Apple iPhone shipments show brisk growth in India

While India is the world's second-largest smartphone market, it still is a developing country which means that lower-priced phones are the top sellers in the country. That is why Android handsets have a massive market share in the country. Those Indian consumers who prefer iOS usually end up purchasing older model iPhones including some that are manufactured right in the country. For example, last year Apple advertised the "Incredible iPhone 6s" in India. Priced at the equivalent of $383 USD at the time, the phone was originally launched globally in 2015.

Apple iPhone shipments show strong growth in India

Apple has started manufacturing more recently released handsets in India including the most popular smartphones in the world during 2019 and 2020; those would be the iPhone XR and iPhone 11 respectively. The iPhone SE (2020) is also produced in the country. By offering several locally manufactured models, Apple avoids having to pay an import tax on models brought in from China. It also allows Apple to curry favor with the Indian government by participating in the Prime Minister's Make in India program. Last month, Apple opened its first online Apple Store allowing consumers in the market to order directly from Apple for the first time. Previously Apple devices had to be ordered in India through e-commerce firms like Amazon India, Flipkart, and others. Apple also has plans to open a physical Apple Store in India next year.

Xiaomi and Samsung were the top two smartphone manufacturers in India during the second quarter

According to research and analytics firm Canalys, during the third quarter of this year, iPhone sales grew at a double-digit rate to reach nearly 800,000 units sold. Canalys Research Director Rushabh Doshi states that "Apple is finally paying attention to India. It has opened a direct online store, giving it several new angles in its go-to-market strategy, such as utilizing device trade-ins to provide purchase incentives, or bundling AirPods with iPhones to make them more appealing. However, its new iPhone 12 family will be a tough sell in India this year, as network operators do not yet have the infrastructure for mass market 5G deployment, erasing a key feature of the devices. Not to forget, Apple’s pricing strategy for its new iPhones in India needs serious consideration."

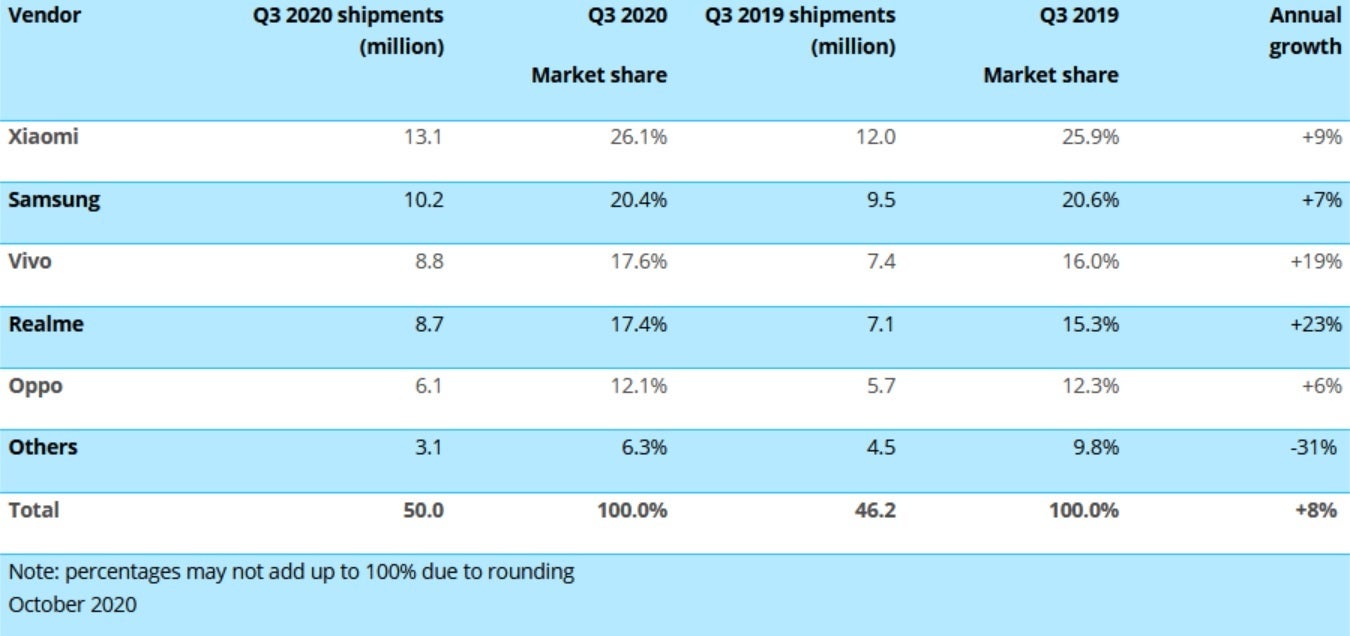

Despite the pickup in sales growth, Apple still falls into the "Others" category based on the lower number of devices it shipped to the country for the quarter. Xiaomi remained the top smartphone manufacturer in India during the quarter thanks to its value for money strategy. For the period from July through September, the Chinese company shipped 13.1 million handsets to India, up 9% year-over-year. Xiaomi had 26.1% of the country's smartphone market during the three months. Thanks to its popular mid-range handsets Samsung was second after delivering 10.2 million phones to Indians during Q3. This was an increase of 7% year-over-year and it gave Samsung 20.4% of the market.

The 8.8 million handsets that Vivo shipped to India during the quarter was enough to place the manufacturer third with a 17.6% share. The company enjoyed a 19% annualized growth rate during the three months. RealMe was just slightly behind Vivo with its third-quarter shipments of 8.7 million phones just slightly behind Vivo. The manufacturer delivered a strong 23% growth rate in India from July through September. And Oppo finished fifth after shipping 6.1 million phones to India during Q3. That worked out to a 12.1% market share for the third quarter of this year.

Apple has been promoting the idea of reducing the number of iPhone models that are assembled in China. While India would seem to have a head start on grabbing some of that business, there might be some questions about whether Apple would be able to access a nearby supply chain that would allow it to obtain components in the quantity and quality that it needs.

Things that are NOT allowed: