MediaTek's lead over Qualcomm in SoC shipments declined sharply in Q4

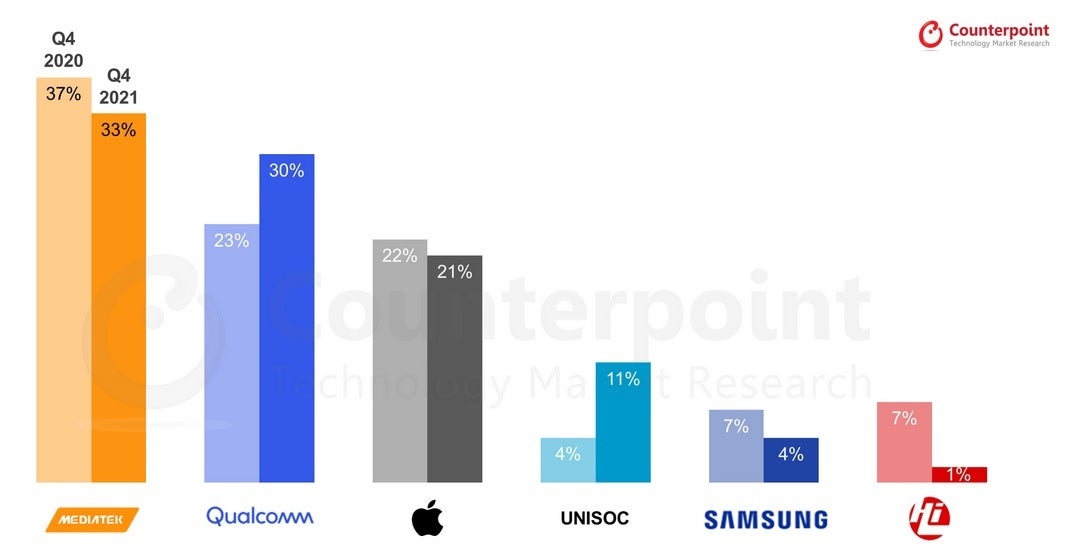

Market research firm Counterpoint has released its latest report on the smartphone Applications Processor (AP) chipset market for the fourth quarter of 2021. During the period from October to the end of the year, the top chipset supplier in the industry was MediaTek which saw its lead over Qualcomm decline to just three percentage points from 14 percentage points last year. Overall, AP chipset shipments rose 5% from Q4 2020 to Q4 2021.

MediaTek's lead over Qualcomm shrinks dramatically

MediaTek had a 33% market share during the last quarter of 2021 which was down from the 37% it garnered during the fourth quarter of 2020. Counterpoint said that MediaTek's shipments dropped in Q4 because smartphone manufacturers had been ordering more chips than needed during most of the year just in case the chip shortage prevented them from obtaining the amount of components needed.

MediaTek's market share lead over Qualcomm dropped sharply during the fourth quarter of 2021

But for the most part, this turned out not to be an issue and when the fourth quarter arrived, manufacturers went through an inventory correction ordering fewer chipsets compared to the amount ordered at the beginning of 2021. The Dimensity 9000 chip helped MediaTek keep its position as the largest shipper of chipsets to smartphone manufacturers. Counterpoint also cited heavy demand for 5G handsets as a reason for MediaTek's strong showing, and it expects another strong year in 2022 for the company as more consumers buy 5G phones.

Qualcomm, the San Diego-based designer of Snapdragon chips, saw its market share soar from 23% in Q4 of 2020 to 30% for the fourth quarter of 2021. This cut sharply into MediaTek's lead. Qualcomm was able to obtain enough chips by having both TSMC and Samsung Foundry dual-source various chips. Recent reports indicate that Qualcomm will return to TSMC for next year's 3nm Snapdragon 8 Gen 2 Applications Processor.

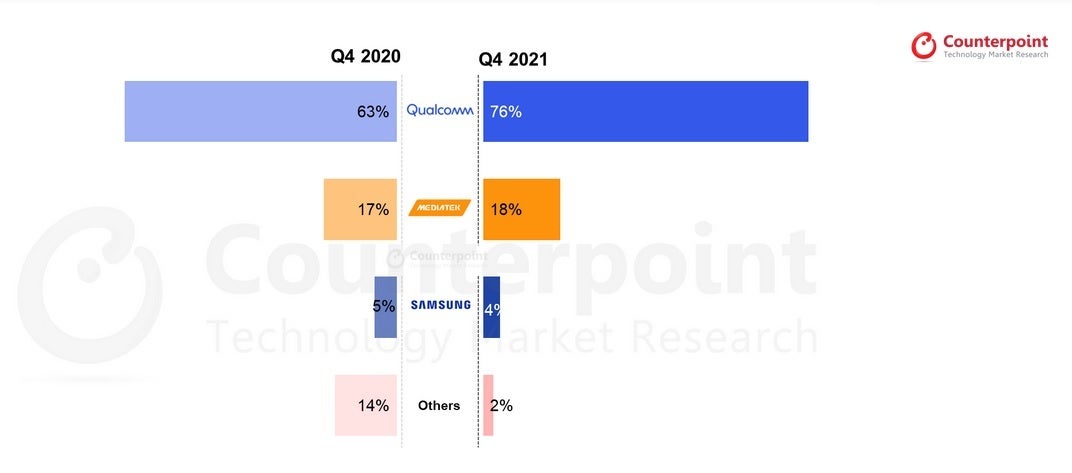

Qualcomm put its emphasis on the company's high-priced, high-margin Snapdragon chips. Its Snapdragon 5G baseband modem chips dominated that sector with a 76% share compared with 63% for the same quarter during the previous year. Counterpoint credits demand for the 5G iPhone 12 and iPhone 13 lines, and those Android flagships that are equipped with Snapdragon 5G modems.

Apple's share in the smartphone chipset world dropped by 1 percent from the fourth quarter of 2020 to the same quarter last year. Counterpoint says that Apple had a 22% slice of the smartphone chipset pie in 2020 which declined to 20% last year. Keep in mind that all of the chipsets designed by Apple and built by TSMC and Samsung wind up used by Apple for its own products.

Qualcomm dominates the 5G baseband modem market

Unisoc, a less well-known chip designer, saw its Q4 market share rise from 4% to 11% year-over-year. That company provides chipsets for smartphone manufacturers such as Honor, Realme, Motorola, ZTE, Samsung, and others. Speaking of Sammy, the Exynos chipset line saw its share of the smartphone chipset market decline from 7% in Q4 2020 to 4% for Q4 2021. Counterpoint blames the decline on Samsung's growing use of MediaTek and Qualcomm chips for its mid-range 4G and 5G models.

Qualcomm dominated the 5G baseband modem market during the fourth quarter of 2021

Thanks to the continuing U.S. restrictions placed on Huawei, the inventory of Huawei's HiSilicon Kirin chips are almost totally exhausted. A change to U.S. export rules made in 2020 prevents foundries using American technology from shipping chips to Huawei, even if they are Huawei's own Kirin chipsets.

As a result, Huawei has been forced to use 4G Qualcomm Snapdragon chips for some of its flagship phones. This was reflected in Counterpoint's data which shows Huawei's HiSilicon unit with a 7% share of AP chipset shipments in the fourth quarter of 2020 dropping to just 1% during the fourth quarter of 2021.

As we previously mentioned, Qualcomm has a huge lead in modem chip shipments with a 76% share. That is followed by MediaTek which saw its share rise in this sector from 17% in Q4 2020 to 18% in Q4 of 2021. Samsung's modem chips went from 5% of the market to 4% from the last quarter of 2020 to the last quarter of 2021. Apple could enter this market as soon as next year which is bound to be bad news for Qualcomm.

Things that are NOT allowed: