After last week's crash, T-Mobile announces a plan to buy $14 billion of its shares

This past week comments made by T-Mobile CEO Mike Sievert set off a panic among investors in the carrier's publicly listed shares. Actually, Sievert made a comment about his expectations for the company's fourth quarter that were misinterpreted by an analyst who believed that the executive was delivering a warning to investors. T-Mobile's investors took a heavy beating as the shares plunged $14.92 or 6.12% to close at $228.86. That was a sharp drop from the recently set 52-week high of $248.16.

Yesterday, T-Mobile announced that it will spend billions of dollars to support the stock. Previously, the company announced that it would return up to $50 billion to stockholders over the next three years. This figure doesn't include the $19 billion that the company last year agreed to return to shareholders before the end of this year. This ploy of propping up a company's stock by announcing that the company will return money to stockholders is not only legal but is also a common practice on Wall Street.

Returning money to stockholders can be done by paying stockholders cash or stock dividends, or by implementing a stock buyback. The latter involves a company buying back some of its own stock. The cash and stock dividends are pretty much self-explanatory as the stockholders are sent a check for the amount of the dividend or are sent additional shares to cover the amount of the dividend.

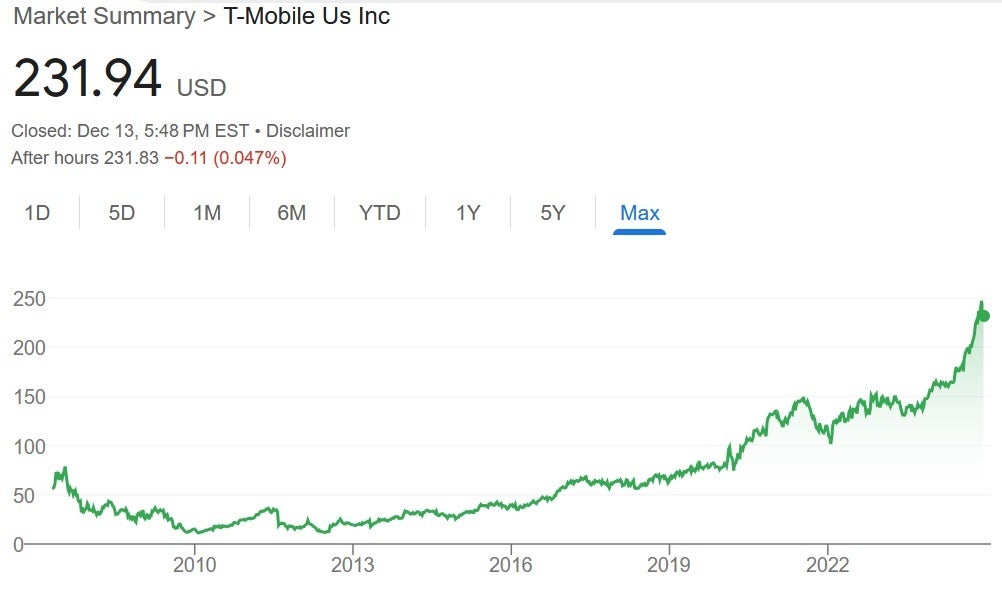

T-Mobile's shares have been in an uptrend for approximately a year. | Image credit-Google

With the stock buyback, the company places buy orders through a broker and will pay the prevailing price for the stock at the time the buyback begins. This reduces the number of shares outstanding and in theory, raises the value of the remaining shares. On Friday, T-Mobile said that it would spend as much as $14 billion by the end of 2025 buying back its own shares.

Earlier this month AT&T said that it would return over $40 billion to stockholders over the next three years. The telecom company said that it would accomplish this goal through the use of dividends and share repurchases.

On Friday, T-Mobile shares closed the regular trading session at $231.94, a decline of $1.33 on the day. Still, that is more than $3 higher than the price that the stock closed at last Monday following Sievert's comments which were made at the UBS Global Media and Communications Conference.

Things that are NOT allowed: