Samsung remained the top smartphone manufacturer during the first quarter

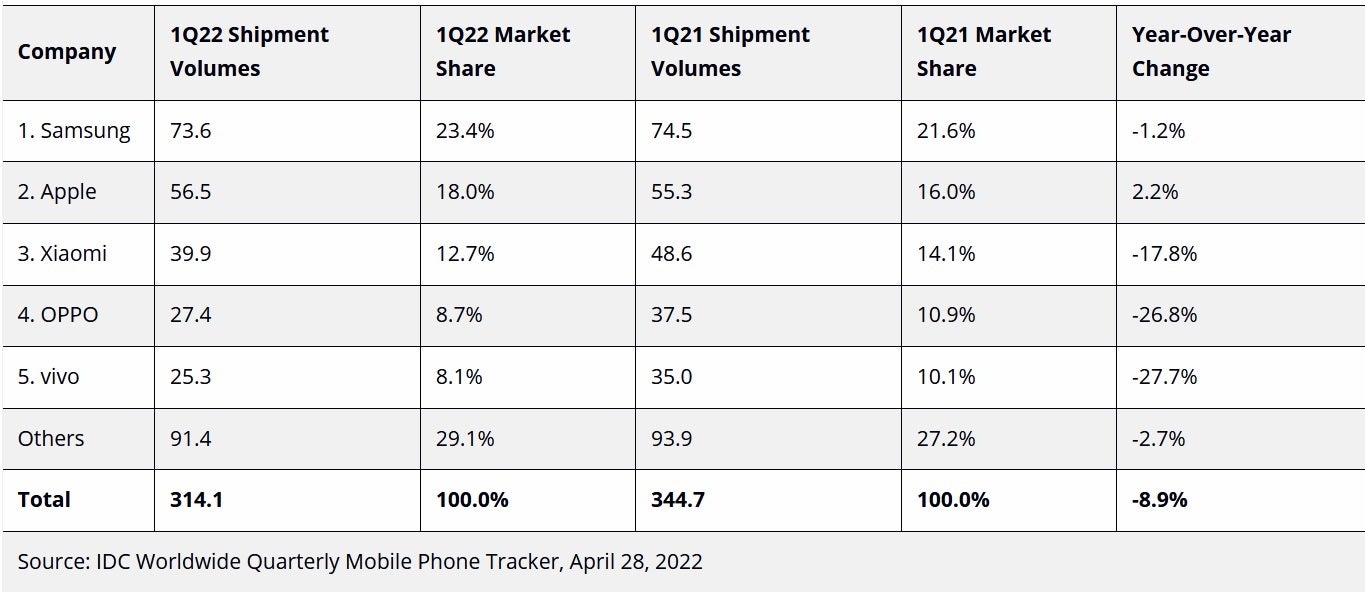

The latest data from the International Data Corporation shows that Samsung remained the top smartphone vendor during the first quarter of 2022 as the South Korean manufacturer delivered 73.6 million handsets during the first three months of the year. That works out to an 1.2% year-over-year decline in Q1 shipments for the company which has a global market share of 23.4%. Behind Samsung in second place is...you got it! Apple.

Samsung and Apple outperformed the competition during the first quarter of 2022

The U.S. based company sold 56.5 million iPhone units from January through March which resulted in an 18% slice of the worldwide smartphone pie for Apple. Unlike Samsung, Apple was able to score a 2.2% annual gain in shipments making the company the only one to show year-over-year growth in smartphone shipments during the first three months of the year.

Samsung was the leading smartphone manufacturer worldwide during the first quarter

Returning to the list, IDC shows Xiaomi in third place after shipping 39.9 million phones during the first quarter. That gave the company a market share of 12.7% during the period. Oppo and Vivo were fourth and fifth during the first quarter of 2022 with shipments respectively of 27.4 million and 25.3 million. Both companies saw a year-over-year decline in their shipments for the quarter with Oppo's deliveries declining 27% and Vivo's falling by 28%.

Oppo's Q1 market share was 8.7% while Vivo's share came to 8.1%. Other unnamed manufacturers had 91.4 million shipments. The IDC reports that overall, global shipments of smartphones declined 8.9% year-over-year during the first quarter. It is now has been three straight quarters with declining shipments for the industry. 314.1 million units were delivered during the first quarter of this year, 3.5% less than the researcher predicted for the quarter during February.

Last year's first quarter saw 344.7 million smartphones shipped world wide which means that more than shipments during this year's first quarter declined by more than 30 milliom phones.

IDC's research director Nabila Popal blames the current struggle on issues in the supply chain for important smartphone-making components. Consumer demand, she says, has been hurt by economic question marks and global inflation which have reduced demand for handsets. She says, "Although some decline was expected in Q1, due to the ongoing supply and logistical challenges and a difficult year-over-year comparison, things seemed to have taken a turn for the worse."

IDC says that consumers are concerned about rising inflation and economic instability reducing demand for phones

She adds, "Consumer sentiment across all regions, and especially China, is broadly negative with heavy concerns around inflation and economic instability that have dampened consumer spending. This is now coupled with the rising costs of components and transportation and the recent lockdowns in Shanghai, which are exacerbating an already difficult situation. On top of all this is the Russian invasion of Ukraine, which immediately impacted that region and continues on an unknown trajectory. Given all these uncertainties, most OEMs are adopting a more conservative growth strategy for 2022."

Ryan Reith, Program Vice President, Worldwide Mobile Device Trackers for IDC, says that the drop in demand is temporary and once the economy stabilizes, demand for smartphones will go back up. He notes, "It goes without saying that the world continues to face numerous challenges, whether it be geopolitical, pandemic related, or macroeconomic. Almost everything that’s happened in recent months has been a headwind on the smartphone market, and realistically many other technology segments."

Reith adds that Samsung and Apple outperformed the competition because they were able to navigate the supply chain better than the competition. Meanwhile, not much changed from the first quarter of 2021 to the first quarter of 2022. The top five manufacturers during the first quarter of 2022 were the same five last year even matching the same position that each firm achieved last year.

More data about first quarter phone shipments came to us last month via Counterpoint Research showing that Apple owned a whopping 62% of the premium market during the first three months of the year. That is Apple's highest share of this market since Q1 of 2017. As far as the premium market is concerned, it outperformed the overall smartphone market for the eighth consecutive quarter even though it declined 8% year-over-year.

Counterpoint considers premium phones to be those priced at $400 and up.

Things that are NOT allowed: