that N2 production will start in 2025. TSMC's Wei states, "At N2, we are observing a high level of customer interest and engagement. Our 2-nm technology will be the most advanced semiconductor technology in the industry in both density and energy efficiency when it is introduced and will further extend our technology leadership well into the future."

The recent chip inventory correction has been worse than TSMC expected and the company said that it might report a drop in annual revenue (for 2023) which would be the first drop in a decade. The average inventory holdings for TSMC's fabless clients (chip designers that don't own a factory and turn to TSMC to make their chips) is 92 days. During Q4 of 2022, Nvidia had over 200 days of inventory with Marvell around 180 days and Qualcomm with about 160 days of inventory.

Things that are NOT allowed: