There's a connection between Apple shares' freefall and Foxconn losing some iPhone 15 Ultra orders

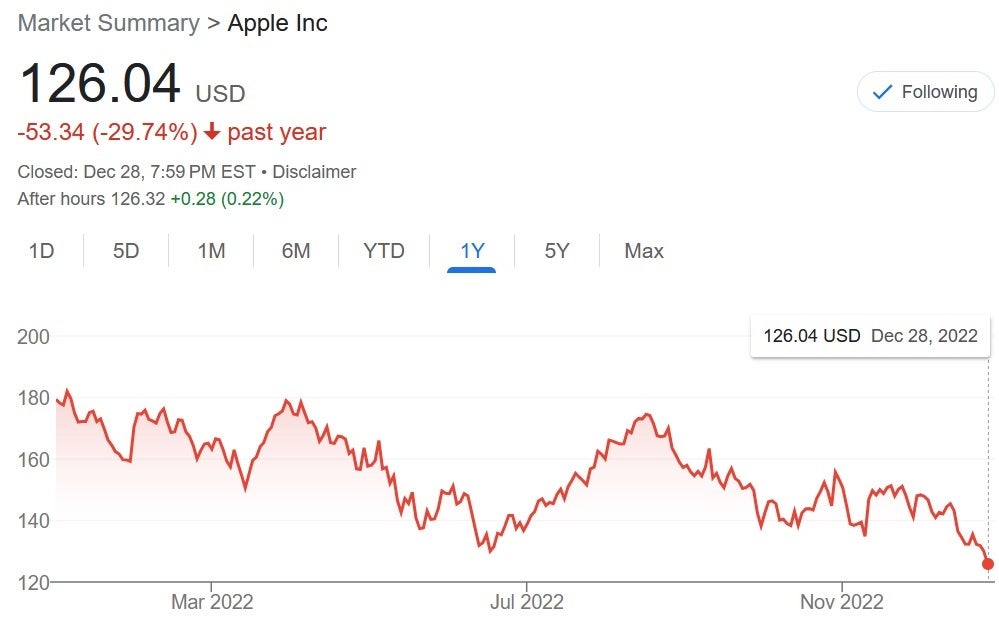

Apple shares are tumbling and investors are dumping the stock of the most famous tech company in the world. For technical analysts who use charts to predict the future trends of stocks, Apple made a huge sell signal today by hitting a 52-week low at $125.87. Many chartists will tell you that a downtrend consists of a series of three lower highs and three lower lows. By hitting a 52-week low on Wednesday, Apple has made this pattern for 2022.

Early in January, Apple made a 52-week high at $182.94. In the middle of March, the stock dropped down to $150 before falling just short of the January high at the tail end of March. In May, the stock took out the old low in the $150 area declining to $130 in June. A rebound took the stock to a peak above $173 in August, but that was well short of the previous high. With three lower peaks, undercutting the $130 area would signal a downtrend for the stock. That happened today with a decline of $3.99 to $126.04, a new 52-week low.

Apple's shares have made a series of lower highs and lower lows

What has Apple investors scared? The COVID outbreak in China has forced Apple's top contract manufacturer Foxconn to cut back sharply on production of the iPhone 14 Pro and iPhone 14 Pro Max. As the two priciest iPhone models available, Apple's revenue is bound to take a hit and Apple even issued a warning to both investors and customers last month. "We now expect lower iPhone 14 Pro and iPhone 14 Pro Max shipments than we previously anticipated and customers will experience longer wait times to receive their new products," the company said.

Apple's shares have taken a dive this year

In addition, the iPhone 14 Plus, despite its large 6.7-inch display and outstanding battery life, has been a flop. Demand for the phone is weaker than expected. According to market researcher TrendForce (via 9to5Mac), the Foxconn factory in China that produces the most iPhone units (which is the one in Zhengzhou) has not been able to hike its utilization rate above 70% of capacity since October. Trying to make up for lost production, Foxconn turned to its plant in Shenzhen City, but the plant there can't make up the shortfall.

TrendForce has cut its estimate of 2022 iPhone 14 production to 78.1 million units. And it says that the labor shortage problems in China that are hurting Apple this year could get worse during the first quarter of 2023. As a result of this and other factors, the report from TrendForce calls for a 22% year-over-year decline in iPhone production for the calendar first quarter to 47 million units. The research firm says that Apple is working very hard to move as much production as possible out of China and into India and Vietnam.

Apple will reportedly take some iPhone 15 Ultra orders away from Foxconn

While this doesn't move any iPhone production out of China, possibly to punish Foxconn for the staffing issues it has had this year, Apple is reportedly going to take some of its orders for next year's iPhone 15 Ultra away from Foxconn and turn them over to Luxshare. While Luxshare has a plant in Vietnam making certain Apple products, it is not set up to assemble the iPhone which means that even if this becomes a fact, Apple will have to depend on Luxshare's factory in China to assemble its most expensive phone.

Foxconn has produced all of the iPhone Pro models over the last few years, but the decline in Apple's stock over the last couple of months could be traced back to the problems that Foxconn has had keeping its assembly lines fully manned. And the violent protests between Foxconn workers and security also might be a factor when Apple decides whether to pull iPhone 15 Ultra orders from its most important contract manufacturer.

As TrendForce writes, "For 2023, Apple aims to double its device production capacity in India and have factories in Vietnam start making contributions by the middle of the year. In view of the escalating trade dispute between China and the US, Apple will be compelled to rely only on production sites outside China to meet the sales demand of the North American market."

The research firm adds, "In order to realize this, TrendForce believes that at least 30~35% of Apple’s entire device production capacity will have to be located in Vietnam and India. Therefore, Apple will need to keep raising the share of device production based in these two countries over the next several years."

All of this makes for a depressing backdrop that is leading Apple investors to sell their shares. Over the last year, Apple's stock has declined by $53.34 or nearly 30%. That works out to a stunning decline in market valuation for Apple of close to one trillion dollars over the course of this year.

Things that are NOT allowed: