Apple to receive the majority of 5nm wafer shipments this year thanks to demand for 5G

Over the next few years we should see continued growth in smartphone performance and improvements in energy-efficiency (read battery life). That's because we are getting closer and closer to what could be the final years of Moore's Law. Commented on during the mid 1960s by Intel co-founder Gordon Moore, and revised a decade later, this observation about transistor density is seemingly entering its final years. The "Law" calls for the number of transistors squeezed into a square mm to double every other year.

Another strong year expected in the semiconductor industry

Last year, the iPhone 12 series were the first smartphones to be powered by chips manufactured using the 5nm process node. As a result, the A14 Bionic contains 134 million transistors per each square mm compared to nearly 90 million per square mm for the 7nm A13 Bionic chip. The number of transistors rose from 8.5 billion for the 2019 A13 Bionic to 11.8 billion packed inside the A14 Bionic. You'll note that the transistor density didn't come close to doubling but it is getting harder and harder for foundries to manufacture cutting-edge chips. And the new 5nm M1 chip conceived by Apple to replace Intel's silicon on some MacBooks carries a transistor count of 16 billion.

The Apple A14 Bionic was the first 5nm chip to power a smartphone

Foundries like TSMC (which counts Apple as its largest customer) and Samsung have roadmaps down to 2nm integrated circuits. As things stand now, we could see the iPhone 14 powered by a 3nm A16 Bionic. And this is more than just a mathematical exercise; the larger the transistor density, the more powerful and energy-efficient a chip is.

The gang at Counterpoint Research just completed its analysis of what we can expect from the chip industry in 2021. While the semiconductor industry delivered better than forecast growth in 2020, more of the same is expected this year. Foundries are expected to be hard at work taking orders from phone manufacturers for 5nm and 7nm chips for 5G phones. Counterpart says that in 2020, the industry raked in $82 billion in revenue for a 23% year-over-year gain. The research firm sees more double-digit growth this year albeit at a lower 12% rate. The world's largest foundry, TSMC, will grow revenue at a 13%-16% clip in 2021 says Counterpoint, allowing it to outperform the industry this year. Samsung Foundry is expected to deliver revenue growth in the neighborhood of 20% after winning business from customers like Qualcomm and NVIDIA. For example, Samsung is manufacturing Qualcomm's Snapdragon 888 chipset this year after TSMC produced last year's Snapdragon 865 SoC.

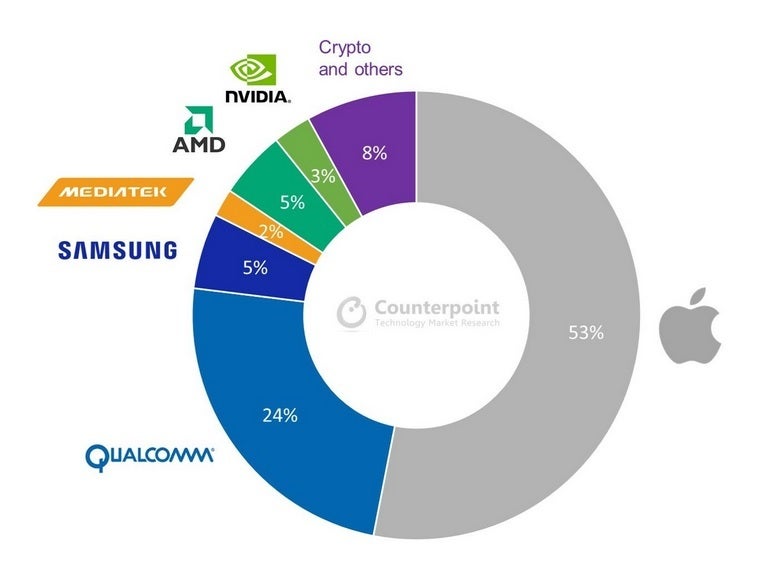

According to the report, the combination of increased shipments of wafers and price increases will lead foundries to report growth in revenue during 2021. With some foundries reporting supply shortages during the second half of last year, wafer prices have been hiked by 10%. Meanwhile, Counterpoint says that 5nm wafer shipments will make up 5% of all 12-inch wafer shipments in 2021, up from less than 1% last year. As we pointed out earlier, Apple is TSMC's largest customer and that goes for 5nm production as well. The A14/A15 will be topping the list along with the new M series. Qualcomm will be second since it still uses TSMC for production of its 5nm X60 modem and Apple could use the latter for the iPhone 13. Looking at the wafer shipments for 5nm chips expected this year, 53% of the deliveries will be earmarked for Apple while Qualcomm will be the recipient of 24% of these wafers. Samsung is next with 5%.

Apple will receive the majority of 5nm wafer shipments this year

Old rules to determine the state of the chip industry are being tossed. At the end of the third quarter last year, the industry held 79 days of inventory compared to the average of 70 days since 2016. That normally would be seen as bearish (negative) for chipmakers. But strong demand for 5G components, strong demand for Work From Home (WFH) devices and strong demand for Cloud Servers means that the chip industry can afford to keep inventory levels high while still reporting growth.

Things that are NOT allowed: