Global smartphone shipments rise for the third consecutive quarter

We may earn a commission if you make a purchase from the links on this page.

Smartphone shipments rose worldwide for the third consecutive quarter as Canalys reports that global deliveries of the device grew 12% year-over-year for the second quarter of 2024. This follows annual gains of 10% for 2024's initial quarter and 8% for the final quarter of 2023. Shipments declined 1% during last year's third quarter, the last time Canalys' report showed a quarterly year-over-year decline.

Pre-order the Samsung Galaxy Z Fold 6 and Samsung Galaxy Z Flip 6 right here, right now!

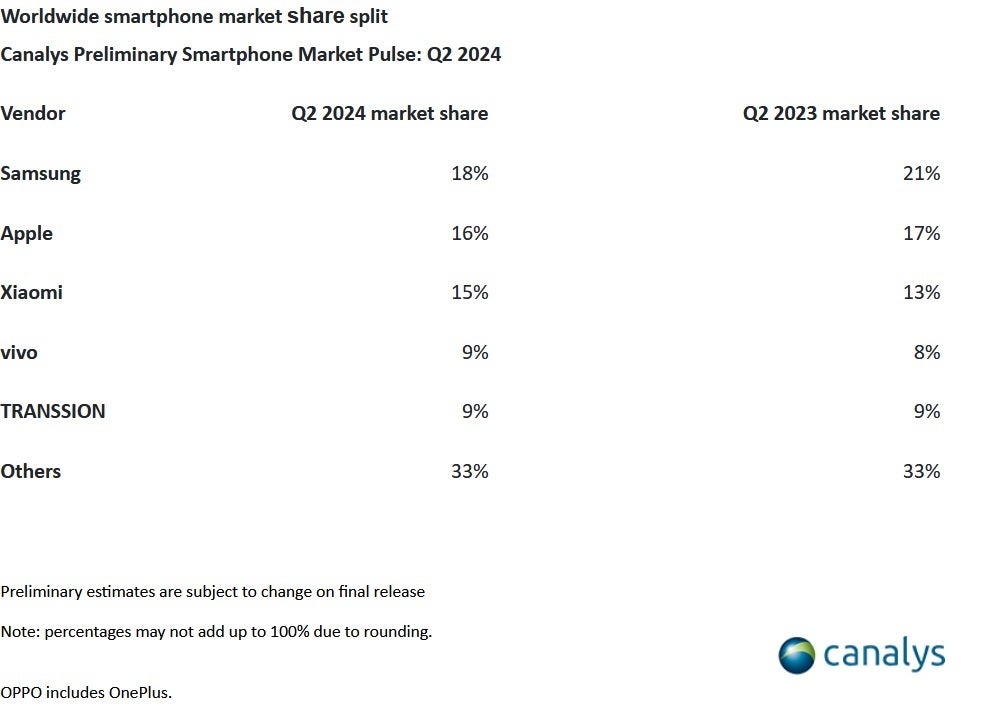

Apple lowered the gap with leader Samsung during the three months from April through June. The latter had 18% of the worldwide smartphone market during the second quarter which was down three percentage points from the 21% share the company had a year earlier. For Samsung, the second quarter is a quiet one following the first quarter release of its latest flagship series which this year included the Galaxy AI-powered S24, S24+, and the Galaxy S24 Ultra. During the current third quarter, Samsung will release its updated Galaxy Z Fold 6 and Galaxy Z Flip 6 foldable models.

For its part, Apple lost one percentage point in market share declining to 16% from 17%. Despite the drop, Apple did "less worse" than Samsung allowing the tech giant to move within two percentage points of the leader. Apple will remain quiet on the smartphone front until the end of the calendar third quarter when it is expected to unveil the iPhone 16 series and Apple should release the new line before the end of September.

"Samsung and Apple are rapidly advancing their premium product strategies with GenAI feature as a key focus. Samsung recently launched its Galaxy Z Fold 6 and Flip 6 series, building on the AI capabilities first introduced with the Galaxy S24 to deliver enhanced experiences on its latest foldable devices. By integrating software innovation with the foldable form factor, Samsung aims to provide differentiated value to users. While Apple has yet to announce new products, the company generated excitement at WWDC around anticipated refreshes coming soon that will likely demonstrate its leadership in technology innovation."-Sheng Win Chow, Analyst with Canalys.

Xiaomi didn't miss topping Apple by much during the second quarter as the manufacturer was able to garner a 15% market share during Q2. That placed Xiaomi just one percentage point behind Apple after adding two percentage points to its Q2 2023 market share. Vivo was next although it was a rather large six percentage points behind Xiaomi with 9% of the market during the quarter. Last year, Vivo accounted for 8% of smartphones shipped worldwide during the second quarter. Transsion finished fifth during the quarter with a 9% market share which was the same market share it earned during the same quarter last year.

Samsung, Apple, and Xiaomi remain the leading smartphone manufacturers during Q2 2024. | Image credit Canalys

Canalys Research Manager Amber Liu sounds as though she expects the global smartphone rally to continue thanks to innovative technologies such as AI. Galaxy AI, as we previously noted, was launched earlier this year with the release of the Galaxy S24 series. Apple's Apple Intelligence AI will be available to owners of the iPhone 15 Pro, iPhone 15 Pro Max. and the entire iPhone 16 line once the stable version of iOS 18 is disseminated in September.

"Optimism continues to build in the global smartphone market, fueled by innovative technologies like GenAI and recovering demand from the mass market. Since early 2024, easing inflation in emerging markets across Asia-Pacific, the Middle East, Africa and Latin America has stimulated shipment growth in the mass-market price segment. Companies, including Xiaomi and TRANSSION, are actively promoting product upgrades to capitalize on these opportunities. Meanwhile, HONOR, OPPO and vivo are focusing their expansion outside Mainland China this year as competition in the domestic market is heating up."-Amber Liu, Research Manager at Canalys

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: