The role of mobile tech in the current "GameStop" investment craze

If you've been reading and watching the news everyday and are tempted to jump into the new investment craze that has captured the attention of many Americans, you need to tread lightly before you end up losing a fortune. Sure, it looks like people are practically printing their own money and just yesterday a fifth-grade student who got 10 shares of GameStop (GME) from his mom two years ago (she paid $6 a share) sold the gift for $320 each or $3,200.

Participating in the latest investment craze could be dangerous to your wealth

There are many stories like that as investors pushed up the stock of the video game chain from $4 this past July to a recent high of $413. What is going on here, you ask? We are happy to clear this up. First of all, thanks to the brokerage app Robinhood (App Store, Google Play Store), small investors can trade through their phone without paying any commissions. Even option traders can place orders through the app without having to pay for brokerage.

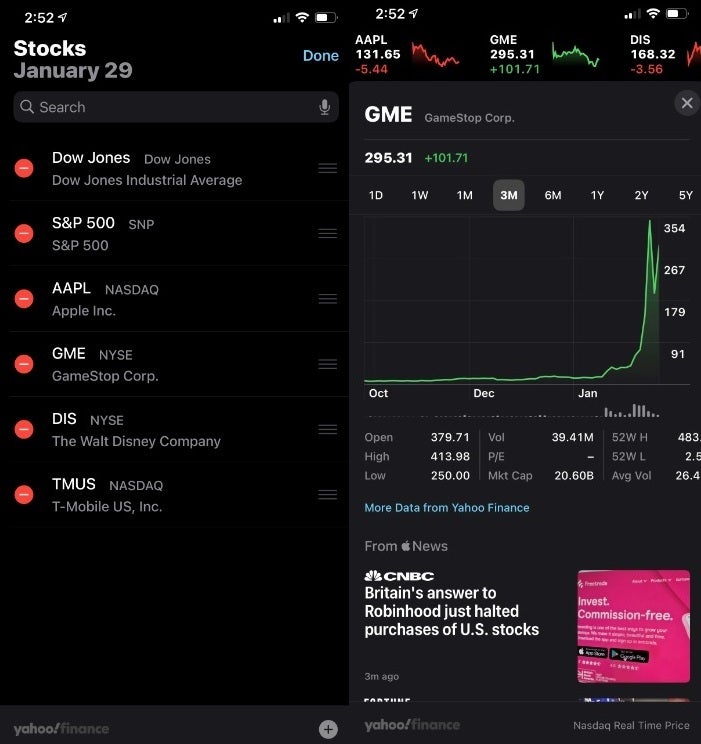

The iOS native stock app includes prices and charts

Also involved is the subreddit board Wall Street Bets. This social media site recommended certain stocks like GameStop and BlackBerry (BB) that were sure to rise once buy orders started flooding in for the stock. The stocks selected by WallStreetBets were heavily shorted. Shorting a stock is like buying a stock and selling it at a higher price, but in reverse. Let's say that at $20 you thought that GameStop was overpriced. You borrow the shares from your broker and sell the stock. Hopefully, when the stock drops, you buy back the shares you borrowed and return it to the brokerage firm. But this is a very risky play. When you buy a stock, your loss is limited to the amount you paid for it; when you short a stock, your potential loss is infinite. As a result, shorting a stock is something that only the wealthy and huge hedge funds practice.

To make this as easy to understand as possible, small time investors decided to get back at those billionaires running hedge funds and starting buying shares like GameStop that were heavily shorted by the pros. This created what is known in market lingo as a "short squeeze." But thanks to social media, there were plenty of small investors betting against the hedge funds by buying GameStop and other heavily shorted stocks. As the latter rose in price, the pros started seeing their accounts flow red ink as their bets against GameStop and others started to go against them. More buying by the public led to more buying by the pros to cut their losses. And that is how GameStop ran up to over $400.

On Thursday, Robinhood was on the verge of raising $1 billion of financing. To make sure that it didn't lose this financing by costing its customers their nest eggs, the company banned them from buying GameStop and a number of other stocks that were having similar experiences for the same reason. The only transactions allowed were those that would result in a Robinhood customer exiting his or her position in these stocks. As a result, GameStop plunged 40% on Thursday. But on Friday, Robinhood removed the ban allowing its account holders to buy the stock once again. As a result, on Friday GameStop opened at $379 after closing Thursday at $197.

It seems like easy money as more and more little guys get involved looking for revenge against snooty hedge fund operators. Some of the pros who were short GameStop have had to resort to loans from other hedge funds to stay afloat. But before you install Robinhood on your phone and buy some of the targeted stocks (which also includes AMC Entertainment, American Airlines, and Tootsie Roll), keep in mind that the window of opportunity here could be closing. Once the public runs head first into an investment style, that style usually stops working. When the pros finish covering their short sales, they have no incentive to buy these stocks anymore and the public will be left holding the bag when these stocks drop down to prices more reflective of their current business status.

What is interesting is how mobile technology has its fingerprints all over the short squeeze. You have the Robinhood app offering free trading, the WallStreetBets subredit disseminating the names of companies whose shares are heavily shorted, and apps that provide mobile investors with real time quotes wherever they go. Heck, iOS has a native stock app of its own.

We don't want to be the wet blanket here, but we do want to point out that this investment style is not going to last forever.

Things that are NOT allowed: