Apple Card interest-free installment payments extended to iPad, AirPods purchases and more

Back in December, Apple Card holders were given the option to purchase an iPhone from Apple and pay it off by making 24 monthly interest-free payments. Yes, most carriers offer some similar deal, but by purchasing the device from Apple you can buy a model that is unlocked from day one without having to wait months or make a call to request that your carrier unlock your handset.

Citing people familiar with the plan, Bloomberg says that Apple will announce sometime over the next few weeks that it will allow Apple Card holders to purchase other products with the Apple Card using monthly interest-free installment payments. For example, the report says that Apple will allow cardholders to purchases iPads, Macs, the Apple Pencil, iPad keyboards, and the Mac XDR Display monitor with 12 monthly interest-free payments. Other products like the AirPods, Apple TV, and the HomePod smart speaker can be bought using the Apple Card and paid off with six monthly no-interest payments.

Apple hopes that by expanding its Apple Card installment plans, it will sell more devices

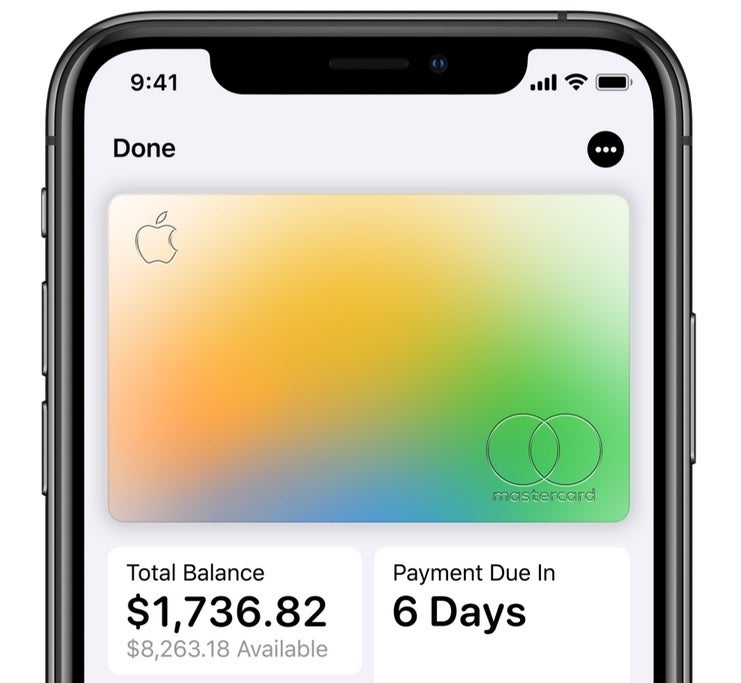

While Apple declined to comment on the report, CEO Tim Cook mentioned during the company's fiscal second-quarter earnings call in April that the company was going to extend its installment plans to other devices beyond the iPhone. Payments will be handled through the Apple Card section of the iPhone's Wallet app and educational discounts can still be applied.

Apple Card holders can now buy more Apple devices using installment payments

Not only will extending the installment plans to additional devices help increase sales of the Apple products involved, it just might result in more applications for the card, which Apple is offering through a partnership with investment banking giant Goldman Sachs. The Apple Card doesn't charge an annual fee nor is there a late fee. In fact, there are no fees added at all. And Apple says that its goal is to provide interest rates that are among the lowest in the industry.

When it comes time to pay each month, Apple will estimate how much interest you will owe and suggest an amount to pay each month to help holders pay off their balance faster. And Apple Card holders also can earn 1% to 3% cashback depending on what they buy with the card.

If you want to apply for the card, you can do so from the Apple Card website. You can also apply from the Wallet app on the iPhone or by going to Settings > Wallet & Apple Pay on the iPad. To apply for the card you need to be a U.S. citizen or resident 18 years of age or older and your device must be running the latest version of iOS. Most importantly, your iPhone needs to be as model compatible with the Apple Pay mobile payment app. Those devices include iPhone models with Face ID, iPhone models with Touch ID (except for the iPhone 5s) and iPad models with Touch ID or Face ID.

Back in November, Goldman Sachs denied that Apple Card approvals were sexist when it turned out that men (some with lower credit scores than their wives) were being awarded much larger credit lines than their spouses. Even Apple co-founder Steve Wozniak noted that his limit was 10 times larger than Mrs. Wozniak's credit line. The creator of the Ruby on Rails web framework, David Heinemeier Hansson, said that even though he and his wife share their assets he got 20 times the credit limit for his Apple Card than his wife received. Apple weighed in by stating, "Goldman Sachs uses your credit score, your credit report, and the income you report on your application when reviewing your Apple Card application."

Things that are NOT allowed: