Declining interest in iPad will reduce orders for the 3nm M3 chip says reliable Apple analyst

Remember when the pandemic first picked up speed in 2020? Working from home became so popular among companies that the acronym WFH was seen everywhere. And students had to deal with learning from home via streamed classes. Both those working for a living behind a desk and students getting educated, ended up shelling out to buy the latest tablets including iPads from Apple.

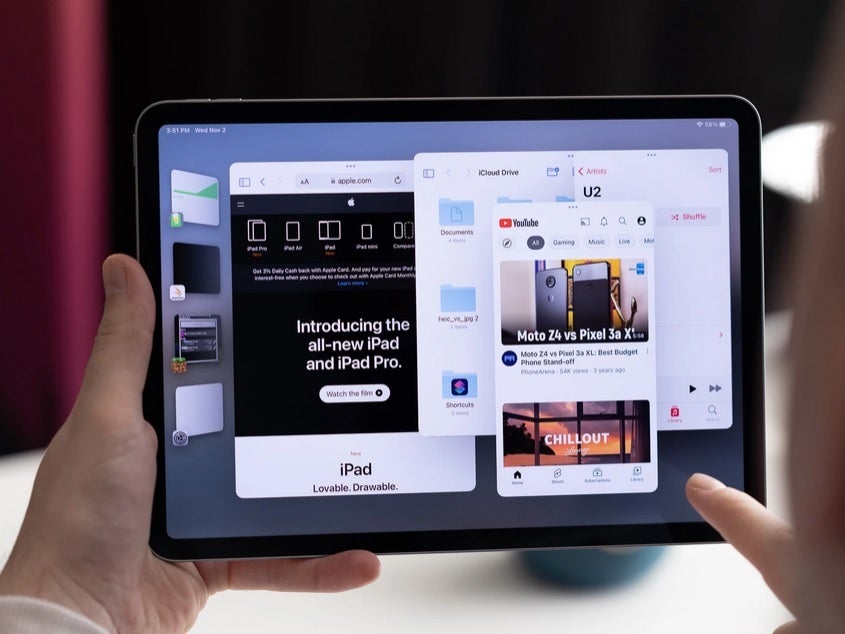

Apple has seen demand rise and fall for the iPad thanks to the pandemic

During the day, these devices would be used by corporate employees and students for work and classes and at night the very same device would deliver entertainment and relaxation thanks to streaming content including movies, music, and television shows. And some of the stress of the day could be relieved by playing video games. For example, during the fiscal first quarter of 2021, Apple reported a hefty 41% year-over-year increase in iPad sales to $8.44 billion.

Since the end of the pandemic, iPad sales have been declining

But with the pandemic over, tablet sales have dropped off and the iPad has been no exception. Last month, when Apple reported its fiscal third-quarter earnings for 2023, iPad sales declined 19.8% on an annual basis to $5.79 billion. For 2023, iPad shipments will decline by 22% to 48 million units according to TF International's Apple analyst Ming-Chi Kuo. The drop off in WFH demand also applies to MacBooks and Kuo sees shipments of those devices declining 30% this year to 17 million units.

Besides the end of the WFH era reducing demand for these products, Kuo says that potential buyers seem to be less enthused by new specs like Apple Silicon and Mini-LED displays. As a result, the analyst says that Apple's demand for 3nm M3 chips next year will decline due to a lack of "growth drivers" for the MacBook and iPad. Apple is expected to use the 3nm M3 chip on the next iPad Pro models and will equip them with OLED screens for the first time in iPad history.

Kuo notes that Apple isn't the only company that will be making some last-second changes in 2024. Qualcomm's demand for 3nm production from TSMC is expected to fall short of expectations. That is due to Huawei's sudden ability to procure 7nm 5G Kirin chipsets from China's largest foundry, SMIC. Previously, Huawei was using a special variant of Qualcomm's Snapdragon 8+ Gen 1 SoCs that do not support 5G connectivity. The Chinese manufacturer is under U.S. sanctions preventing it from buying cutting-edge chips from foundries using American technology.

The analyst, who has a history of making successful calls, also points out that Qualcomm could be negatively impacted by what the analyst sees as Samsung's higher-than-expected use of its homegrown Exynos 2400 chipset on Galaxy handsets such as the upcoming Galaxy S24 series. The latest rumor calls for Samsung to use its own chips on the Galaxy S24 and Galaxy S24+ and reserve the Snapdragon 8 Gen 3 for Galaxy to the Galaxy S24 Ultra model.

Kuo says that the semiconductor industry could bottom out during the second half of this year

The TF International analyst states that demand has been declining for chip production using Samsung's 3nm 3GAP+ and Intel's 20A (equivalent to TSMC and Samsung's 5nm node). Additionally, three memory chip producers, Samsung, Micron, and SK Hynix, won't be expanding production until 2025-2027.

One of the most important foundry suppliers, ASML, is having issues as well says Ming-Chi Kuo. The Dutch firm is the only company in the world that manufactures the extreme ultraviolet lithography (EUV) machines used to etch circuity patterns on silicon wafers for advanced semiconductors. These machines cost $200 million each and the next generation machine will be priced at $300 million. But the analyst says that ASML will cut 2024 shipment forecasts by 20% to 30%.

The bottom for the semiconductor sector might not be too far away according to Kuo who says that this might occur during the second half of this year. But close monitoring of the sector is needed, the analyst warns, to make sure that the low point doesn't get delayed to the first half of next year which could add six additional months of pain for chipmakers, foundries, and their suppliers.

Things that are NOT allowed: