Wall Street firm sees one key Apple unit (not iPhone) pushing the company to a $4 trillion valuation

It's hard to believe that it was nearly five years ago when Apple and Amazon were battling to become the first U.S. publicly traded firm to reach a valuation of $1 trillion. For tech nerds and those that follow the stock market closely, this was almost like watching Maris and Mantle take aim at Babe Ruth's single-season home run record in 1961. Apple won the race and was valued at over $1 trillion on August 2nd, 2018.

A tad over two years later, on August 20th, 2020, Apple became the first U.S. public company to reach a valuation of $2 trillion. And in January of 2022, the Cupertino-based tech giant was the first publicly traded U.S. outfit to be valued at $3 trillion. But for a while, that was where the story ended. Since first reaching $3 trillion in valuation, Apple's shares dropped from the $179 area to under $130 last December. Apple rallied and recently made a new all-time high above $190 partially due to the Vision Pro spatial computer it introduced at WWDC.

Wedbush says Apple could be valued at $4 trillion by 2025

And now, per BGR, Wall Street brokerage firm Wedbush has released a note to clients in which it says that Apple could hit a $4 trillion valuation by 2025. The current valuation of the company is just under $3 trillion and it will once again cross over that mark with a print (that's stock market lingo!) at $190.73. As I type this article, Apple is trading at $189.78 so it is not far away from a return to $3 trillion.

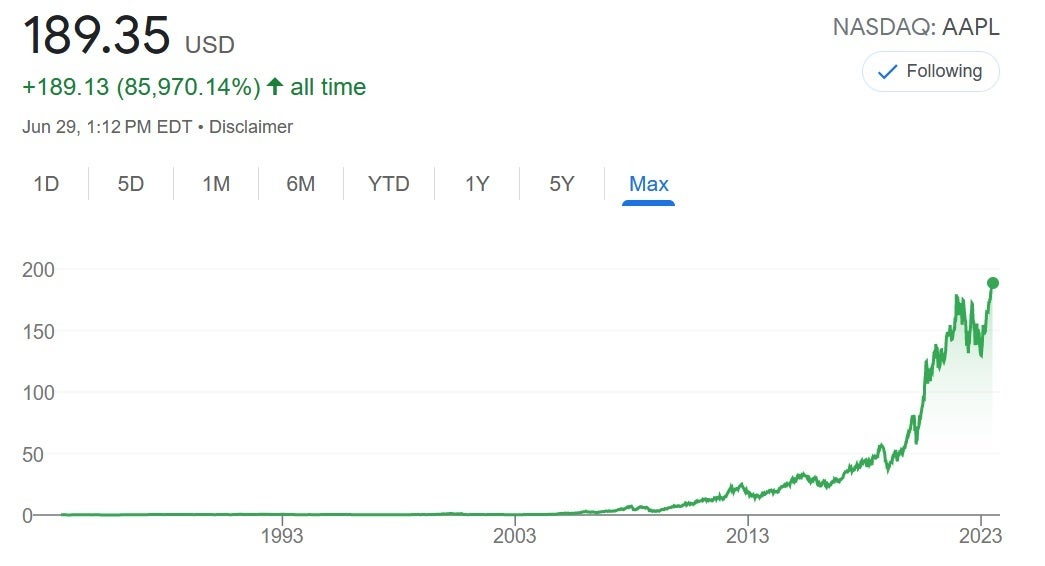

Since going public in December 1980, Apple's shares are up nearly 86,000%

Wedbush tells clients about Apple's relative strength during the shares' recent journey back to the $3 trillion mark after selling off starting in January 2022. Apple, Wedbush writes, "navigated a myriad of China supply chain challenges along with a softer macro over the last 18 months in Rock of Gibraltar fashion, and thus Cook and Cupertino find themselves back against all odds (from the bear view) on the doorstep of the $3 trillion market cap threshold this week."

And the brokerage firm says that while many consider Apple to be a "broken growth story," Wedbush sees the company heading into a "massive renaissance of growth over the next 12 to 18 months." The brokerage house says that Apple is being overlooked by investors despite what Wedbush calls a "massive installed base upgrade opportunity around iPhone 14."

And as we hear often from those working on the street called Wall, the next iPhone models will launch a super cycle. In this case, though, Wedbush calls the iPhone 15 story "a mini super cycle" in the making as it expects a quarter of those iPhone owners who have failed to upgrade over the last four years to do so starting this year. Of course, every year there is at least one securities house calling for an iPhone super cycle.

Apple's shares will be driven by its second-largest business unit after the iPhone

But it isn't the iPhone that has Wedbush analysts salivating over Apple's shares. Talking about Apple's services revenue (the unit is Apple's second largest after the iPhone), Wedbush says that when it comes to services Apple is playing chess when others are playing checkers. The firm notes that for fiscal 2024, Apple is on pace to reach $100 billion in revenue compared to the $50 billion generated by the unit in fiscal year 2020.

The note to clients says, "Herein lies the key to the valuation re-rating that we believe will continue to take place around Apple's stock as the Street further appreciates the sheer massive potential of this services revenue that we now assign a valuation in the $1.4 trillion range." Apple's services unit includes the App Store, Apple Pay, iCloud, Apple Music, Apple News+, Apple TV+, Apple Fitness, Apple Card, Apple Arcade, Apple Books, Apple One, and more.

Wedbush also believes that the Vision Pro headset could help Apple achieve a $4 trillion valuation by 2025. The firm calls it the "first step in a broader strategy for Apple to build out a generative AI-driven app ecosystem for its golden customer base that will have thousands of use cases across fitness, health, sports/movies," and more.

A rough back-of-the-envelope calculation shows that for Apple to reach a $4 trillion valuation, the shares would have to rise approximately 34% from the current price to $253.74.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: