Apple's China hopes are looking up after a solid Q2 and the upcoming 5G iPhone 12 launch

The iPhone 11 family

But while the world's largest smartphone market was affected like no other between January and March by the coronavirus pandemic, its recovery was also faster than the encouraging signs noticed stateside towards the end of the year's second quarter. As such, China's smartphone sales scores actually increased by 9 percent from the first three months of 2020, which was however not enough to stave off a pretty substantial year-on-year drop.

Two regional standouts, one clear winner

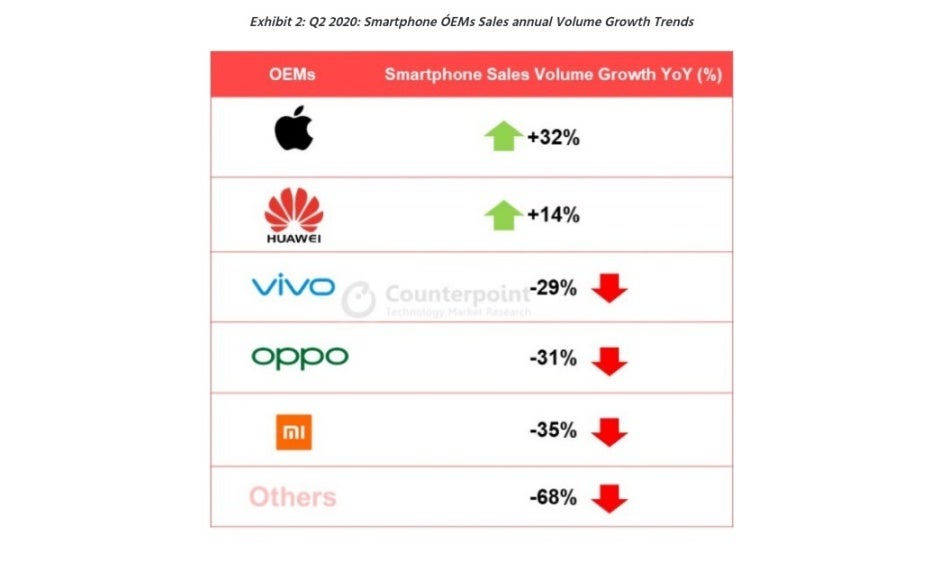

Overall, Q2 2020 smartphone sales in China fell by 17 percent compared to the same timeframe of 2019, although two major vendors were able to defy that general trend and boost their second-quarter numbers.

First and foremost, we're talking about Huawei, which improved its sales by 14 percent to consolidate its already crushing market dominance and jump to an even more towering 46 percent slice of the pie. Secondly and perhaps more surprisingly, Apple pulled off a remarkable 32 percent year-on-year gain thanks primarily to the "continued popularity of the iPhone 11 and price cuts."

Unsurprisingly, the budget-friendly iPhone SE (2020) played a crucial role of its own in boosting the tech giant's presence in one of its historically weakest (and most important) markets, which has always put more value on prices than things like premium designs or cutting-edge specifications.

Apple's regional achievement is made that much more impressive by the absence of a 5G-enabled iPhone model from its roster, and it will certainly be interesting to see what impact the iPhone 12 family launch will have on the company's numbers in Q4 2020.

The market is starting to revolve around 5G

5G handsets are already incredibly popular in China, accounting for 33 percent of total Q2 2020 sales after "only" registering a 16 percent market share during Q1. Of course, many of the country's successful 5G-capable devices are unlikely to be rivaled by the iPhone 12 lineup in terms of affordability, but high-enders like Huawei's Mate 30 and P40 series have also quickly caught on, giving Apple hope that its vital Chinese numbers will continue to grow for the foreseeable future.

Apple, of course, is not the second-largest smartphone brand in the world's most populous nation, instead ranking behind both Vivo and Oppo in addition to Huawei while narrowly defeating Xiaomi. Xiaomi, Vivo, and Oppo all registered huge declines in Q2, although the "others" section of Counterpoint's rankings, which includes the likes of Samsung, suffered an even worse combined drop of no less than 68 percent.

Then again, Xiaomi actually ended the quarter on a high note, with a 42 percent month-on-month surge in June sales, which contributed to the year's best 30-day period so far, also suggesting Apple will probably not be able to retain its fourth spot in the country in Q3 2020. Not without additional discounts on the iPhone 11 series and older devices like the iPhone XR, at least.

Obviously, the market's evolution will greatly depend on the COVID-19 health crisis, which has been largely contained in China but could always erupt and come back with a vengeance again, as other regions have experienced of late. Even with the deadly virus "mostly contained", a certain level of consumer skepticism and a general desire to avoid or at least limit non-essential spending is to be expected for a while longer practically worldwide.

Things that are NOT allowed: