Global shipments of the iPhone decline almost 10% during the first quarter

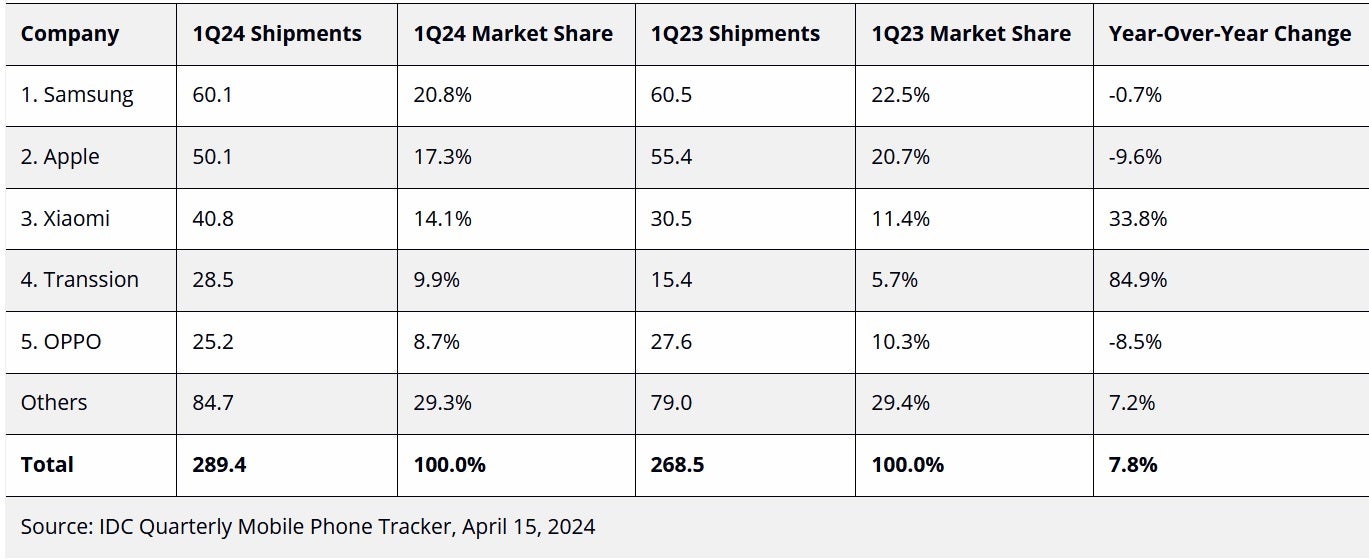

The first quarter of 2024 was not a good one for the iPhone. According to IDC, iPhone shipments declined 9.6% globally even though the smartphone industry as a whole recovered. Global shipments rose 7.8% year-over-year to 289.4 million units led by Samsung. The manufacturer's Galaxy S24 flagship series with its Galaxy AI features helped Samsung ship 60.1 million phones during the three months. While that was down .7% on an annual basis, it still left Samsung with an industry-leading 20.8% market share.

Apple's 9.6% annual decline in Q1 iPhone shipments came as 50.1 million iPhones were delivered by Apple from January through March, good enough for second place. The iPhone's global market share came to 17.3% for the quarter. Thanks to a 33.8% hike in Q1 shipments, Xiaomi finished in third with a 14.1% market share. The company shipped 40.8 million smartphones during the first three months of the year.

The fastest-growing smartphone manufacturer in the quarter was China's Transsion which has been showing huge gains for months. The company sells its phones in Africa, the Middle East, Southeast Asia, South Asia, and Latin America. For the quarter, its shipments soared a leading 84.9% to 28.5 million phones leaving it with a global market share just shy of 10%.

Samsung takes the top spot in IDC's global Q1 2024 global smartphone report

Having delivered 25.2 million phones in Q1, Oppo was the fifth-largest smartphone manufacturer for the period. That is a year-over-year decline of 8.5% in shipments and Oppo ended the quarter with an 8.7% global market share.

Ryan Reith, group vice president with IDC's Worldwide Mobility and Consumer Device Trackers said, "As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands. While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter."

He added, "While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we're likely to see the top companies gain share as the smaller brands struggle for positioning."

IDC says that average selling prices for smartphones are on the rise. The analytics firm said that consumers are looking to buy premium models that they plan to use for a long time period. IDC also says that Apple probably sold more iPhone 15 Pro and iPhone 15 Pro Max units than non-Pro models helping Apple garner a higher revenue figure for each unit sold. But the report also noted that Apple had to do the unusual and cut prices of the iPhone by as much as the equivalent of $180 in China, the world's largest smartphone market.

Things that are NOT allowed: