Google Tensor grabbed some AP chipset market share in 2021

We may earn a commission if you make a purchase from the links on this page.

Google's first homegrown SoC, the Google Tensor, has started to make its mark in the world of cutting-edge chipsets for Android phones according to Counterpoint Research. The chip was included in Counterpoint's list of the volume share for Application Processors (AP) used by Android phones last year, broken down by the price range for the handsets supplied.

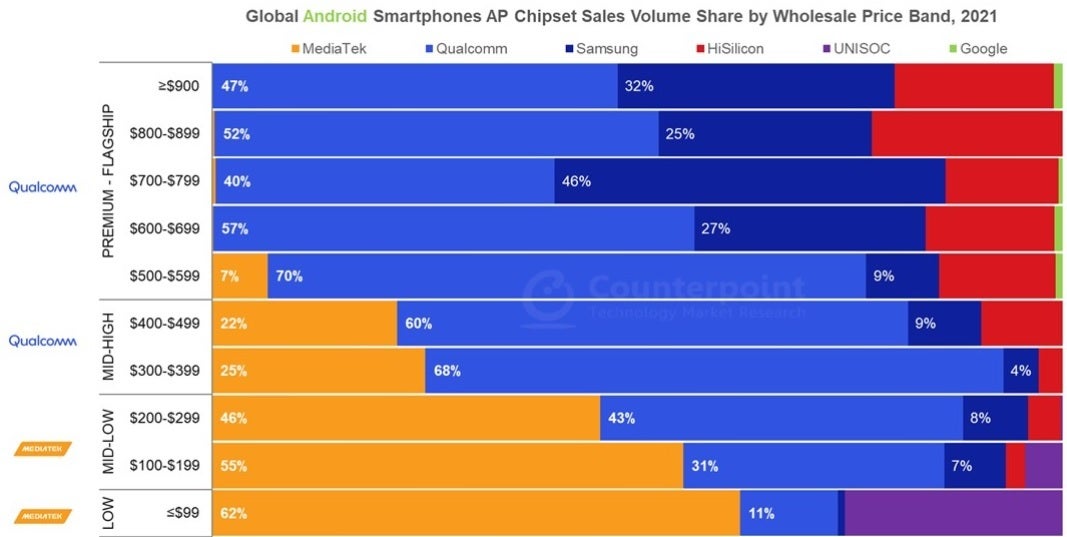

For example, with Android phones considered to be in the premium-flagship tier priced at $900 and up, Qualcomm's Snapdragon chipsets had the leading market share of chips powering phones in that price bracket. For Android handsets priced in the range of $500-$699, and $800 to $900 and higher, Qualcomm was still the leading supplier. Samsung was second with its Exynos AP chips although it did surpass Qualcomm and supplied more chips to mid-range Android phones in the $700-799 range.

Huawei still had some Kirin chipsets left in inventory

MediaTek finished third in the premium/flagship segment followed quite surprisingly by Huawei's HiSilicon brand. In 2020, the U.S. changed its export rules blocking foundries using American technology from shipping chips to Huawei, even those chips that Huawei designed itself. The Hi-Silicon chipsets that Huawei used last year for its own devices most likely used up the last of the company's inventory and led to its inclusion in the chart.

Google's new Tensor AP chip surfaced in Counterpoint's chart

Huawei has been using 4G LTE versions of Qualcomm's Snapdragon 888 chipset on its new flagship models. There has been speculation that the company will manufacture a phone case that will allow the P50 series to connect to 5G networks.

Google Tensor, Google's first homegrown chipset made for the Pixel 6 series, had a very small slice of the Android chipset pie for phones priced above $900 (which probably includes most configurations of the Pixel 6 Pro), Android handsets priced in the range of $500-$799 (Pixel 6 purchases).

Qualcomm still had the lead in supplying chips to high-mid-range models priced in the $300-$499 tier. Its top AP chips in that sector included the Snapdragon 870, 720G, 750G, and 778G. In that price band, MediaTek's Dimensity SoCs had the second largest market share with Samsung dropping off to third, and Huawei a close fourth.

In the low-mid-range category, MediaTek and its Dimensity chipsets had the lead last year with Qualcomm second, Samsung third, Huawei fourth, and Unisoc fifth. For low-end handsets priced at $99 and less, MediaTek had the vast majority of the market with Qualcomm second, Samsung third, and Unisoc fourth.

Counterpoint says that to alleviate chip shortages in the future, Qualcomm could rely on dual-sourcing from both TSMC and Samsung. When it comes to its designs, the research firm says that "Qualcomm is generations ahead of its competition when it comes to premium experiences in a chipset, whether it is compute (CPU, DSP, GPU), AI (NPU), connectivity (4G, 5G sub-6GHz, 5G mmWave, Wi-Fi6/6E), security, or gaming capabilities."

As for MediaTek, Counterpoint points out that most of MediaTek's growth came from smartphones priced wholesale at $299 and less. The research firm says that most of the shortages in the chip market were for SoCs destined for 4G LTE handsets.

As expected, MediaTek dominated the low-end of the smartphone market

MediaTek is going after Qualcomm and Samsung's flagship business with the Dimensity 9000. Most of the smartphone manufacturers in China such as OPPO, vivo, Xiaomi, and HONOR will release phones powered by the Dimensity 9000 this year. And Counterpoint says that MediaTek could end up supplying chips to as much as 10% of the premium Android market this year.

Pick up the Google Pixel 6 or Pixel 6 Pro

Samsung suffered declines in market share for its chipsets across most price points. Big changes were seen in the low-mid segment ($100-$299) where Sammy's market share declined from 17% in 2020 to 7% last year. Samsung outsourced its phones belonging to its mid-high segment, where its share decreased from 13% in 2020 to 6% in 2021.

Samsung Mobile handed off the design and manufacturing chores for many of its high-mid-range handsets including models in the A, F, and M series. These third-party design firms mostly employed AP chips designed by Qualcomm, MediaTek, or Unisoc instead of using Samsung's own Exynos chipsets.

Things that are NOT allowed: