The Chase is on as Apple seeks new financial partner for Apple Card

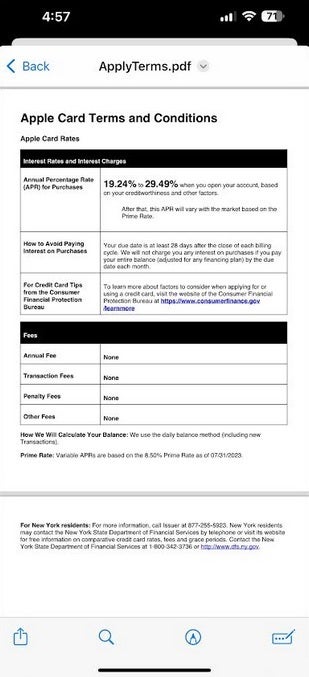

Last week, we told you that the partnership between Apple and investment banking firm Goldman Sachs was coming to an end. The latter was taking some big red hits on its financial statement over the Apple Card which isn't surprising since the card offers fee-free features including no fees charged holders for making late payments, no fees charged holders for exceeding the credit limit, and no fees charged holders for annual membership.

In addition, the Apple Card offers 3% back on Apple Pay purchases made by cardholders at the App Store, Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware. On purchases made by cardholders using Apple Pay at other retailers, customers get 2% cash back. And that cash is not only received daily, it can be swept every day into a savings account that pays interest.

According to Mark Gurman, the Bloomberg writer who writes the weekly Power On newsletter, Apple is doing Goldman Sachs a favor by disengaging from the partnership and looking for a replacement. One thing that Apple does not want to do is just end the Apple Card as that would make Apple look bad. On the other hand, Goldman Sachs is looking to exit the business of providing consumers with credit which is why it plans to get rid of a card it offers with General Motors and ended plans to create a T-Mobile branded card.

Terms and conditions for the Apple Card

American Express was one name mentioned last July as a possible replacement for Goldman Sachs. After all, as Mark writes, the company's CEO golfs with Apple Services head Eddy Cue. But Gurman notes that J.P. Morgan Chase would seem like the best fit to replace Goldman Sachs even though the firm passed on the Apple Card originally.

Apple has some of its free cash in Chase accounts and Chase was one of the first financial firms to get involved with Apple Pay. It also is one of Apple's largest credit card partners at the physical and online Apple Stores and the App Store. Chase's Ultimate Rewards program also offers its banking and credit card customers discounts on Apple devices.

Why would Chase be interested in backing an offering that has created nothing but red ink for Goldman Sachs? As Gurman notes, the Apple Card has millions of users who combined have over $10 billion sitting in related savings accounts. With its "prime placement" inside the iPhone Wallet app, the Apple Card does have an advantage over all other cards that can be used on the iPhone.

While Chase might have to write off some of the red ink for a few years, it is a more consumer-oriented financial institution than Goldman Sachs is and it might be able to use such a connection with Apple to its benefit when it comes to improving the bank's bottom line.

Things that are NOT allowed: