Feeling the heat from lawmakers, Google seeks to spin-off some ad-related businesses to Alphabet

Google has been considering spinning off parts of the businesses it owns that depend on ad sales into separate units that would be owned by parent company Alphabet. This plan is being developed to keep Google away from lawmakers and regulators who would love to do nothing more than point one of their big fat fingers at the firm and yell at the top of their lungs, "Monopolist."

A couple of months ago U.S. Senators focused on possible conflict of interest allegations in the advertising technology industry hoping to get dominant firms like Google to break up into smaller operations. According to eMarketer, advertisers plan on spending more than $600 billion to place online digital advertisements worldwide this year.

Google could own 29% of the global digital ad market this year

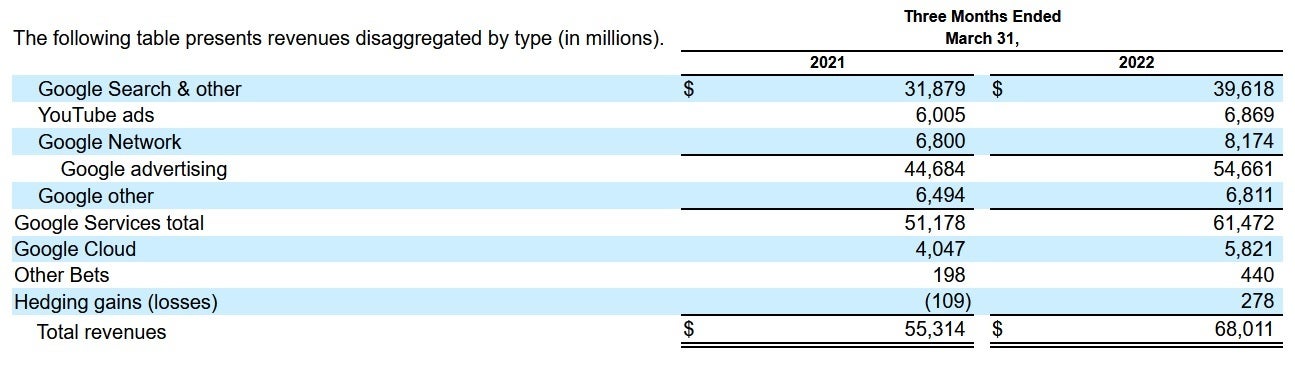

Google's advertisement related businesses showed strong growth during the first quarter of 2022

Google's move here is actually a smart one. By working on its own break-up plan, Google will be able to have more say about how to split up the firm. In an email to Search & Performance Marketing Daily, a Google spokesman wrote, "We have been engaging constructively with regulators to address their concerns. As we've said before, we have no plans to sell or exit this business, and we're deeply committed to providing value to a wide array of publisher and advertiser partners in a highly competitive sector."

Google has been under fire from lawmakers and regulators who complain that the company has a conflict of interest when it acts as both a broker and auctioneer of online ads. Google acts as a broker when it places ads for companies on third party sites. It acts as an auctioneer when it runs the bidding for ads placed on Google's search engine. In a lightning fast process, Google looks at the bids that advertisers are willing to pay each time an ad is clicked on by a consumer. It also looks at the quality of the advertisements competing in the auction.

Google revealed strong first quarter ad revenue of $54.7 billion (including the figures for Search, YouTube, and the Google Network) compared to the $44.7 billion it collected during the year-ago quarter. That works out to a 22.4% increase for Google during the first three months of this year.

Google could face a lawsuit that would accuse it of being anticompetitive

The Justice Department has reportedly been working on a lawsuit that would charge Google with using anticompetitive business practices. The suit could be filed as soon as this summer. A Google spokesman pointed out that the "rigorous competition in ad technology" not only makes this sector of the ad industry more competitive, but it also offers publishers and advertisers more advertising options at a lower price.

The Wall Street Journal says that the advertising-focused parts of Google's businesses, the units that the company might be turning over to its parent firm, could be valued at tens of billions of dollars. Currently, Alphabet has a market capitalization (stock price multiplied by the number of shares outstanding) of $1.53 trillion.

Last month, Alphabet said that it would allow rival advertising brokers to place ads on its YouTube app as part of a strategy by Google to settle a European Union antitrust investigation.

Besides being the number one player in digital ads, Google is forecast to enjoy a leading 59.4% share of the global search ad market. This could result in worldwide search ad revenue for Google of $142.30 billion this year. Google also has a nice-sized display ad business that eMarketer estimates will reach $32.51 billion in gross this year giving the company a 9.6% share of the spending on display ads worldwide.

Alphabet's stock, found under the ticker symbol GOOG, is currently trading at $2,326.73 a share resulting in a 20% decline for the year to date. The shares are much closer at present to the 52-week low of $2,044.16 than the 52-week high of $3,042.00. If Google does decide to move some of its online digital ad business into Alphabet, the stock could move higher since some traders will see it as a way to unlock hidden value inside the company.

Things that are NOT allowed: