Commerce Department report on the chip shortage names the major bottleneck holding things up

The U.S. Commerce Department has been investigating the global chip shortage and on Tuesday it released its report. So what caused companies as big as Apple to lose out on some revenue last year because they were unable to get their hands on certain chips? The report says that the factors involved all converged to create a "perfect storm" that made it difficult for manufacturers to obtain the chips needed.

Even a company like Apple, which has a very strong relationship with the world's largest foundry, TSMC, found itself short of chips at times. One report said that Apple was unable to get its hands on enough legacy chips used to build older devices. In November, CEO Tim Cook admitted that the company was having problems obtaining certain chips and said that Apple had lost $6 billion in revenue due to the semiconductor shortage.

The private sector is best equipped to handle the chip shortage says the report

The Commerce Department noted in its report that even going back before 2020, some semiconductor manufacturing equipment used to make older chips became hard to find. That also was the case for certain components used to build chips including diodes, capacitors, and substrates.

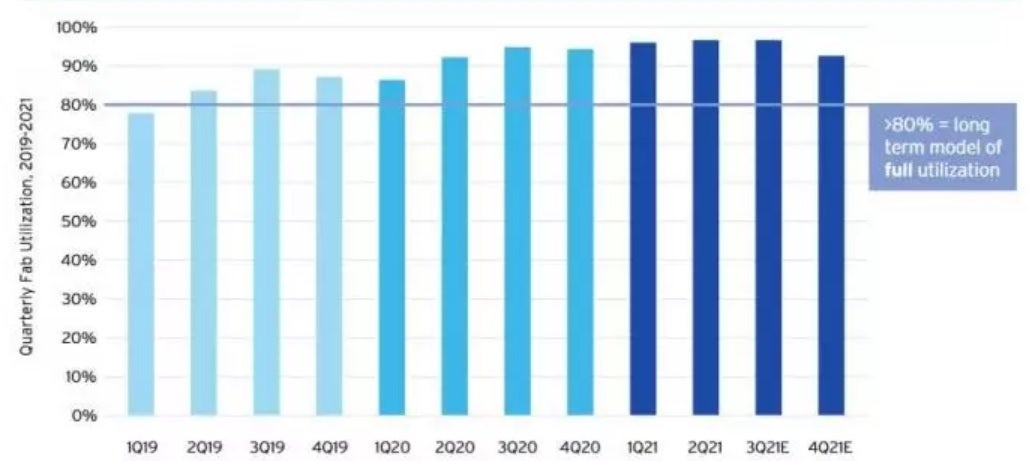

Semiconductor fabrication facilities are being utilized at a rate above 90% of capacity

And as demand for 5G phones and base stations increased, and more consumers became interested in electric vehicles, more chips were needed. While demand was up, supply was down due to events that foundries could not plan for such as factory fires, energy shortages, shutdowns caused by COVID, and winter storms.

The Commerce Department says that the private sector is best positioned to deal with the chip shortage by increasing chip production, managing the supply chain in order to keep supplies flowing in and to improve product design to optimize the use of semiconductors. But the Biden Administration is also getting involved due to what the Commerce Department calls "the importance of semiconductors to U.S. economic security."

The administration has worked to improve transparency in the supply chain and has helped to create long-term partnerships that help ease the pain of dealing with a chip shortage that forced car manufacturers to lay off workers and at the same time, call for a halt in production. Still, no matter what semiconductor firms try, chip demand continues to outpace supply.

In September, the Department of Commerce sent Request for Information (RFI) solicitations to firms in the semiconductor supply chain in order to find out info directly from companies dealing with the chip shortage and the shortage of supplies. More than 150 responses came back including those from nearly every major semiconductor producer and from "companies in multiple consuming industries."

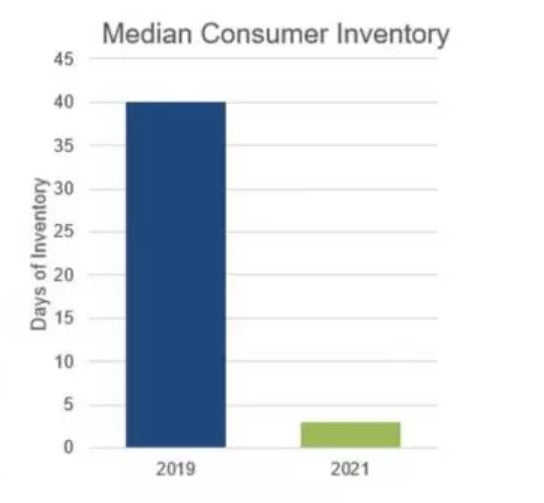

What the Commerce Department learned was that the median demand for chips rose by 17% from 2019 to 2021. Despite this rise in demand, buyers are not seeing a matching increase in supply. This is considered a major supply and demand mismatch. Now here is a stat that you can easily envision; median inventory of certain semiconductor products for intermediate/end users of these products sharply declined from 40 days in 2019 to just 5 days in 2021.

The main bottleneck is the need for additional wafer production capacity

The Commerce Department notes that the RFI helped it find areas where bottlenecks led to supply and demand mismatches. In areas where these mismatches are extremely bad, the agency will dedicate resources to open up these bottlenecks. The main bottleneck across the board is wafer production capacity.

Median days of inventory of certain semiconductor products for intermediate and end users declined from 40 days in 2019 to just 5 days two years later

A wafer is a thin cut of semiconductor. Each wafer goes through a series of processes until wafer dicing cuts them into individual chips.

One of the interesting stats cited by the Commerce Department's report notes that since the chip shortage started in 2020, the chip manufacturers have been running their fabs at a rate above 90% which the department says is "incredibly high" for a production facility that requires regular maintenance and high amounts of energy.

The kinds of chips impacted most by the shortage include:

- Microcontrollers that are primarily made of legacy logic chips, including, for example, at 40, 90, 150, 180, and 250 nm nodes.

- Analog chips including, for example, those produced at 40, 130, 160, 180, and 800 nm nodes.

- Optoelectronics chips including, for example, at 65, 110, and 180 nm nodes.

The bad news is that those in the industry who responded to the RFI do not see the chip shortage going away over the next six months. Additional fab capacity is needed, especially with foundries bumping up against 90% right now. Unfortunately, it takes years to design, build, and open a fab.

Watch for the big foundries including TSMC, Samsung, and even Intel to throw money at this problem and hopefully, we will get the semiconductor industry back into a perfect supply-demand balance.

Things that are NOT allowed: