Motorola is quietly thriving in the US, but it needs a real flagship to get to the next level

This article may contain personal views and opinion from the author.

The excellent Moto G7 lineup is primarily responsible for the brand's recent revival

While the $2.9 billion deal seemed like an incredible bargain at first, Lenovo struggled to capitalize on one of the oldest, most respected brands in the history of mobile phones for years.

The beginning of a (potentially) beautiful resurgence

Before we go any further, it's important to highlight Lenovo's mobile division isn't exactly swimming in money all of a sudden. Because the Chinese tech giant never detailed the profit scores of its "Mobile Business Group" during the final three months of 2018 and first quarter of 2019, we're guessing those are still fairly modest. But small profits (for two consecutive quarters) sure beat the massive losses reported over the last few years, as Lenovo tried a number of different strategies, reorganizing its vast product portfolio more than once before deciding on focus on a handful of Asian markets with own-brand devices and primarily aiming Moto handsets at North and Latin American audiences.

8 percent is not a lot, but 100 percent share growth in just one year is pretty impressive

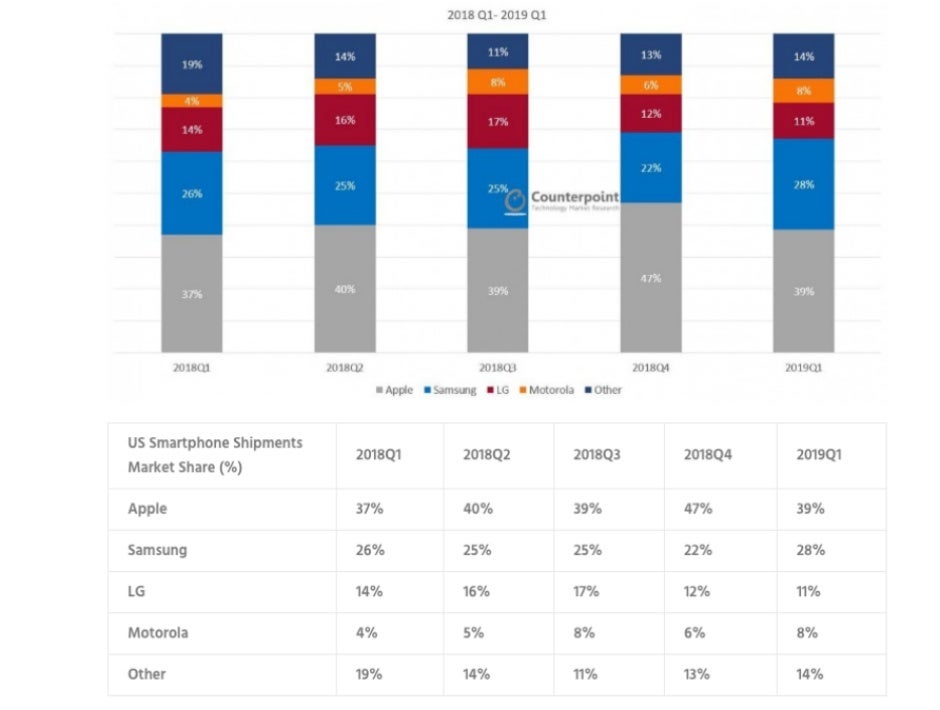

Widely beloved in the US since the good old Razr days, Motorola essentially doubled its regional market share between Q1 2018 and Q1 2019, according to the Counterpoint Research records. The latest preliminary Kantar report suggests the brand had a great second quarter as well, and although its 8 percent slice of the pie doesn't feel as impressive as, say, the 145 million phones it sold around the world back in 2005, it's definitely something that could one day lead to... something bigger.

But while this spectacular promising comeback would have never been possible without the increasingly popular mid-range Moto G series and the even humbler Moto E family, "Lenovorola" has to step things up if it wants to be taken seriously as a potential challenger for the global podium. Speaking of podiums, it's interesting to point out that Motorola is inching closer to LG's bronze medal position in the US while ranking a very distant seventh in worldwide smartphone shipments as of Q1 2019.

No high-end presence, no long-term growth prospects

Quick, what do Samsung, Huawei, and Apple have in common? Aside from a penchant for "borrowing" each other's best ideas, designs, and features, that is. Yup, we're thinking about the best, most popular high-end handsets around. Granted, Huawei's incredible rise through the ranks these last few years is owed in large part to the company's excellent low-cost products. But without blockbusters like the P20 and Mate 20 lineups, overtaking Apple would still be a pipe dream. Ditto for Samsung and the Galaxy S10 family, as well as previous members of the super-premium Galaxy S and Note families.

The failure of the Moto Z3 is not reason enough to abandon the high-end segment

High-end devices don't just sell better than low-enders and mid-rangers, also generating much higher profits that sometimes allow humbler products to be sold at a loss. Unfortunately for Lenovo, the Moto Z lineup hasn't been able to catch on quite at the same level as the G series. Need proof? According to Counterpoint Research, Motorola is ranked outside the top five vendors in the global premium segment, behind both OnePlus and Google.

OnePlus and Google are ahead of Motorola when it comes to US sales of "premium" smartphones as well, which is... not great. After all, OnePlus barely made its regional debut last year. On a single carrier, too. Clearly, the Moto Z3 was a flop, while the recently released Z4 doesn't feel very premium, packing a Snapdragon 675 processor. On the bright side, there's always the Z4 Force to look forward to, right? Well, apparently not, which means the company is giving up on the high-end segment entirely, not even having a US contender for the likes of the Galaxy S10e and iPhone XR in the works.

Motorola needs to do better than the upper mid-range Moto Z4 to sustain long-term US growth

That seems like a big mistake, essentially relegating the brand to second-tier status. There's obviously nothing inherently wrong with focusing squarely on the low and mid-end categories, especially when doing it with awesome devices like the Moto G7 and G7 Power. But these are also inevitably low-margin segments, unlikely to generate the kind of long-term growth a brand associated with the cell phone's invention should be pursuing. Instead of thinking big picture and dreaming big, Motorola appears to be settling for marginal, short-term gains.

Unless the foldable Razr is real, more powerful than recently rumored, and closer to a commercial release than currently believed, in which case I take it all back.

Follow us on Google News

![A new Android bug is making it impossible to install new apps. Are you affected? [UPDATE]](https://m-cdn.phonearena.com/images/article/176703-wide-two_350/A-new-Android-bug-is-making-it-impossible-to-install-new-apps.-Are-you-affected-UPDATE.webp)

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: