AirPods shipments decline over 33% in Q3 as Samsung cuts into Apple's lead

Ever since Apple released the AirPods in December 2016, the true wireless stereo (TWS) earbuds have been a hit. Last year, the device continued to lead the audio wearables category in the number of units shipped and over 100 million units were sold last year. Back in April, a report stated that Apple was planning to build 75 million to 85 million pairs of AirPods this year down from the 110 million that were manufactured in 2020.

AirPods shipments declined by over 33% during the third quarter on an annual basis

That was the first sign that consumers might be getting tired of the device which looked so strange when first donned by users five years ago. These days you can't go out into the city without running into several people wearing a pair. But back in October, a report stated that AirPods were out and wired earbuds were in, a trend that picked up momentum when influential celebrities started to make the switch to old school wearables.

Apple remains the leader in shipping TWS devices

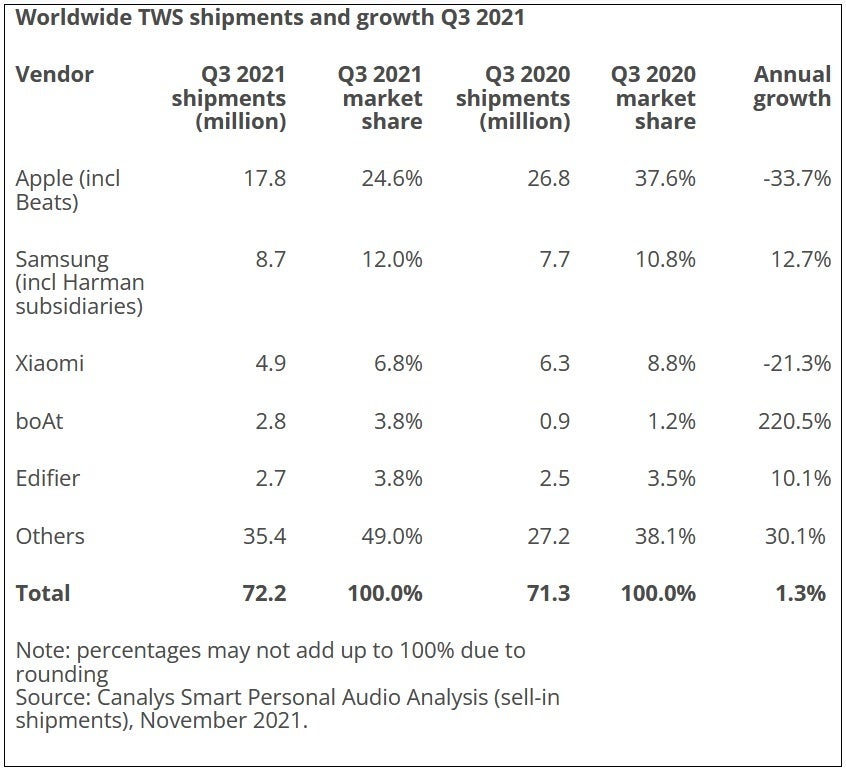

Market researcher Canalys issued its third-quarter report on global shipments in the TWS market during the third quarter. The data includes deliveries made from July through the end of September and revealed a sharp 33.7% decline in AirPods and Beats shipments during the quarter. For the three months, Apple shipped 17.8 million pairs of AirPods and Beats wearables compared to the 26.8 million it delivered during the same quarter last year.

As a result, Apple's market share in the TWS industry declined from 37.6% to 24.6%. Meanwhile, Samsung (including Harmon Industries) has picked up some ground on Apple as its shipments of TWS devices rose 12.7% to 8.7 million pairs during the quarter. That compares with the 7.7 million shipped a year ago and moved Sammy to within 9.1 million units of Apple from the 19.1 million unit lead that Apple had at the same time last year.

Xiaomi finished third with Q3 shipments of 4.9 million TWS wearables giving the company 6.8% of the global TWS market. However, on an annual basis, its shipments declined by 21.3%. India's boAt and China's Edifier were fourth and fifth with shipments during Q3 of 2.8 million and 2.7 million respectively.

The company with the largest gain on an annual basis during the quarter was boAt. The firm saw its TWS shipments rise 220.5% from the third quarter of 2020 to the same quarter this year.

Canalys blamed some of the decline in Apple's AirPods shipments to consumers waiting for Apple to release the third-generation AirPods. That took place in late October which was after the end of the third quarter and shipments of the latest model did not qualify for Canalys' third-quarter report. Samsung rode the demand for its Galaxy Buds 2 and from the latest additions to JBL's TWS lineup to report its solid results.

Canalys Research Analyst Ashweej Aithal said, "There is no turning back, and Canalys forecasts that TWS growth will accelerate. We expect the next quarter to be the turning point where the TWS category overtakes wireless earphones in shipment numbers in India and other markets. The challenge is to ensure robust supply, given the supply chain bottlenecks and the push to manufacture locally."

"Audio players, such as Jabra, Sony and JBL, are now taking an increasingly aggressive stance by peppering TWS models across a range of price points," stated Canalys Research Analyst Sherry Jin. "These players are pressured to lower the average selling price of their TWS devices to make themselves competitive in the market. Together with the release of the third-generation AirPods, the global TWS market is expected to return to robust growth in Q4 in time for the holiday season."

During the third quarter, shipments of TWS units narrowly topped last year's total by a count of 72.2 million compared with the 71.3 million delivered during last year's third quarter. Those figures provided the TWS industry with a slight 1.3% increase year-over-year.

Things that are NOT allowed: