Apple, Goldman Sachs partnership reportedly coming to an end; new partner sought for the Apple Card

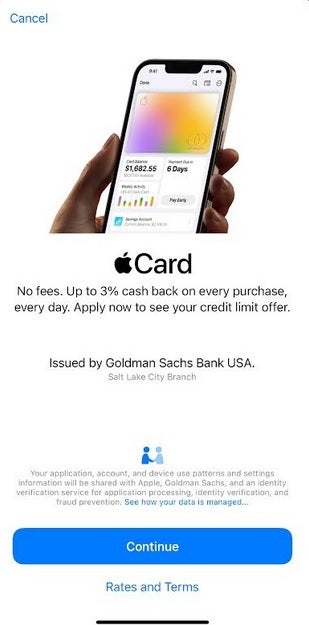

This past summer we told you that global investment banking firm Goldman Sachs, Apple's partner in the Apple Card, was looking to exit the partnership. At the time, American Express was considered a possible replacement for Goldman Sachs. The Apple Card launched in August 2019 with no fees charged for late payments, going over the credit limit, or for an annual membership.

Account holders get 3% back on Apple Pay purchases made using the Apple Card at the Apple Store (both physical and online), the App Store, Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware. On purchases made from other retailers that accept the Apple Card via Apple Pay, customers get 2% cash back. The cashback amount belonging to each cardholder is tallied daily and can even be swept daily into an interest-bearing savings account.

Today, a person familiar with the situation told CNBC's Leslie Picker that Apple has presented Goldman Sachs with a proposal that will dissolve the Apple-Goldman Sachs partnership within the next 12 to 15 months. This would force Apple to find a new financial partner to keep the popular Apple Card alive along with Apple's high-yielding savings account. While Apple offers the card via its Wallet app, Goldman Sachs is running the back-end of the operations.

Apply for the Apple Card directly from your iPhone's Wallet app

An Apple representative told CNBC today, "Apple and Goldman Sachs are focused on providing an incredible experience for our customers to help them lead healthier financial lives. The award-winning Apple Card has seen a great reception from consumers, and we will continue to innovate and deliver the best tools and services for them." It isn't clear whether Apple has a deal with a new partner although, as we mentioned at the beginning of this article, American Express was rumored in July to be interested in the business.

At the start of this year, a report said that Goldman Sachs had put aside $1.2 billion in loan-loss provisions for its consumer credit division covering the first nine months of 2022. These funds are put aside by a bank to cover debt that the bank believes will not be repaid. At the time, analysts said that the large increase in load-loss provisions was due to the Apple Card.

Goldman originally hoped to have its consumer credit division, which includes the Apple Card, hit the breakeven mark in 2022. But that has been pushed back until 2025. Last year, Wolfe Research analyst Bill Carcache said, "The Apple Card portfolio may generate lower revenues and face higher loss content relative to the industry average."

If Goldman does want out, we'd expect Apple to announce a partnership with another firm fairly quickly. Stay tuned.

Things that are NOT allowed: