Apple sold 13.8% fewer iPhones during the second quarter; Huawei sold 16.5% more handsets

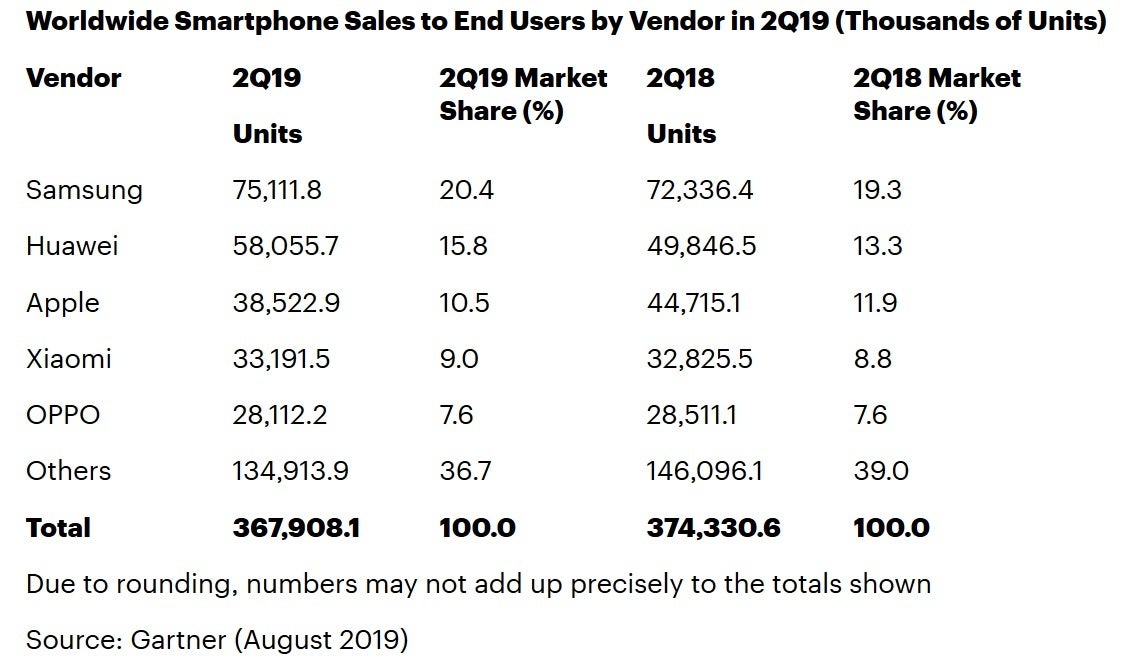

The global smartphone market continued to languish during the second quarter according to the latest report from Gartner. 367.9 million units were sold to end-users during the three month period from April through June, down 1.7% from the 374.3 million units rung up during the same period last year. The analytical firm's senior research director Anshul Gupta notes that high-end models have experienced a harsher slow down in demand than low and mid-range handsets. To generate upgrades, Gupta says that manufacturers are trying things like bezel-less displays, multi-camera setups in back and front and larger capacity batteries.

Samsung remains King of the smartphone world after selling 75.11 million handsets during the quarter. The company's market share rose year-over-year from 19.3% to 20.4%. Huawei's sell-through of 58.06 million phones gave it a 15.8% slice of the global smartphone pie. The company had hoped to be on top of this list by the fourth quarter, but its placement on the U.S. Entity List makes that a long shot. Huawei is not allowed to access its U.S. supply chain, although U.S. suppliers have a second 90-day window to help the company service its existing customers and update certain smartphone models. Despite the ban, Huawei sold 16.5% more units during the period, compared to the same quarter last year.

Apple iPhone sales declined 13.8% during the quarter on a year-over-year basis

Gartner's data shows Apple selling 38.52 million iPhones during the quarter, down 13.9% from the 44.72 million units it sold during last year's second quarter. The company no longer reveals this data during its quarterly earnings report but does release a breakdown of revenue. For the calendar second quarter (Apple's fiscal third-quarter), iPhone revenue declined 12% and represented less than 50% of the company's total revenue for the first time since 2012. According to Gartner, the iPhone accounted for 10.5% of smartphone sales during the three-month period.

Samsung remained on top of the global smartphone market during the second quarter

If Apple continues to struggle with iPhone sales, it will soon be surpassed by Xiaomi. The latter sold 33.19 million phones globally from April through June, representing 9% of the market. Oppo finished fifth after selling 28.11 million phones in the quarter, giving it 7.6% of the smartphone market.

"“Strong demand for Samsung’s new Galaxy A series smartphones and the revamp of its entire entry-level and mid-range smartphone range helped this positive performance. Demand for Samsung’s flagship Galaxy S10 started to weaken during the quarter, however, indicating that achieving growth in 2019 as a whole will be a challenge...too few incremental benefits are preventing existing iPhone users from replacing their smartphones"-Anshul Gupta, senior research director, Gartner

The struggling smartphone industry is a worldwide phenomenon. Gartner points out that of the top five smartphone markets in the world, only China and Brazil showed growth on an annual basis. China remains the top market in the world for connected handsets with sales of 101 million units during the quarter, a small gain of 0.5% Sales in the country benefitted from lower prices as vendors looked to get rid of their inventories of 4G LTE phones with more 5G models made available. The 10.8 million smartphones sold in Brazil from April through June was 1.8% more than the number rung up in the country during the same time period last year. In India, the world's second largest smartphone market, 35.7 million phones were sold during the quarter. That was a 2.3% decline on an annual basis as fewer consumers in the country decided to upgrade from a feature phone to a smartphone.

Gartner says that smartphone sales will remain weak for the rest of the year and that a total of 1.5 billion handsets will be sold to end-users during 2019.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: