Meta shares collapse, drop over $79 after report paints a bleak picture for 2022

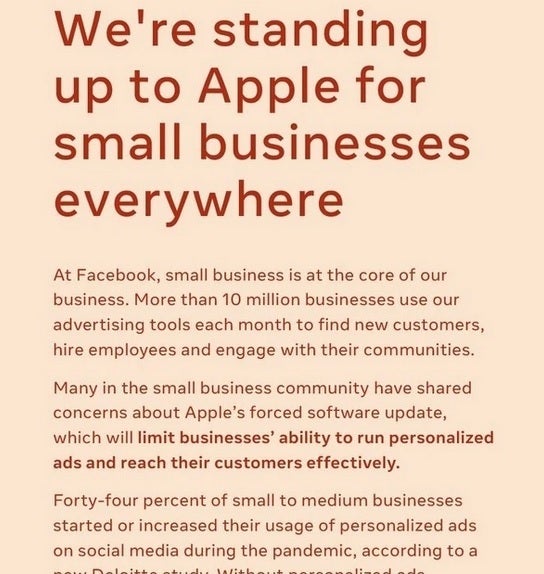

You might recall that when Apple announced in 2020 that it was going to allow iPhone users to opt-out of being tracked in order to escape being hit with targeted ads, Facebook had what you might call a "shit fit." Facebook co-founder and CEO Mark Zuckerberg accused Apple of harming small businesses and even had two full-page ads published in big-city newspapers to broadcast his feelings toward Apple's new privacy feature.

Facebook went after Apple after the latter announced its App Tracking Transparency feature

Facebook complained that small businesses would be hurt the most if iPhone users had the ability to block ad trackers from knowing their locations. This would stop users from finding out about that special sale taking place at the store across the street. And when the App Tracking Transparency (ATT) feature finally arrived in iOS 14.5 last April, a vast majority of iPhone users decided to opt-out of receiving personalized ads, no surprise there.

Facebook attacks Apple's App Tracking Transparency feature in full-page ads

Facebook parent Meta reported its fourth-quarter earnings on Wednesday and some of those numbers failed to meet expectations. At the same time, Meta said that Apple's ATT feature will cost Meta $10 billion in revenue during 2022. Meta CFO Dave Wehner said, "We believe the impact of iOS overall is a headwind on our business in 2022."

Wehner, talking to analysts during the conference call after the earnings report was released, forecast how much ATT will hurt the company. "It’s on the order of $10 billion, so it’s a pretty significant headwind for our business," he said. After rising $4 to $323 a share during the regular trading session, Meta shares were dumped in after-hours trading following the release of the report (more on this later).

For the first quarterly report since Facebook changed its corporate name to Meta in October, revenue was reported as $33.67 billion for the fourth quarter, up 20% year-over-year and topping Wall Street forecasts of $33.4 billion. But costs and expenses rose 38% to $21.10 billion. And net income of $10.29 billion was an 8% decline from the fourth quarter of 2020.

Earnings per share came in at $3.67 which was below Wall Street expectations of $3.84 and a decline of 5% from the $3.88 reported for last year's fourth quarter. Advertising revenue amounted to $32.64 billion during the fourth quarter, up 15.4% over last year's fourth-quarter advertising revenue. For all of 2021 advertising revenue rose 36.5% to $114.93 billion,

Revenue related to Facebook's "family of apps" such as Facebook, Instagram, Messenger, WhatsApp, and others was $32.79 billion during the fourth quarter of 2021 which resulted in a profit of $15.89 billion during the three months. For the entire year, those apps took in $115.66 billion and reported a $56.95 billion profit.

Hardware and VR products including the Portal smart screen line and the Oculus headset brought in $877 million from October through December but spilled $3.30 billion in red ink. For all of 2021, the hardware grossed $2.27 billion but lost $10.19 billion for the year.

For all of 2021, the top line was $117.93 billion, up 37% from 2020's revenue of $85.97 billion. Net income last year rose 35% from the prior year's $29.15 billion to $39.37 billion.

Facebook sees headwinds ahead impacting 2022 and Meta's stock plunges over 20%

Meta stock (FB) dropped $73.95 following the release of the report to finish the day at $249.05. Besides the impact of Apple's ATT, META also blamed other events for this year's shortfall including supply chain disruptions, inflation, and more. And the beat goes on as Meta is calling for first-quarter revenue to be in a range of $27-$29 billion while most analysts expected the top line to be $30.15 billion according to a consensus of Wall Street analysts.

The number of Daily Active Users for the fourth quarter was 1.93 billion, short of estimates of 1.95 billion and a year-over-year increase of 5%. The number of monthly active users was 2.91 billion, again, short of Wall Street forecasts of 2.95 billion and a 4% annual increase. The average revenue per user for the fourth quarter was announced at $11.57 vs $11.38 expected by Wall Street analysts.

Facebook sees more problems ahead. "On the impressions side, we expect continued headwinds from both increased competition for people’s time and a shift of engagement within our apps towards video surfaces like Reels, which monetize at lower rates than Feed and Stories," Facebook said.

So looking at a possible $10 billion shortfall from ATT, users spending their time on Reels (a less profitable platform), and finding other things to do besides going on Facebook, 2022 does not look promising for the platform and Mark Zuckerberg.

Things that are NOT allowed: