TSMC's current 3nm chip production not enough to satisfy Apple's needs

A report by the EE Times (via MacRumors) says that the world's leading foundry, TSMC, is having problems meeting the demand for 3nm chips from Apple. The latter is TSMC's largest customer accounting for 25% of its revenue. Apple reportedly locked up all of TSMC's 3nm production for this year and plans on debuting the 3nm A17 Bionic chipsets with the iPhone 15 Pro and iPhone 15 Ultra.

The smaller the process node, the smaller the chip's feature set including transistors. Smaller transistors mean that more can fit inside a chip and that is important because the higher a chip's transistor count, the more powerful and energy-efficient it is. For example, the Apple iPhone 11 line was released in 2019 and was powered by the 7nm A13 Bionic which contained 8.5 billion transistors in each chip. Last year's iPhone 14 Pro models were powered by the 4nm A16 Bionic SoC with a transistor count of 16 billion.

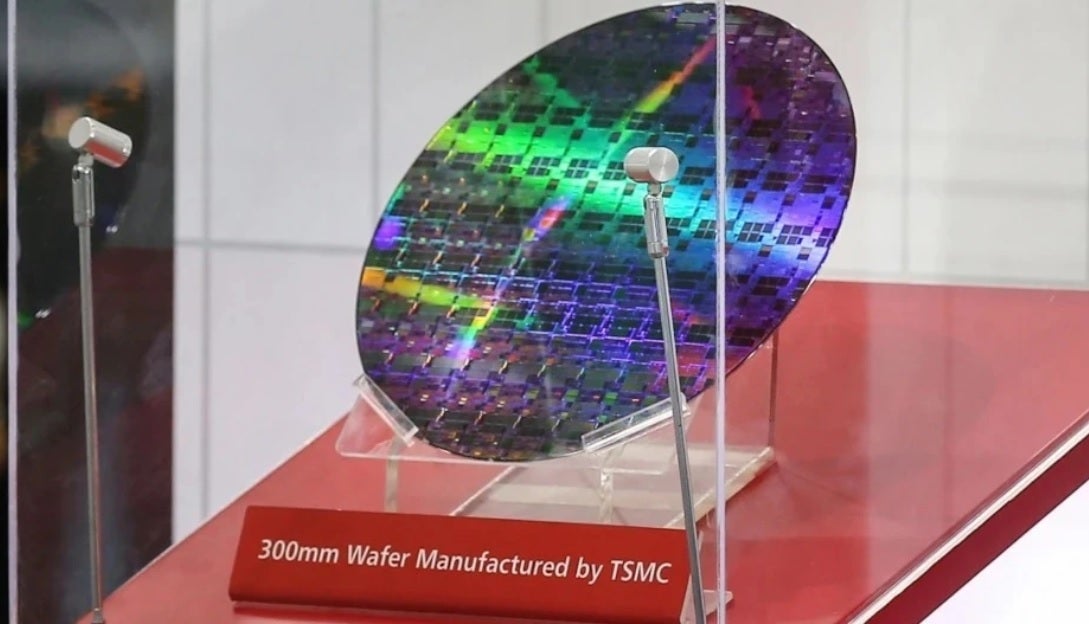

Most phone manufacturers don't want to pay $20,000 for silicon wafers used in 3nm chip production

The aforementioned A17 Bionic that will power Apple's premium iPhone 15 models this year will be made on the 3nm node and could include more than 20 billion transistors. The iPhone 15 Pro and iPhone 15 Ultra could be the only two phones from a major brand to use a 3nm chip under the hood this year. One reason is cost. With the price for each silicon wafer used for 3nm chip production tagged at approximately $20,000, moving to 3nm this year is an expensive proposition, especially with yields still improving.

Silicon wafers for 3nm chip production are $20,000 each

As TSMC and Samsung jockey for 3nm leadership, TSMC CEO C.C. Wei recently spoke to analysts during a conference call and said, "Our 3-nm technology is the first in the semiconductor industry to high-volume production with good yield. As our customers' demand for N3 (TSMC's 3nm production) exceeds our ability to supply, we expect N3 to be fully utilized in 2023, supported by both HPC (high-Performance Computing) and smartphone applications."

The executive added, "Sizable N3 revenue contribution is expected to start in the third quarter, and N3 will contribute a mid-single–digit percentage of our total wafer revenue in 2023." The sizable N3 revenue contribution Wei sees in Q3 has to do with the release of the 2023 premium iPhone models.

While TSMC and Samsung are the top two chip foundries in the world, Intel has joined the fight and promises to regain process node leadership in 2025. Right now, that crown belongs to TSMC. Mehdi Hosseini, senior equity research analyst with Susquehanna International Group says, "TSMC, in our view, remains the preferred foundry choice for leading-edge nodes as Samsung Foundry has yet to demonstrate a stable leading-edge process technology, all while IFS [Intel Foundry Services] is years away from offering a competitive solution."

Yields for the A17 Bionic and M3 are currently at 55% which is considered good at this stage of production

Besides the A17 Bionic, TSMC will also produce Apple's M3 chip using the 3nm node. Brett Simpson, senior analyst at Arete Research, said in a report provided to EE Times, "We think TSMC will move to normal wafer-based pricing on N3 with Apple during the first half of 2024, at around $16-17K average selling prices. At present, we believe N3 yields at TSMC for A17 and M3 processors are at around 55% [a healthy level at this stage in N3 development], and TSMC looks on schedule to boost yields by around 5+ points each quarter."

As is the case in the chip industry, there is no time to rest because you always have to look ahead. With 3nm heading for the iPhone this year, 2nm production will start in 2025. TSMC CEO Weil says, "At N2, we are observing a high level of customer interest and engagement. Our 2-nm technology will be the most advanced semiconductor technology in the industry in both density and energy efficiency when it is introduced and will further extend our technology leadership well into the future."

Even with Apple's 3nm business, 2023 is not shaping up as a good year for TSMC and revenue might fall this year for the first time in a decade. Year-over-year sales could decline by a mid-single–digit percentage point. Even with business slowing, the foundry expects capital expenditures to remain in the range of $32 billion to $36 billion.

The Apple A17 Bionic has a die size in the range of 100-110 mm square allowing it to produce 620 chips per wafer. With a die size of 135-150 mm square, TSMC's yield for the Apple M3 is 450 chips per wafer.

Things that are NOT allowed: