Apple's iPhone dominates North American phone shipments in Q2; Google doubles its market share

We may earn a commission if you make a purchase from the links on this page.

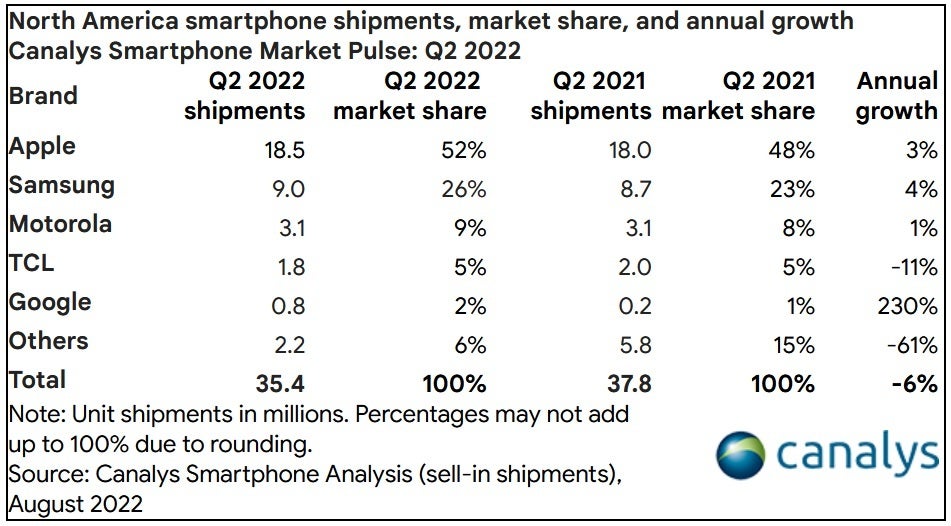

We've been pointing out for several weeks that the global smartphone industry is in the middle of a slump. Market researchers at Canalys confirmed this with its report on second-quarter shipments in North America which declined 6.4% on an annual basis to 35.4 million units. Apple still managed to show growth despite the gloomy overall picture with a 3% year-over-year growth in iPhone deliveries.

Apple's iPhone dominated the North American smartphone market in Q2

During the period from April through June, Apple's 52% market share doubled Samsung's slice of the North American smartphone pie. Shipments of the iPhone 13 line in the continent were characterized as "solid" in the report, and the numbers included the first full quarter of results for the budget-priced third-generation iPhone SE. Apple shipped 18.5 million iPhone units in North America during the quarter, a half million more than it shipped during the second quarter of 2021.

Second-quarter smartphone shipments in North America. Source-Canalys

Samsung actually outperformed Apple in North America with a 4% annual growth rate in smartphone shipments bringing that figure to 9 million up from 8.7 million a year ago. The manufacturer's premium Galaxy S and low to mid-range Galaxy A handsets continue to be in demand in the region. Shipments of the latest versions of the company's foldables, the Galaxy Z Fold 4 and Galaxy Z Flip 4, will show up in the next report covering the third quarter.

Pre-order the Samsung Galaxy Z Fold 4 and the Galaxy Z Flip 4 now!

Resurgent Motorola continued to hold down the third position in North America with a solid 9% market share. Shipments rose 1% on an annual basis to 3.1 million smartphones. The company has some high-profile phones that will hit North America this year including the foldable third-gen Motorola RAZR, and the flagship Motorola X30 Pro which will feature a 200MP camera sensor.

TCL had a rough quarter with its North American phone shipments off 11% from the same quarter last year. That dropped the number of units delivered by the Chinese manufacturer in the region to 1.8 million, good enough for 5% of the market.

Thanks to the release of the Pixel 6 and Pixel 6 Pro, Google had the largest annual increase in North American shipments for the second quarter with a huge 230% hike. 800,000 Pixel 6 units shipped during the second quarter compared to 200,000 Pixel units shipped during the same quarter last year. As a result, Google doubled its North American market share from 1% to 2% for the period.

Canalys Research Analyst Runar Bjørhovde said, "Following a rapidly recovered performance in 2021, the tide has turned in the North American smartphone market. A combination of high inflation, decreasing consumer confidence, and an economic slowdown is shrinking demand in North America, which was previously the world's most resilient market. Vendors are responding quickly to falling demand and are focused on reducing the risk of oversupply as they prepare for new launches in the second half of 2022."

Canalys estimates that the top ten smartphones in North America by shipments were:

- Apple iPhone 13

- Apple iPhone SE (third generation)

- Apple iPhone 13 Pro Max

- Apple iPhone 13 Pro

- Apple iPhone 12

- Samsung Galaxy S22 Ultra

- Moto G Power (2022)

- Samsung Galaxy A13

- Apple iPhone 13 mini

- Samsung Galaxy S22

Canalys Research Analyst Brian Lynch said, "Consumer interest for low-end and high-end devices is sustaining the market, while the appetite for mid-range devices is vanishing fast. The performance of the iPhone SE (3rd Gen), Galaxy A53, and Galaxy A33 are poorer than initially expected. Decreasing purchasing power is forcing buyers who normally would consider devices costing between US$250 and US$600 to look for cheaper options as consumers continue to feel the financial pressure of inflation on everyday expenses."

Lynch adds, "In the low-end, demand remains solid, but competition between vendors is fierce. Motorola's refreshed G Power, Samsung’s A13 models, and TCL's new launches with Tracfone, Verizon, and T-Mobile provide numerous budget-friendly options that are increasing in demand. The high-end's performance also remained strong with Apple's iPhone 13 series and Samsung’s Galaxy S series finding opportunities. For Samsung, the S Pen in Galaxy S22 Ultra has been an effective differentiator among premium Android devices, making it Samsung’s best performing model in the market."

Follow us on Google News

![A new Android bug is making it impossible to install new apps. Are you affected? [UPDATE]](https://m-cdn.phonearena.com/images/article/176703-wide-two_350/A-new-Android-bug-is-making-it-impossible-to-install-new-apps.-Are-you-affected-UPDATE.webp)

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: