The world's second largest smartphone market sees shipments drop in half during Q2

A double whammy negatively impacted the second-largest smartphone market in the world during the second quarter of the year. According to Canalys, the global outbreak of coronavirus led to the shutdown of smartphone production in the country. And the demand for handsets dropped sharply as retailers both online and offline were not allowed to sell them. This was the case in India until the middle of May; that means that COVID-19 affected smartphone supply and demand in India for half of Q2.

Xiaomi remained the leading smartphone manufacturer in India during the second quarter

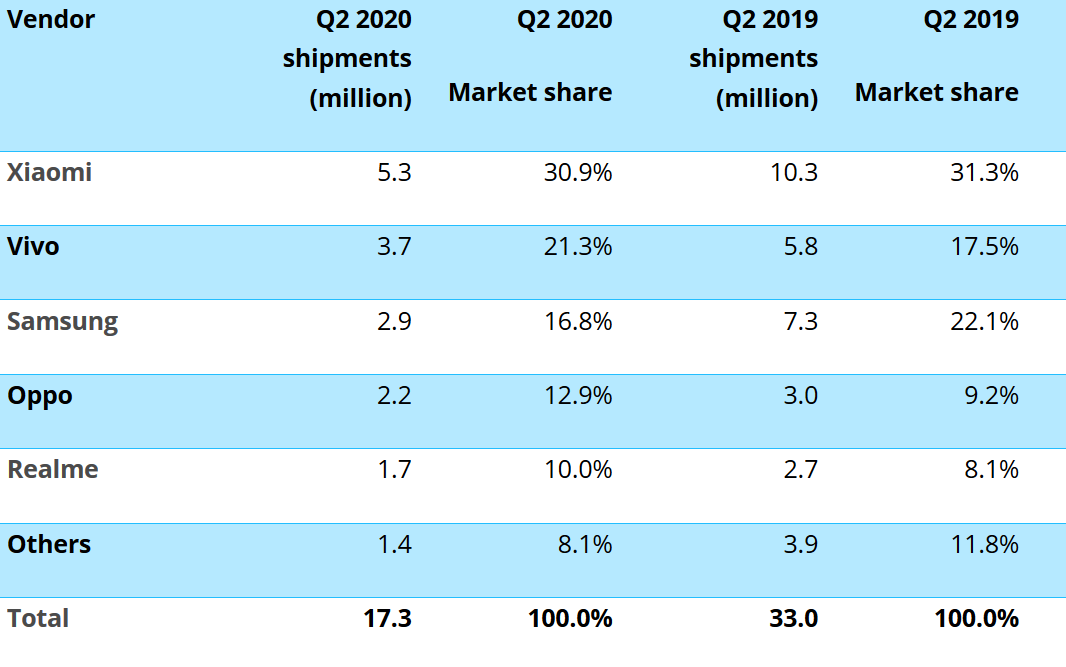

, with its value for money approach that is tailor-made for a developing country like India, remained the top smartphone manufacturer in the market during the second quarter. Even though shipments, at 5.3 million units, declined 48% year-over-year (the company shipped 10.3 million phones during the same quarter last year), Xiaomi's market share barely declined from 31.3% during Q2 2019 to 30.9% during this year's second quarter.

Xiaomi was the top smartphone manufacturer in India during the second quarter

Vivo was second during Q2 after delivering 3.7 million phones during the three months. Even with a 36% decline in the number of phones shipped, the manufacturer's market share rose from 17.5% to 21.3% from April through June of this year. Samsung saw phone shipments in India decline by 60% on an annual basis as the number of phones it delivered dropped from 7.3 million to 2.9 million. Even the popular Galaxy A series couldn't stop the bleeding as Sammy saw its slice of the Indian smartphone market decline from 22.1% to 16.8%.

Oppo finished fourth for the quarter with a 27% decline in shipments from 3 million to 2.2 million, allowing the company to expand its market share from 9.2% to 12.9%. And in fifth place during the quarter was Realme. The latter shipped 1.7 million phones during the three months, one million or 35% fewer than during the same quarter last year. Realme owned 10% of the Indian smartphone market in Q2, which was up from the 8.1% share it had during Q2 of 2019.

Canalys Analyst Madhumita Chaudhary said, "While vendors witnessed a crest in sales as soon as markets opened, production facilities struggled with staffing shortages on top of new regulations around manufacturing, resulting in lower production output. The fluidity of the lockdown situation across India has had a deep-rooted effect on vendors’ go-to-market strategies. Xiaomi and Vivo have undertaken an O2O (offline-to-online) strategy to support their massive offline network. Online channels, too, while seeing a positive effect of the pandemic on market share, have seen sales decline considerably."

What might negatively impact Chinese phone manufacturers like Xiaomi, Vivo, Oppo, and Realme in India during the current quarter is a border skirmish between the two countries. 20 Indian soldiers were killed by the Chinese and India started holding up shipments from China into the country. Canalys says that 96% of all smartphones sold in India last year were made locally. Despite this, Canalys analyst Adwait Mardikar notes that the lure of lower pricing on phones from Chinese companies like Xiaomi will help those manufacturers sell their wares in India. He says, "Vendors are driving the message of 'Made in India' to consumers and are eager to position their brand as 'India-first.' Despite the sentiment, the effect on Xiaomi, Oppo, Vivo and Realme is likely to be minimal, as alternatives by Samsung, Nokia, or even Apple are hardly price-competitive." Canalys analyst Chaudhary says that manufacturers are hoping that new 5G handsets lead to increased sales. He noted that "The transition to 5G is the next big opportunity, and Jio’s announcement of readiness to deploy 5G, as soon as spectrum is made available, has provided a ray of hope to most vendors who have been beaten by the current pandemic."

Xiaomi's value for money strategy plays very well in India

Speaking of Apple, the company turned in the best performance out of India's top 10 smartphone manufacturers with a 20% year-over-year decline in shipments. The number of iPhones delivered in India was slightly over 250,000 units. Even though pricing makes iPhones luxury items in China, another iPhone assembler is working on building a new plant in India joining Foxconn and Wistron. Bloomberg reports that Pegatron, the second-largest iPhone assembler in China after Foxconn, will eventually start producing iPhone models in India. Apple is looking to move up to 20% of iPhone production out of China to avoid the possibility of tariffs in the future as the tense relationship between the U.S. and China continues.

Overall for the quarter, 17.3 million handsets were shipped in India down 48% from the 33 million that were delivered during the same quarter last year.

Things that are NOT allowed: