Global tablet market woes continue: iPads remain on top, Huawei shipments soar

Ever since the pandemic ended, the global tablet market has been suffering from a lack of demand. Of course, it didn't help matters that Apple, for the first time since it launched the first-gen iPad in 2010, went a whole year without introducing a new iPad model. During the pandemic, demand for tablets rose as employees turned to these devices to help them do their job during the day and students used their tablets to attend virtual classes. During the evening, the tablets were used by both to view streaming entertainment and play games.

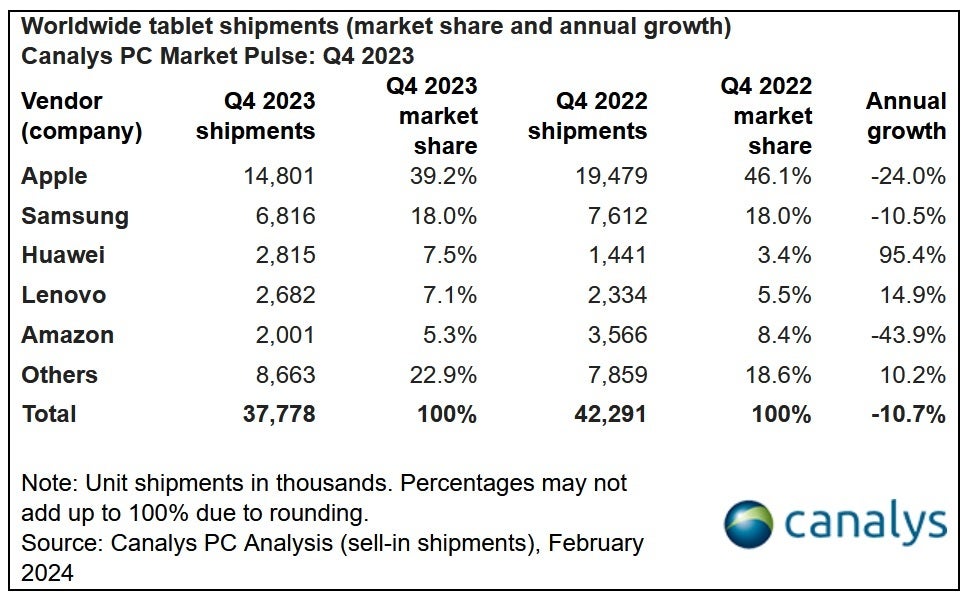

According to data published by Canalys, global tablet shipments declined over 10% during the fourth quarter of 2023 (a decline of 10.7%) and during all of 2023 (a decline of 10.3%). During the quarter running from October through December 2023, 37.8 million tablets were shipped. Compare that to the 42.3 million tablets that were delivered during Q4 of 2022.

Apple's fourth-quarter global tablet market share declined by 6.9 percentage points to 39.2%

For the final quarter of 2023, Apple led the way with shipments of 14.8 million iPad units, down 24% from the 19.5 million the company shipped during the same quarter in 2022. That performance led to a sharp decline in Apple's global market share from 46.1% in Q4 2022 to 39.2% during the fourth quarter of last year.

The iPad had a tough fourth quarter last year

Samsung was a distant second having shipped 6.8 million tablets during the last three months of 2023. That figure was down 10.5% from the 7.6 million tablets Sammy delivered during the fourth quarter of 2022. Despite the huge decline in shipments year-over-year, Samsung's market share in the global tablet market remained the same at 18% which is an indication of how bad the tablet market was worldwide during the three months.

Huawei was the big winner as its tablet shipments soared 95% on an annual basis during Q4 to 2.8 million. During the same quarter the previous year, the company delivered 1.4 million tablets. The company's share of the global tablet market more than doubled from 3.4% during the 2022 fourth quarter to 7.5% during the 2023 fourth quarter. Right behind Huawei was Lenovo. For the fourth quarter of 2023, Lenovo shipped 2.7 million tablets, up 14.9% year-over-year from the 2.3 million it delivered during the same quarter in 2022.

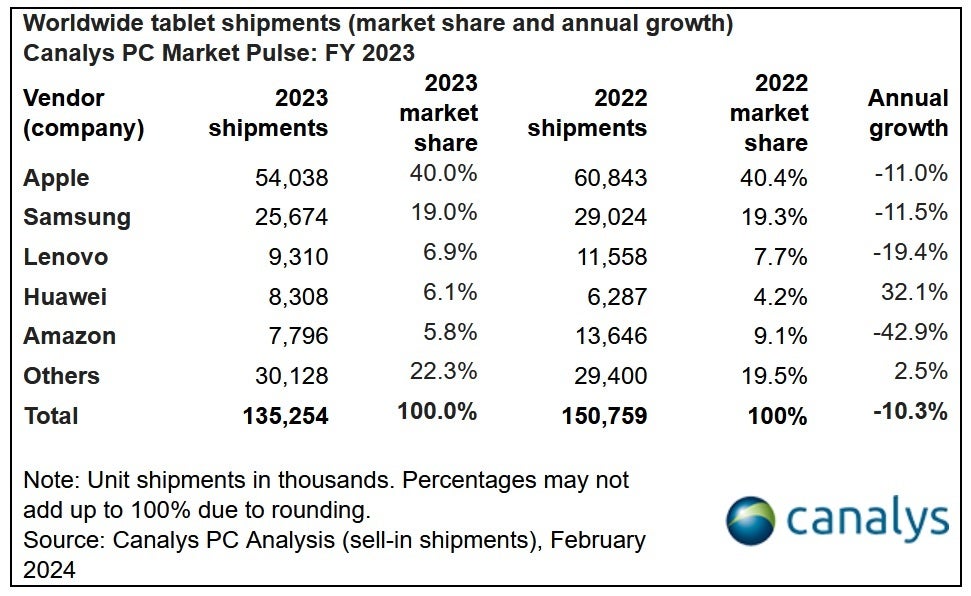

The iPad had 40% of the global tablet market in 2023

Amazon still made the top five despite a 43.9% decrease in tablet shipments during the quarter. The company delivered 2 million units during the last three months of last year compared to the 3.6 million it shipped from October through December 2022. Amazon's market share declined from 8.4% to 5.3% on an annual basis.

Huawei shipped more tablets than any company in the 2023 top five outside of Apple and Samsung

For all of 2023, Apple remained on top after shipping 54 million iPad units, off 11% from the 60.8 million it delivered in 2022. Apple's market share remained steady at 40% compared to the 40.4% it had for 2022. Samsung was next after delivering 25.7 million tablets during 2023 which was a 11.5% drop. The company's slice of the global tablet pie declined from 19.3% in 2022 to 19% in 2023.

A 19.4% decline in 2023 tablet shipments left Lenovo in third place with 9.3 million units delivered and a 6.9% market share. Huawei grew its tablet deliveries by 32.1% in 2023 to 8.3 million units allowing the firm to finish fourth with a 6.1% market share. Amazon's tablet shipments for 2023 declined a whopping 42.9% to 7.8 million as its share in the global tablet market plunged from 9.1% to 5.8%.

For all of 2023, 135.3 million tablets were delivered compared to the 150.8 million shipped in 2022. That is a decline of 10.3% on an annual basis. Canalys analyst Kieren Jessop says, "The innovation gap between tablets and other personal computing devices is something for key tablet vendors to pay attention to. Plans around on-device AI integration in tablets trail behind those in PCs and smartphones. Bringing this functionality across devices will be crucial for vendors aiming to deliver a unified and seamless experience on ecosystems."

Jesson adds, "Elsewhere, this year will see a greater focus on foldable tablet form factors. Although shipment volumes will likely remain restricted due to the premium pricing of these models, they will provide an opportunity for vendors to showcase user-experiences benefits for content consumption, learning and productivity."

Things that are NOT allowed: