The Apple iPhone had its largest global market share of all time during Q4 2022

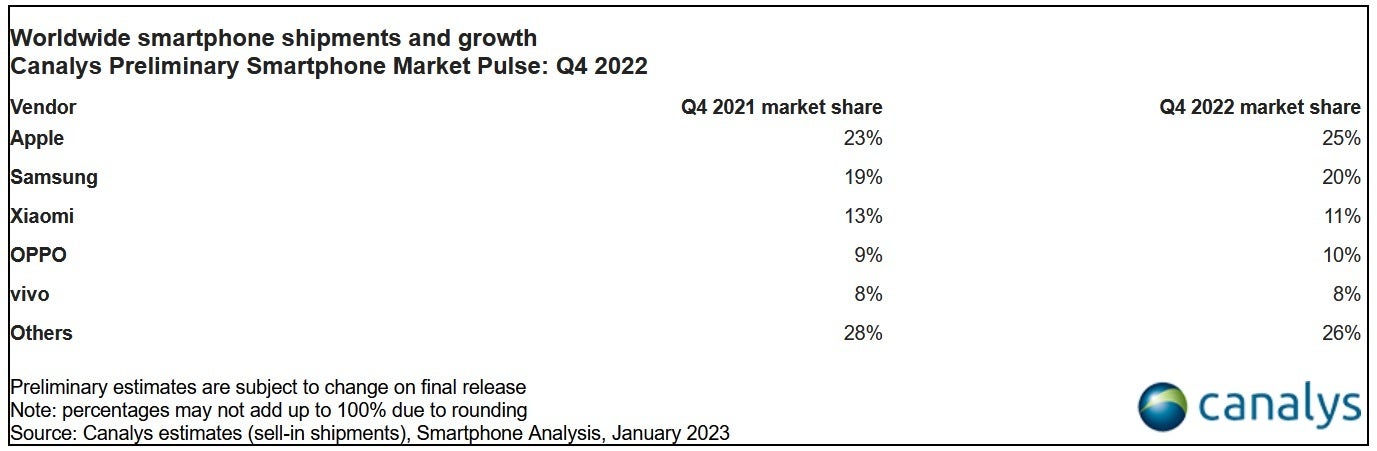

The final quarter of 2022 was not such a great one for the smartphone industry. Research firm Canalys released a report today revealing that smartphone deliveries declined by 17% to less than 1.2 million units for the three months from October through December 2022. Apple was on top and had its highest quarterly market share ever at 25% even though it suffered from production shortfalls when employees at Foxconn's Zhengzhou factory left to avoid a COVID crackdown. During the 2021 fourth quarter, Apple had a 23% share of global smartphone shipments.

Samsung saw its slice of the global smartphone pie increase to 20% during Q4 2022 from 19% during the fourth quarter a year earlier. Xiaomi was third with 11% of the global smartphone market compared to the 13% market share it had during the previous year. Oppo grabbed 9% of the global smartphone market in the final quarter of last year compared to the 8% it had during the last quarter of 2021.

Samsung was second to Apple during the fourth quarter but was the top smartphone manufacturer worldwide in 2022

And rounding out the top five is Vivo. Like Oppo, one of the companies under the BBK Electronics umbrella (along with OnePlus, Realme, and iQOO), Vivo captured the same 8% of global smartphone shipments during the fourth quarter of 2022 that it had in 2021. The "others" category had a year-over-year decline from 28% in 2021's Q4 to the final quarter of 2022.

Apple had the biggest market share among smartphone manufacturers worldwide during Q4 2022

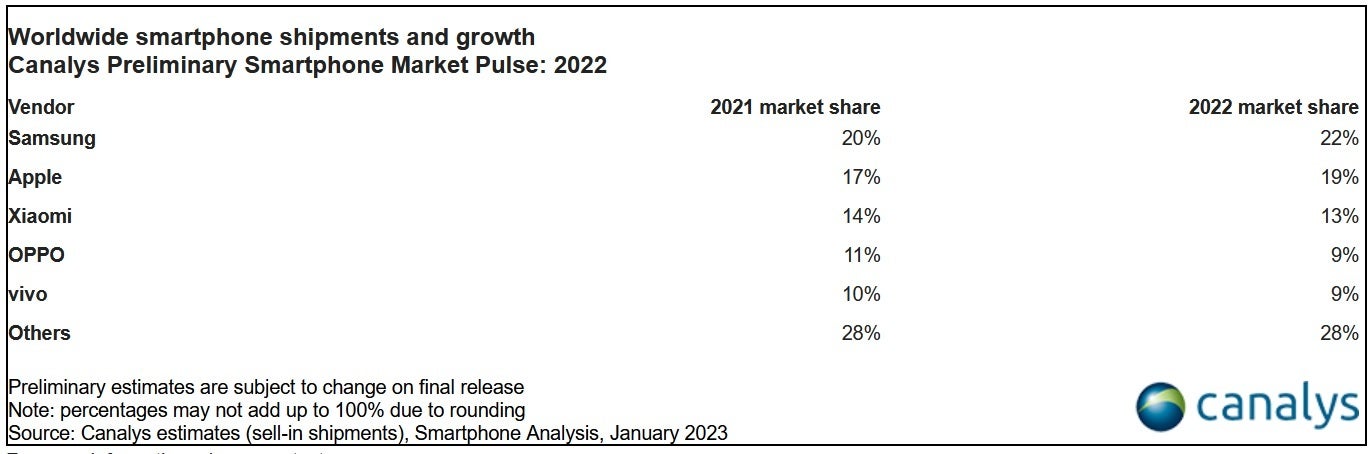

For all of 2022, Samsung remained the number one smartphone brand in the world based on shipments. The company was responsible for 22% of smartphone shipments worldwide last year. That is up from the 20% share it owned in 2021. Apple was second and kept pace with Samsung by having its slice of the global smartphone pie rise from 19% in 2021 to 21% in 2022.

For all of 2022, Samsung shipped the most smartphones globally

Xiaomi finished last year with 13% of the global smartphone market down slightly from the 14% market share it captured the year before. Oppo and Vivo both were responsible for 9% of global smartphone deliveries in 2022. Oppo registered an 11% share in 2021 while Vivo had 10% of the smartphone market that year. For 2022, brands mixed together in the "others" category made up 28% of global smartphone shipments which was flat with the 2021 number.

Canalys Research Analyst Runar Bjørhovde said, "Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022. Q4 marks the worst annual and Q4 performance in a decade. The channel is highly cautious with taking on new inventory, contributing to low shipments in Q4. Backed by strong promotional incentives from vendors and channels, the holiday sales season helped reduce inventory levels.

Canalys says that the 2023 smartphone market will be impacted by higher interest rates, weak economies, and inflation

Bjørhovde added, "While low-to-mid-range demand fell fast in previous quarters, high-end demand began to show weakness in Q4. The market’s performance in Q4 2022 stands in stark contrast to Q4 2021, which saw surging demand and easing supply issues.”

"Vendors will approach 2023 cautiously, prioritizing profitability and protecting market share," said Canalys Research Analyst Le Xuan Chiew. "Vendors are cutting costs to adapt to the new market reality. Building strong partnerships with the channel will be important for protecting market shares as difficult market conditions for both channel partners and vendors can easily lead to strenuous negotiations."

Chiew also made a prediction about the smartphone market for 2023. "Though inflationary pressures will gradually ease, the effects of interest rate hikes, economic slowdowns and an increasingly struggling labor market will limit the market’s potential. This will adversely affect saturated, mid-to-high-end-dominated markets, such as Western Europe and North America."

The analyst concluded by saying, "While China’s re-opening will improve domestic consumer and business confidence, government stimuli are only likely to show effects in six to nine months and demand in China will remain challenging in the short term. Still, some regions are likely to grow in the second half of 2023, with Southeast Asia in particular expected to see some economic recovery and a resurgence of tourism in China helping to drive business activities."

Things that are NOT allowed: