Xiaomi and Apple were the top two global wearable shippers during the second quarter of 2017

Xiaomi had the largest market share among wearable manufacturers during the second quarter, just edging out Apple

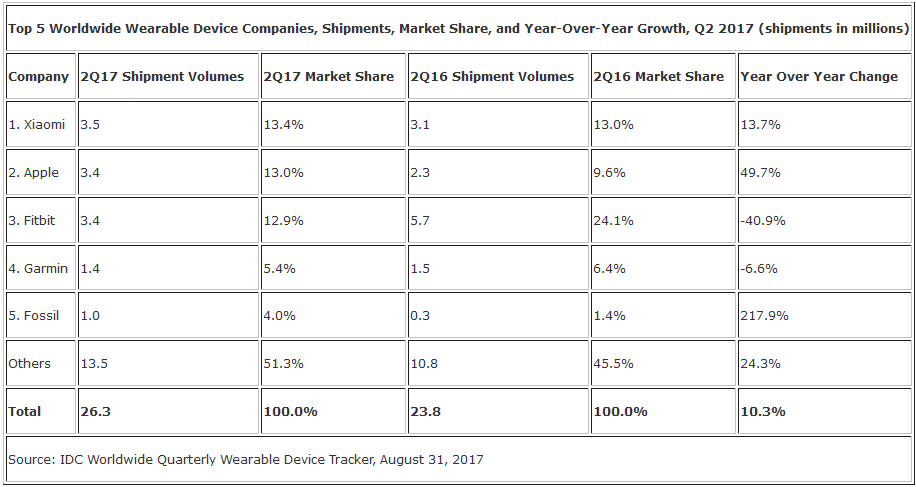

According to analysis firm IDC, worldwide shipments of wearable devices rose 10.3% year-over-year during the second quarter of 2017. For the three-month period from April through June, a total of 26.3 million wearable units shipped. For the first time ever, basic wearable devices (which are those that don't run third party apps) had a year-over-year decline in shipments with an annual growth rate of -.9%. On the other hand (no pun intended), smartwatch shipments rose at an annual rate of 60.9% in the second quarter.

As we pointed out, Apple's 3.4 million Apple Watch units delivered from April through June fell just shy of Xiaomi's shipments. But for Apple, it still represented an outstanding increase of 49.7% year-over-year from the 2.1 million watches that the tech titan shipped in Q2 2016. Apple now owns 13% of the wearable market. With its Apple Watch Series 3 expected to be unveiled on September 12th carrying an embedded SIM card and an LTE radio, this new Apple Watch variant will reportedly make and take calls and connect to the internet without having to pair to a user's iPhone. This model could help Apple surpass Xiaomi in the rankings by the end of this year.

Garmin's 1.4 million wearable units shipped globally during the second quarter placed it fourth with a market share of 5.4%. During 2016's second quarter, Garmin had 1.5 million units in transit, which works out to a decline of 6.6% year-over-year. And the most improved performer in the second quarter among the top five wearable shippers globally was Fossil. The 1 million wearable units it shipped in the quarter was an impressive increase of 217.9% year-over-year. In 2016, Fossil delivered only 300,000 units. Its market share increased greatly from last year's 1.4% to this year's 4% share during the 2017 second quarter. Fossil's focus on fashion stores allowed it to do well with its smartwatches carrying the Michael Kors and Fossil names.

"The transition towards more intelligent and feature-filled wearables is in full swing. For years, rudimentary fitness trackers have acted as a gateway to smartwatches and now we're at a point where brands and consumers are graduating to a more sophisticated device. Previous niche features such as GPS and additional health tracking capabilities are quickly becoming staples of the modern smartwatch. Just a year ago only 24.5% of all wearables had embedded GPS while today that number has reached almost 41.7%. Equally important to device features will be the algorithms tracking workouts and providing health insights. There is growing interest from the medical industry to adopt wearables and consumer expectations are also on the rise. This is where companies like Apple and Fitibit have the potential to maintain their lead as their investments in the tracking and perhaps diagnosing of diseases will be a clear differentiator from low-cost rivals."-Jitesh Ubrani, senior research analyst, IDC Mobile Device Trackers

source: IDC

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: