Huawei's EUV substitute could change the balance of power in the smartphone industry

It's true. There is only one tool that prevents Huawei from obtaining chips as powerful and energy-efficient as the SoCs used to power the iPhone and the Galaxy S line. That tool is the extreme ultraviolet lithography machine (EUV). We've discussed this machine before as the EUV lithography machine has an important job. It transfers circuitry patterns and places them on the silicon wafers that are the building blocks of chips.

EUV lithography machines are needed to build chips using a process node lower than 7nm

With billions of transistors inside each smartphone application processor, having these patterns appear on the wafer without any errors is very important. EUV lithography machines are needed to build smartphone chips using a process node of under 7nm and the one company in the world that makes these machines, Dutch firm ASML, will not ship them to China.

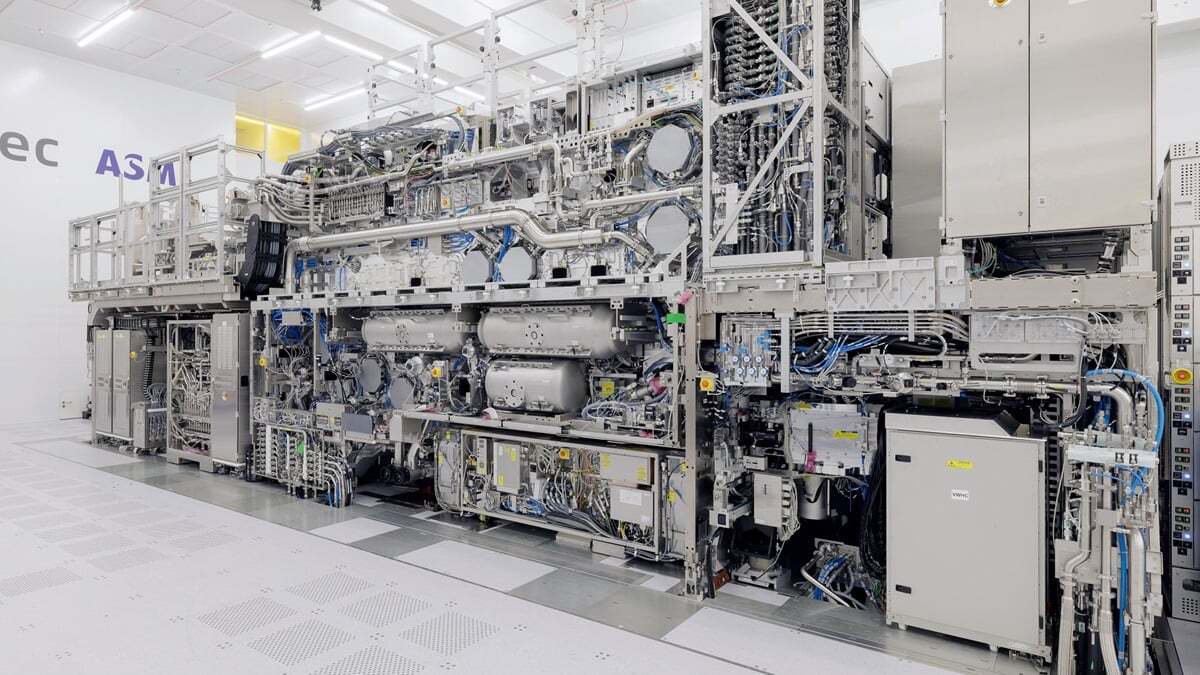

An EUV lithpgraphy machine is the size of a school bus. | Image credit-ASML

Foundries in China are allowed to own older lithography equipment such as the deep ultraviolet machines that the largest foundry in China, SMIC, used to produce the 7nm Kirin application processors (AP) that power recent Huawei flagships such as the Mate 60 series, the Pura 70 line, and the Mate 70 models.

While SMIC is the third largest foundry in the world after TSMC and Samsung Foundry, not being able to buy a EUV lithography machine and the next-gen High-NA EUV machine keeps Huawei's smartphone silicon two to three generations behind processors designed by Apple and Qualcomm. This prevents Huawei from creating smartphones as fast as those made by its rivals.

Despite being several generations behind the chips used to power its competitors' phones, it was a big deal for Huawei to use the chips it designed for the Mate 60 series. That's because it allowed Huawei to support 5G on those phones which was something that U.S. sanctions were designed to prevent. In 2021 and 2022 Huawei used Qualcomm Snapdragon chipsets tweaked to run 4G and not 5G on its phones.

But with 2023's Huawei Mate 60 line, SMIC was able to use techniques such as double and quadruple patterning. This allowed the foundry to transfer more complex circuitry to the silicon wafers it used allowing the foundry to build the 7nm Kirin chips that gave Huawei customers the chance to buy a new flagship model with 5G support.

As big as that was for Huawei, something else is happening that could be a game changer for the beleaguered Chinese company. A system called laser-induced discharge plasma (LDP) technology is being tested at a Huawei facility in Dongguan. With these tests Huawei has been able to create the short 13.5nm wavelength that is needed to build the most advanced chips. The reports out of China say that Huawei is able to create this short wavelength by "vaporizing tin between electrodes and converting it to plasma via high-voltage discharge, where electron-ion collisions produce the required wavelength." LDP could help Huawei build an alternative to EUV lithography.

What could happen if Huawei does create its own EUV lithography substitute?

Should Huawei and SMIC be able to create their own alternative EUV machine the U.S. will have less control over Huawei. Sure, losing Google meant that Huawei no longer could use the Google Mobile Services version of Android. But Huawei went out and developed HarmonyOS. When Huawei was forced to use 4G chips on its flagship phones, the company worked with SMIC to produce 7nm application processors that brought 5G back to its phones.

If Huawei does it again and is able to create an EUV machine of its own, there will be nothing holding it back from reasserting itself as a serious challenger to Apple, Samsung, and Xiaomi in the smartphone industry. After all, just before the U.S. started sanctioning Huawei by calling it a national security threat and putting it on the Entity List, Huawei had passed Apple to become the second-largest smartphone manufacturer in the world.

Once on the Entity List, Huawei was no longer allowed to use U.S. suppliers like Google. The next year, the U.S. extended an export rule that prevented chipmakers using U.S. equipment to build chips from shipping cutting-edge silicon to Huawei. The company had to sell off its Honor sub-brand and endure a huge drop-off in sales before starting to fight back. With the possible development of its own substitute EUV machine, Huawei appears ready to work its way back to the top of the smartphone world once again.

Things that are NOT allowed: