Samsung says solid phone sales kept the fourth quarter from being a total disaster

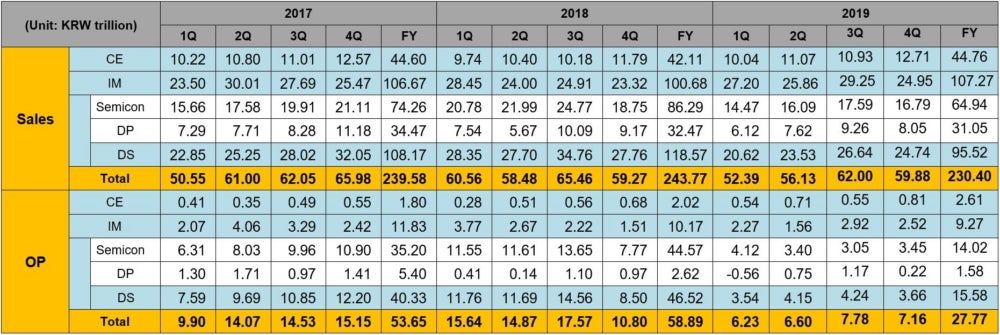

Samsung released its fourth-quarter and full-year 2019 earnings report on Thursday morning (thanks to the time difference, we are writing about Thursday morning's news on Wednesday evening in the states). For the quarter, which includes the holiday shopping season, the manufacturer took in 59.88 trillion Korean Won ($50.57 billion USD), a small 1% year-over-year gain. Operating profit for the period amounted to 7.16 trillion Korean Won ($6.05 billion USD), down 34% from the same quarter in 2018.

For all of 2019, Samsung generated revenue of 230.40 trillion Korean Won ($194.55 billion USD). That was down 5.5% on an annual basis. For all of last year, Samsung saw its operating profit decline a sharp 52.8% to 27.77 trillion Korean Won ($23.44 billion USD). The mobile division saw a 7% rise in revenue and a 67% gain in operating profits for the fourth quarter. For 2019, that division saw revenue rise 6.5% while operating profits declined 8.9%.

Samsung's mid-range Galaxy A series keeps profits up in the mobile division during the fourth quarter

During the fourth-quarter, Samsung ran into the same issues that affected it for most of last year. A drop in memory chip prices negatively impacted the company. DRAM prices continued to drop during the fourth-quarter even though the number of chips being shipped rose. Earnings for this segment increased sequentially leaving some hope of a sustained turnaround. In the display panel segment, Samsung suffered from weak demand for premium mobile device screens and more red ink spilled in the large panels business. These results were partially offset by improving memory chip demand for servers and mobile devices, and what the company characterized as "solid" sales of flagship Galaxy phones. However, profits from smartphones declined quarter-to-quarter as more time passed since the August 23rd release date of the Galaxy Note 10 series.

Samsung's sales and operating profits broken down by division

While fourth-quarter smartphone and tablet demand increased during because of the holiday shopping season, revenue declined on a sequential basis. Despite the drop in gross, profits held up thanks to solid sales of the mid-range Galaxy A series and effective use of marketing.

The Samsung Galaxy Note 10+ 5G

Samsung expects sales of memory chips and OLED panels to suffer from seasonality during the typically weak first quarter. For the three months from January through March, Samsung sees "steady" performance of its mobile business thanks to the release of the new flagship Galaxy S20 line. This includes the Galaxy S20, Galaxy S20+, and the Galaxy S20 Ultra and the latter could easily be the best Android phone for the first half of the year. In addition, Samsung will also release its new foldable Galaxy Z Flip which opens and closes around the horizontal axis. Unlike the Galaxy Fold, the Galaxy Z Flip isn't supposed to turn from a phone into a tablet; instead, this is a pocketable device that opens to reveal a 6.7-inch screen when needed. Offsetting these releases will be the extra marketing costs that Samsung will be paying for once these new handsets are introduced.

For all of 2020, Samsung is calling for a gradual improvement in the memory chip market. The company says it isn't clear yet whether the growth in 5G phone production will have a positive effect on the demand and price of DRAM memory chips. Exciting times are ahead for Sammy's foundry business as the company looks to churn out more 5nm and 7nm EUV chips. Samsung will also start to develop its next-generation 3nm GAA (gate-all-around) technology. These numbers refer to process nodes used to manufacture integrated circuits and relate to the number of transistors that fit in a small dense space. A smaller number means that more transistors fit inside; more transistors inside a chip makes it more powerful and energy-efficient. For example, the 5nm chips being produced this year will perform better using less power than 7nm chips and 3nm chips will take smartphones up another level.

For 2020, Samsung forecasts that its mobile business will see improved profits due to higher sales of premium 5G models and its foldable devices. The company adds that while demand will rise for 5G handsets, competition will rise as well. Rival manufacturers will catch up to Samsung by using more powerful chipsets, memory chips, and cameras. Samsung will look to differentiate its high-end models from competitors by expanding support for 5G and using new foldable designs.

Investors dumped Samsung's stock following the release of the report. In Korea, Samsung's shares declined 2.88% to 57,400 Korean Won ($48.46 USD).

Things that are NOT allowed: