T-Mobile gets downgraded and the shares responded just as you'd expect they would

Since hitting a 52-week high of $276.49 last month, T-Mobile's shares have dropped more than $20 closing the week at $255.98. The shares declined $3.12 (1.2%) during regular trading hours on Friday. After hours on Friday, the stock dropped some more ($1.97 or .77%) to $254.01. What set off the selloff was a downgrade in T-Mobile stock by Citi analyst Michael Rollins who said that the carrier's days of outperforming its rivals might soon be over. Rollins cut T-Mobile to Hold from Buy while keeping his target price of $268 the same. A move to the target would result in a 3% rise in the company's shares.

Rollins says that T-Mobile is trading at a premium to the shares belonging to its rivals which usually means that its price-earnings ratio is higher. For example, T-Mobile is trading at 23 times its earnings, a 70% premium to the price-earnings ratio that AT&T and Verizon are trading at. The problem, according to the Citi analyst, is that he sees nothing in the near-term growth drivers of T-Mobile that would make the stock more fairly priced.

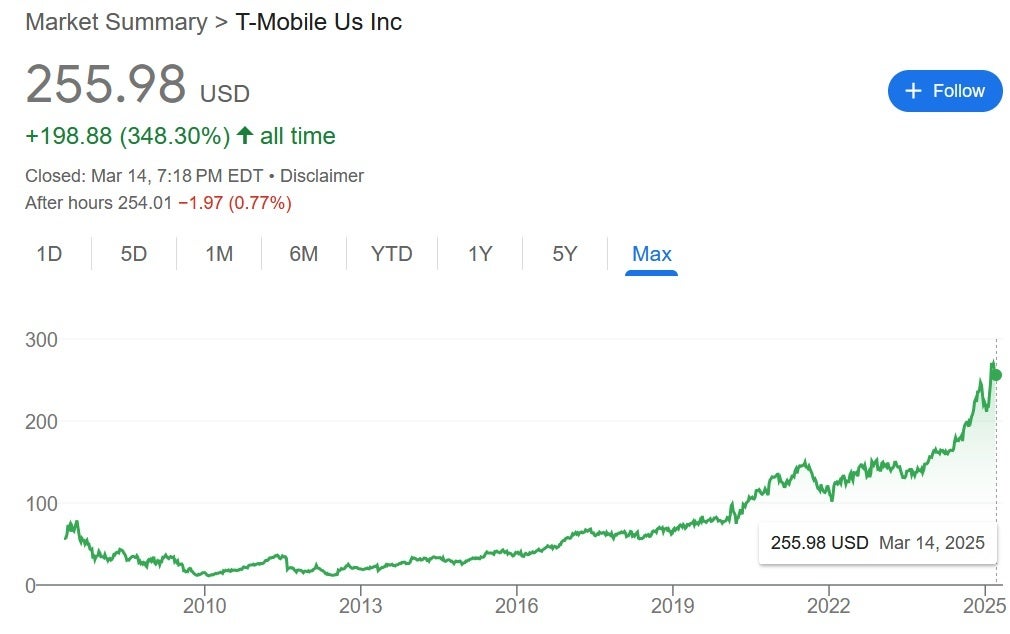

It's been a long and profitable run for T-Mobile's stock. | Image credit-Yahoo Financial.

One way that T-Mobile could reduce that premium without the shares declining would be by increasing its market share or by acquiring a major cable company. As sexy as such an acquisition might be for T-Mobile, Citi's Rollins says that such a pick-up would probably end T-Mobile's growth and significantly dilute top-line revenue growth. Over the last year, T-Mobile's shares are up 58.2% which is above the 55.9% rise pulled off by AT&T and the 10.33% gain that Verizon took on. The S&P 500 is up 7.2% over the same time span.

With a market capitalization of $293 billion, T-Mobile is the most valuable of the three major wireless firms based on market cap. AT&T is valued at $190.7 billion followed by the $183.4 billion that Verizon is valued at. Speaking of AT&T, the company's shares got a shot in the arm yesterday when they received an upgrade from Raymond James analyst Frank Louthan. The latter affirmed his strong buy rating on the stock while raising his target price to $29 from $28. The stock is already in a nice uptrend and gives you a 4.18% dividend yield while you wait for the stock to rise.

Things that are NOT allowed: