These three words said by TSMC are absolutely surprising in light of the chip shortage

TSMC is the world's largest foundry. The company takes designs for chips created by companies like Apple, Qualcomm, MediaTek, and others, and builds them. TSMC reported that for the second quarter, the firm generated a record quarterly profit of 237.03 billion Taiwanese dollars ($7.9 billion U.S. Dollars), up 76.4% year-on-year and ahead of estimates. That was a record quarter in terms of net income for TSMC.

During the quarter, revenue amounted to 534.14 billion Taiwanese dollars ($18.16 billion), a 43.5% rise year-on-year. As you probably know, thanks to the pandemic, there has been a global chip shortage. Foundries were negatively impacted by a shortage of experienced workers and a surprise demand for new automobiles also pumped up demand for integrated circuits.

Apple CEO Tim Cook estimated that the chip shortage cost Apple six billion dollars in lost revenue last year. Interestingly, the shortage had more of an impact on legacy chips than the latest cutting-edge silicon.

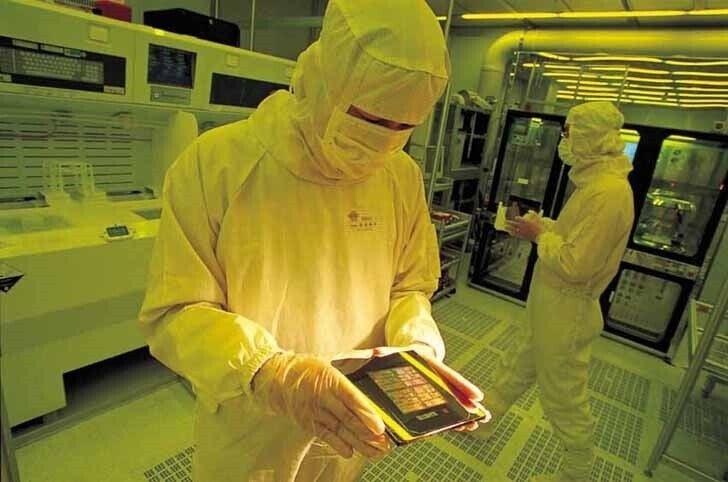

Inside a TSMC clean room,, yellow light is used to prevent interference with the UV light used to mark up circuit patterns

TSMC surprisingly says that it has "excessive chip inventory" thanks to "softening demand" for PC's, smartphones, and other consumer products. TSMC says that it will take a few quarters before the chip industry rebalances. TSMC CEO C.C. Wei says, "Our suppliers have been facing greater challenges in supply chains, which are extending tool delivery times for both our advanced and mature nodes," Wei stated.

The executive is positive about chip demand for the long term. He says, "Now let me talk about TSMC’s long-term growth outlook. While macroeconomic headwinds bring near-term uncertainties that may persist, we believe the fundamental structural growth trajectory in the long-term semiconductor demand remains firmly in place."

Still, the trend is not TSMC investors' friend with the foundry's stick price down $48.20 or 36.02% over the last six months to $85.63 a share. With the list of customers that TSMC has, especially Apple, MediaTek, and Qualcomm, the foundry shouldn't run into any serious economic issues in the short term.

Things that are NOT allowed: