Analysts expect high growth rates ahead for the foldable smartphone market

Foldable smartphones are very much in their infancy. Samsung appears to be the leader right now with the Galaxy Z Fold 4 and Galaxy Z Flip 4 both expected to be released later this year, possibly in August or September. Samsung's two foldable models both serve different purposes.

The Galaxy Z Fold series features an external screen and when the device is opened like a book, a larger tablet-sized screen is revealed. This is perfect for those working in the field who need both a phone-sized display and a larger screen. It also is great for those who like to find a comfortable place to sit down and stream video on a large display.

8.9 million foldable phones shipped last year for a 148% year-over-year gain

The Galaxy Z Flip line is a pocketable device that flips open to become a 6.7-inch smartphone. This form factor is better for those who just want to be able to keep a powerful handset in their pockets until it is needed. Both foldables have their place in the world.

Samsung is the leading provider of foldables worldwide

Other phone manufacturers have released foldables including Huawei. Huawei has released a foldable that opens from a 6.45-inch external display to an 8-inch tablet-sized screen. The company also unveiled a foldable flip phone called the P50 Pocket. Country-mate Oppo has released the Find N foldable and we still could see Google release the Pixel Fold.

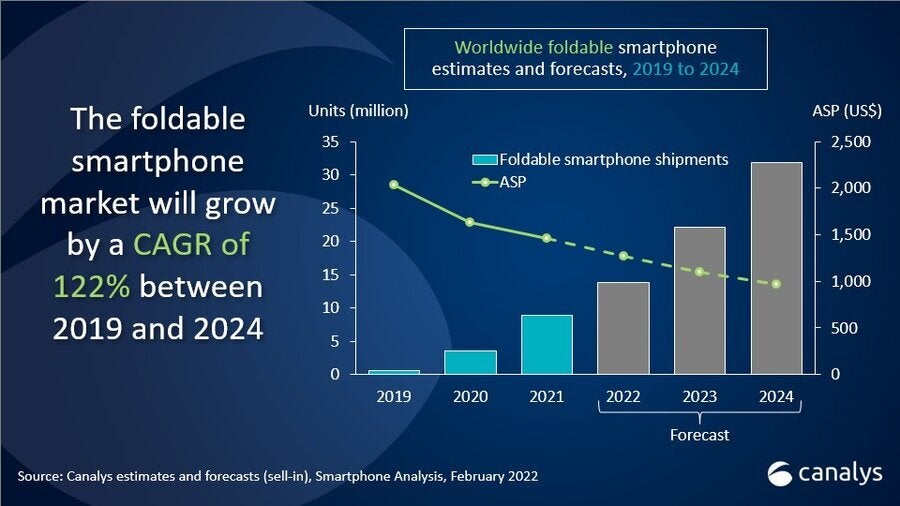

According to a freshly squeezed report from research firm Canalys, shipments of foldable smartphones are expected to grow at a 53% compounded annual growth rate (CAGR) between 2021 and 2024. For that year, total shipments of foldables would reach 30 million units. The CAGR for the period from 2019 (when the first foldables were released) to 2024 is forecast to reach 122%.

Led by Samsung, total foldable shipments reached 8.9 million units last year for an annual year-over-year increase of 148%. That compares to the 7% growth in overall phone shipments in 2021 revealing how important foldables are to the future of the smartphone industry.

Runar Bjørhovde, Research Analyst at Canalys said, "The key catalyst for foldable smartphones has been the booming use of large-screen devices during the pandemic. As consumers are constantly looking for a better experience on their day-to-day mobile devices, the bar has now been set even higher by the productivity and entertainment experience on large screens."

The analyst added, "As the world continues to reopen, it brings new opportunities for smartphone vendors to provide products such as foldable smartphones that can fulfill consumers' needs and desires."

Another Canalys analyst, Toby Zhu, notes that the foldable form factor helps the overall smartphone market because of its appeal to high-end users and early adopters. Zhu says that Android manufacturers in the premium sector of the market have been struggling with shipments in the premium end of the market (phones costing $800 or more) with shipments in this segment down 18% since 2019.

Canalys says Android device makers need to work on foldables to compete with iOS in the premium space

The analyst says that during the same time period, premium iOS models costing $800 or more have risen 68%. "Google and the major Android device vendors must double down on their investments in differentiated hardware and state-of-the-art user experiences to keep appealing to high-end customers," Zhu notes.

Canalys sees a 122% compounded annual growth rate for foldable phones from 2019-2024

Yet another Canalys research analyst, Amber Liu, points out that thanks to Samsung, the supply chain for foldables has developed over the last few years. "While there are an increasing number of suppliers for foldable displays, hinges and other key components, device vendors are also highlighting innovative engineering solutions and product designs for a better user experience while constantly pushing down prices," Liu said.

Amber also states that the foldable app ecosystem is still not optimal and that more investment is needed to develop a capable UI and improve the foldable ecosystem. Liu says that many smartphone manufacturers are getting ready to dip their feet into the foldable smartphone waters as such devices become an important part of these firms' strategy to compete in the high-end market.

And as the years go by, the weight, thickness, and prices of foldable phones will drop which will help these phones catch on with the public driving growth of the sector. As a result, "the leading players will start to flex their muscles in the ecosystem to leapfrog their competitors with advanced and differentiated experiences,” said Liu. Canalys sees the average selling price of foldables dropping from $2,000 in 2019 to $1,000 by 2024.

Things that are NOT allowed: