Qualcomm is no longer the top supplier of chipsets for smartphones

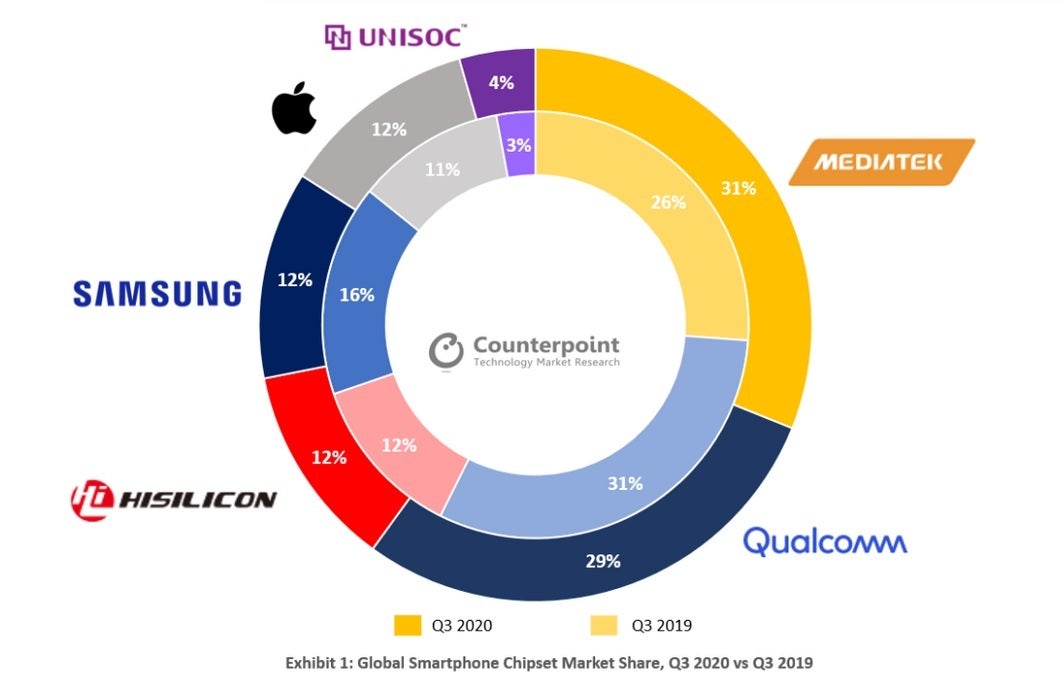

According to Counterpoint Research, there has been a change in the smartphone industry. During the third quarter of this year covering July through September, MediaTek overtook Qualcomm to become the top provider of chipsets for the smartphone industry with a 31% share of the market. Counterpoint attributes MediaTek's success to strong sales of phones in the $100-$250 price range amid strong growth in the top two smartphone markets in the world; that would be China (#1) and India (#2). As a developing country, Indian consumers prefer value brands many of which use MediaTek chips instead of Qualcomm's pricier Snapdragon silicon.

MediaTek takes the smartphone chipset crown from Qualcomm in Q3

This is not to say that Qualcomm couldn't find a sweet spot for growth in Q3. With 39% of the market, the chip maker is the leading provider of 5G chipsets for phones and this is a market that doubled during the third quarter. Counterpoint says that 17% of all phones sold during the third quarter supported 5G. That figure is expected to rise to 33% for the current quarter that started in October and concludes at the end of the year. With strong growth in 5G shipments for the fourth quarter, Qualcomm does have a chance to take back the crown that MediaTek took away from it.

MediaTek is now the number one provider of chipsets to the smartphone market

MediaTek's leading 31% share of the smartphone chipset market was a 19% percent gain from the 25% share that the Taiwan based firm had last year. During the same time period, Qualcomm's slice of the chipset pie for handsets declined from a leading 31% to the current 29%. Apple was third as its A-series chips, built exclusively for its phones and tablets, garnered 12% of the market. That put Apple in a three-way tie with Samsung and Huawei's HiSilicon unit.

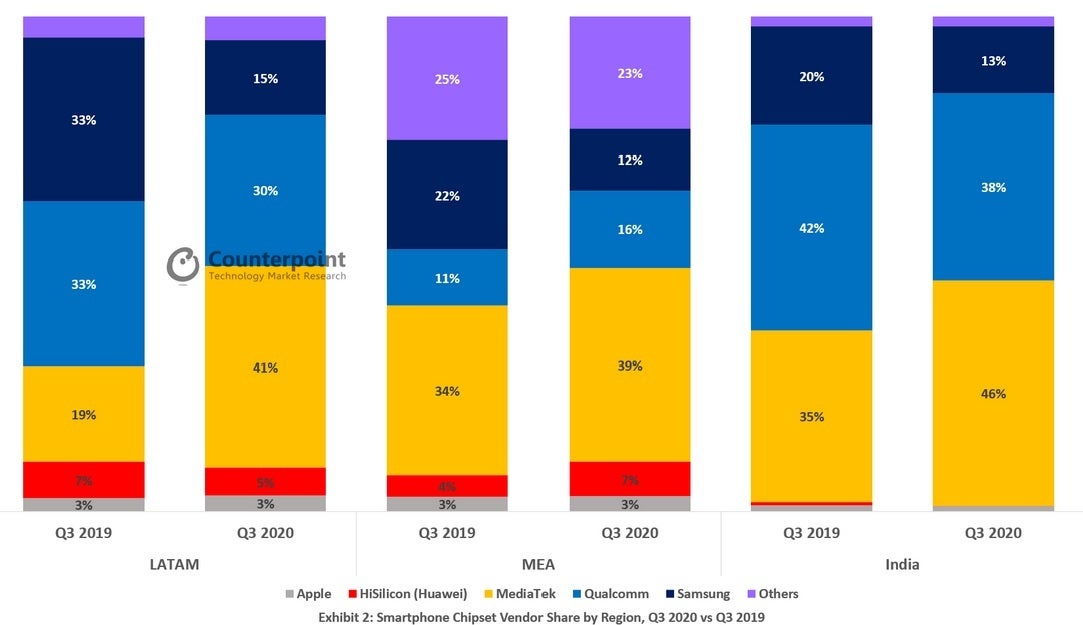

Smartphone chipset breakdown by region

Counterpoint Research Director Dale Gai pointed out that "MediaTek’s strong market share gain in Q3 2020 happened due to three reasons – strong performance in the mid-end smartphone price segment ($100-$250) and emerging markets like LATAM (Latin America) and MEA (Middle East and Asia), the US ban on Huawei and finally wins in leading OEMs like Samsung, Xiaomi and Honor. The share of MediaTek chipsets in Xiaomi has increased by more than three times since the same period last year. MediaTek was also able to leverage the gap created due to the US ban on Huawei. Affordable MediaTek chips fabricated by TSMC became the first option for many OEMs to quickly fill the gap left by Huawei’s absence. Huawei had also previously purchased a significant amount of chipsets ahead of the ban."

Gai also noted that, "On the other hand, Qualcomm also posted strong share gains (from a year ago) in the high-end segment in Q3 2020, again thanks to HiSilicon’s supply issues. However, Qualcomm faced competition from MediaTek in the mid-end segment. We believe both will continue to compete intensively through aggressive pricing, and mainstream 5G SoC products into 2021."

Counterpoint Research Analyst Ankit Malhotra added, "Qualcomm and MediaTek have both reshuffled their portfolios, and consumer focus has played a key role here. Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories. The world’s cheapest 5G device, the realme V3, is powered by MediaTek. Using his crystal ball to look into the future, Malhotra said, "The immediate focus of chipset vendors will be to bring 5G to the masses, which will then unlock the potential of consumer 5G use cases like cloud gaming, which in turn will lead to higher demand for higher clocked GPUs and more powerful processors. Qualcomm and MediaTek will continue to contend for the top position."

Things that are NOT allowed: