Apple Pay celebrates its 10th anniversary by offering more payment options to users

Apple Pay was introduced by Apple back in September 2014 although the mobile payment platform didn't start working until October 20th of the same year. That means Apple will soon celebrate the 10th anniversary of Apple Pay. These days Apple Pay is used by hundreds of millions of consumers in 78 markets helping consumers pay for purchases made over millions of websites and apps, and tens of millions of stores worldwide. The feature has support from 11,000 banks and network partners.

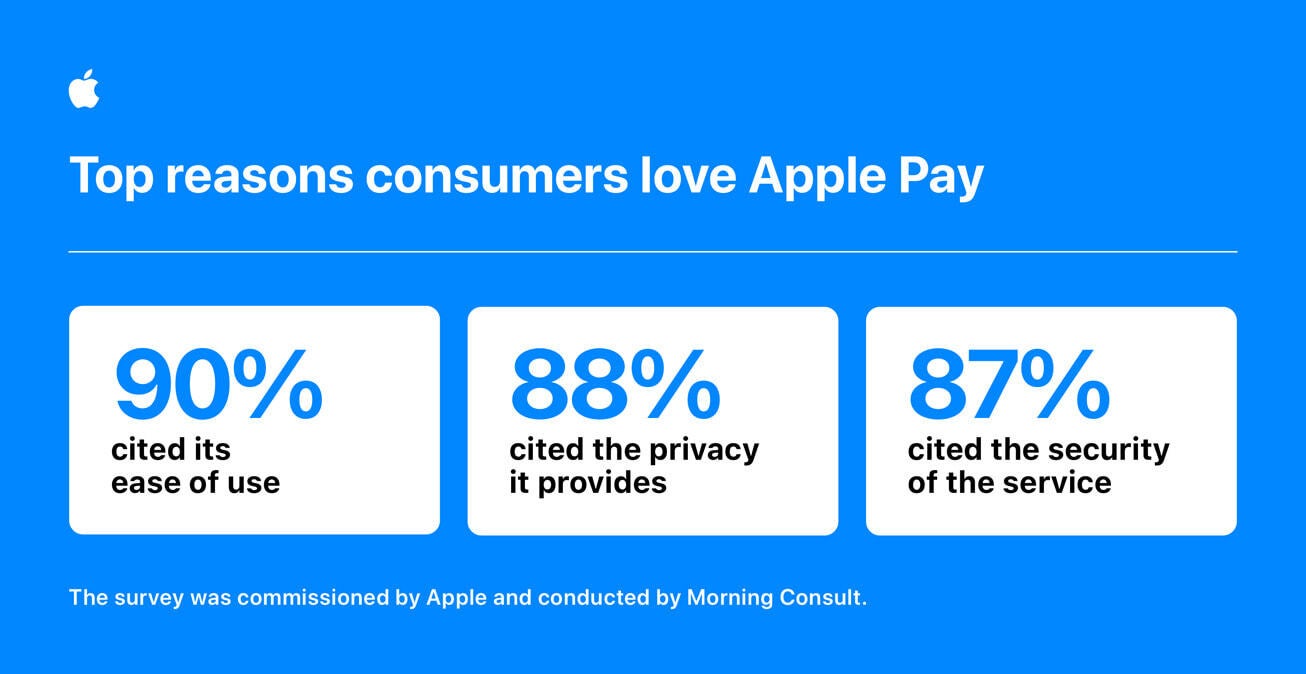

Apple says that they hear from Apple Pay users every day who tell Apple how much "they love the ease, security, and privacy protections Apple Pay provides in their daily lives." The feature is available on the iPhone, iPad, Apple Watch, and Mac. Apple commissioned a survey which was handled by Morning Consult. 90% of respondents said that they love Apple Pay because of its ease of use; 88% said they love Apple Pay because of the privacy of the service, and 87% said the security of Apple Pay is why they love the mobile payment service.

"When we started our journey with Apple Pay 10 years ago, we saw a unique opportunity to leverage Apple’s hardware and software to make a meaningful impact on the financial health and lives of our customers. From the outset, we envisioned a world where you could use your iPhone to seamlessly pay for everything — from groceries to train tickets, in person and online, across the globe — all while keeping your personal and financial information safe and private."-Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet

Apple is looking to expand the use of Apple Pay by giving users the option to redeem rewards and access installment loans right at checkout via Apple Pay online, or on the iPhone and iPad in-app. Consumers get to pay using the Apple Pay experience they know and love; lenders get to stay connected with their customers allowing them to make reward programs and installment offerings more accessible to many.

The results of a survey commissioned by Apple about Apple Pay. | Image credit-Apple

For example, when checking out online using Apple Pay, or in-app on the iPhone and iPad, users in the U.S. receive installment loan options from Affirm and in the U.K. from Monzo Flex. Starting yesterday, eligible users in the U.S. and U.K. can also receive flexible payment options at checkout online and in-app with Apple Pay on iPhone and iPad. Apple says that starting with iOS 18, U.S. Apple Pay users can redeem rewards with eligible Discover credit cards when they check out with Apple Pay online and in-app on iPhone and iPad.

With Apple Pay, user's personal and financial information is protected and the number of the credit card used with Apple Pay is never shared with businesses. The tech giant continues its plan to get users to replace their physical wallets with the Apple Wallet app. Today, iPhone users can add certain event tickets, transit cards, government IDs, and more to their digital wallet.

Apple Pay is truly a volume business as Apple receives only .15% of the value of each transaction paid for using Apple Pay. That means that if Apple Pay is used on a $100 transaction, the banks involved pay Apple 15 cents. It is estimated that Apple generated up to $4 billion in revenue in calendar year 2023 from Apple Pay (15 cents at a time).

Things that are NOT allowed: