The premium smartphone market is 'collapsing', but don't blame it on Samsung or Huawei

It's no longer a big secret that smartphones in general are not selling as well as they used to, largely because companies have slowed the pace of innovation, failing to give customers compelling reasons to upgrade their devices every one or two years. But the situation is particularly dire in the premium market segment, which has apparently "collapsed" during the first quarter of 2019.

Global shipments of phones priced at $400 and up have taken an 8 percent hit compared to the same period last year, according to the latest Counterpoint Research report, which is obviously pretty bad. Of course, things are bad for the entire mobile industry, but the IDC and Strategy Analytics estimated the smartphone market as a whole only declined by 6.6 and 4 percent respectively in Q1 2019 versus the first quarter of 2018.

Bottom line, these so-called "premium" handsets are doing much worse than low to mid-end products, and Apple is primarily to blame for that.

The same top three players, but the gaps are narrowing

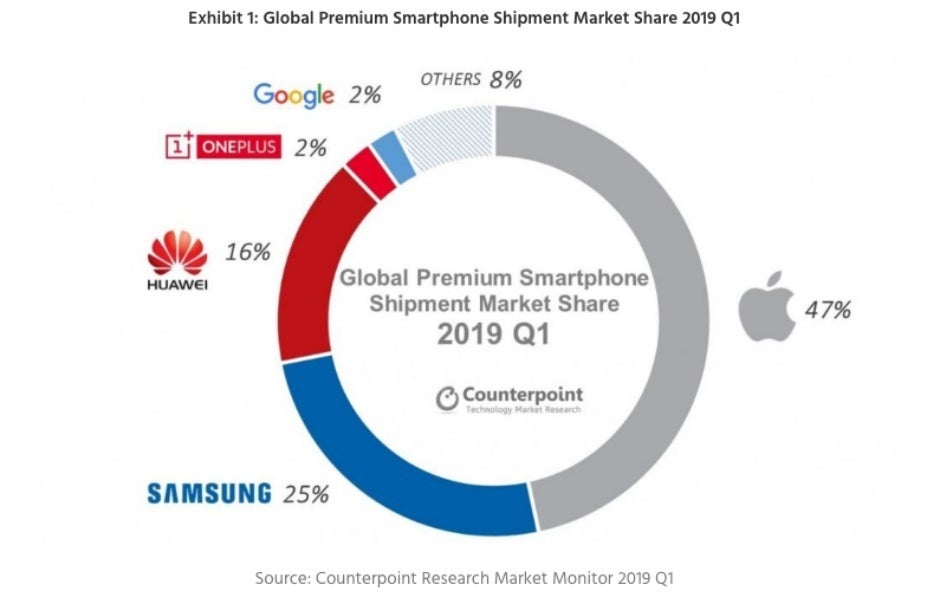

Together, Apple, Samsung, and Huawei accounted for a staggering 88 percent of the world's premium smartphone shipments between January and March. But while the market leader is in no danger of being surpassed anytime soon, iPhone sales tumbled by a worrisome 20 percent, allowing Samsung to capture a quarter of the pie, ahead of Huawei's own juicy 16 percent slice.

Keep in mind Samsung and Huawei only claimed 22 and 10 percent shares respectively in 2018, according to the same research firm, while Apple's numbers have been steadily declining in the last couple of years. The Cupertino-based tech giant had 58 percent of the market in 2017, shrinking to 51 percent last year, and "only" 47 percent during Q1 2019.

Longer iPhone replacement cycles are once again highlighted as the company's main problem, but at the same time, Counterpoint's analysts are also pointing out high-end Samsung devices simply offer better value at similar prices. Meanwhile, the popularity of the Galaxy S10 lineup is believed to be owed to its diversity and attractive design. Finally, Huawei scored big in terms of camera performance, AI technology, and build quality, but the embattled Chinese corporation is unlikely to keep up its recent growth rate.

OnePlus is the standout performer of the "others" category

Incredibly popular in India for quite some time now, premium OnePlus phones available at reasonable prices have quickly caught on in the US as well, propelling the brand to fourth place in the North American chart, narrowly behind Google but ahead of both Motorola and LG. Worldwide, OnePlus scored a 2 percent share of premium shipments, which may not sound like a lot, but it is enough to keep the company in the top five, virtually tied with Google.

This is a particularly impressive achievement when you consider the OnePlus 6T was essentially the brand's only phone up for grabs around the world in Q1, setting the stage for even better results from the OnePlus 7 and 7 Pro over the next few quarters. It's interesting to note that OnePlus was ranked fourth in Q1 2019 not just in North America, but also across the Middle East and Africa (MEA), Western Europe (WE), and Central and Eastern Europe (CEE) regions.

In addition to winning North America's bronze medal, Google only made the top five in Western Europe, whereas Motorola put on its best performance in Latin America. Believe it or not, Sony also shined in Latin America and Asia-Pacific (excluding China), but that's far from enough to keep a dying manufacturer afloat.

Things that are NOT allowed: