T-Mobile's 5G network leadership strategy hinges on 90% coverage, including rural America

T-Mobile's Ryan Sullivan, VP, Device and Technology, and Karri Kuoppamaki, SVP, Network Technology Development & Strategy, sat down for a PhoneScoop interview, and, asked how are they going to combat Verizon and AT&T's expansion in the mid-band 5G spectrum, basically reiterated their 5G coverage plans for the next two years.

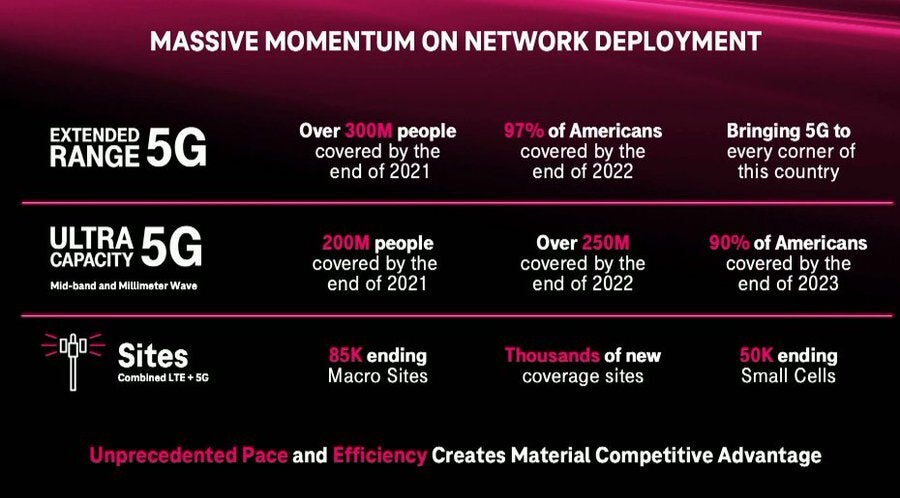

It still wants to blanket 250 million Americans with true 5G coverage in the mid-bands next year, and make those covered 300 million by the end of 2023 as the rollout in rural areas will be rather slow compared to the densely populated cities. The Un-carrier will be adding extra features since the last time we heard about its 5G expansion plans, though, such as carrier aggregation within its midband spectrum that will increase download speeds further.

Another important new addition will be the so-called Voice over New Radio (VoNR) technology. Even though we've had 5G data networks for a good while, voice calls still largely go through the 4G LTE network, whereas by introducing VoNR the 5G network will soon be able to handle both calls and data, paving the way for the 4G LTE network sunset on T-Mobile. That is still a long way off, though.

Currently, T-Mobile is doing an abundance of testing for voice calls over its 5G network, and the first phones to support VoNR are expected as soon as 2022, perhaps by the time the Galaxy S22 models hit the shelves this spring, as Samsung's phones have traditionally been at the forefront of these newfangled 5G technologies. According to T-Mobile’s President of Technology Neville Ray, "with LTE we rolled out data first, then later VoLTE... To have a good, strong reliable voice service on 5G you need a big, strong 5G footprint. It’s important to work out any kinks because once a call is set up on 5G it’s undesirable for it to get bumped down to LTE. Every time those changes happen you can have potential problems."

T-Mobile 5G network coverage plans by 2023

- 97% of Americans with slow 'Extended Range 5G' by the end of 2022

- 90% of Americans with faster 300Mbps-400Mbps 5G network by the end of 2023

In a nutshell, T-Mobile is expected to keep its 5G coverage and speed advantage this year. While Verizon and AT&T have scooped larger amounts of new C-band spectrum at the FCC auction, those won't be deployed en masse until later in 2021 or next year, plus the Un-carrier doesn't really need them.

The big three mobile carriers just bid $78.2 billion in total on new FCC spectrum, yet even after the auction T-Mobile’s mid-band spectrum remains top dog with 301 MHz in total, followed by 167 MHz for AT&T, and 192 MHz for Verizon.

T-Mobile said at its virtual investor conference that 97%t of Americans will have 5G access by the end of next year. What it mentioned, however, is that this coverage will be of the slow low-band variety that doesn't give tangible speed benefits compared to 4G service. It won't be before the end of 2023 that it will blanket 90% of Americans with the faster mid- and high-band Ultra Capacity 5G that now covers about a third of Americans.

Even then, the Americans covered by the 'Ultra Capacity 5G' network will only see an increase in average speeds from 300Mbps up to 400Mbps, or about what Verizon was able to pull off with its 4G CBRS rollout, so don't worry if your phone doesn't sport a flashy new 5G icon just yet.

T-Mobile's faster 5G network will cover 90% of Americans by the end of 2023

T-Mobile's 5-year 5G network plan

Maintaining 5G leadership in the 5G era

- Recent C band investment further positions T-Mobile’s superiority for 5G era.

- Already delivering 5G across more geographic coverage than AT&T and Verizon combined.

- Only operator to have deployed dedicated mid-band spectrum for 5G.

Significantly expanding addressable markets

- T-Mobile’s superior 5G network to unlock growth opportunities in new markets, deepen relationships with customers and take the competition to cable.

- Plans to increase share of smaller markets and rural areas to nearly 20% in next 5 years.

- Expect to double market share in enterprise in next 5 years.

- Bring competition to the $90 billion broadband market, targeting 7-8 million customers in 5 years.

Unlocking bigger merger synergies, faster

- Expect total net present value of merger synergies to be more than $70 billion – up more than 60% from original merger guidance of $43 billion.

- Expect total run rate cost synergies to reach ~$7.5 billion per year by 2024 – up 25% from original merger guidance of $6 billion per year.

Delivering better financial results

- Raising mid-term and long-term guidance across the board w/ higher service revenue, Core Adjusted EBITDA and free cash flow.

- Potentially up to $60 billion in shareholder return between 2023-2025.

Things that are NOT allowed: