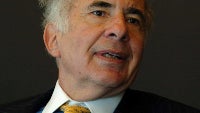

Investor Icahn wants Apple to make $150 billion tender offer for the company's stock

Investor Carl Icahn has just scored a better than 400% profit after dumping his shares in Netflix. Now, he is turning his attention to Apple. The former "greenmailer" has written an open letter to Apple CEO Tim Cook urging Apple to make an immediate tender offer for $150 billion of Apple stock at the current price of $525. A tender offer at that price would allow Apple stockholders to sell their holdings back to the company which would lower the number of shares outstanding. This would raise the company's earnings per share figure which should lead to a higher stock price.

The long time stock market trader even computed that by borrowing the entire $150 billion at 3% and using the money to buy back the stock, it would produce an immediate 33% boost to Apple's earnings. That, said Icahn, would lead to an immediate 33% jump in the price of the stock assuming no change in the company's P/E ratio. The one time raider, who managed to avoid getting caught in the Michael Milken-Ivan Boesky insider trading scandal that defined the market in the 1980's, sees Apple's shares rising to as high as $1250 assuming that the shares receive a normal valuation instead of the discount they now have.

The lengthy open letter from Carl Icahn appears below.

source: AppleInsider

This isn't the first time that Icahn has tried to get Apple to buy back its stock. Back in August, he suggested the same plan to Apple via a tweet and subsequently met with Tim Cook. Icahn now holds 4.7 million shares of the Cupertino based tech titan which means that he added 700,000 shares recently. His stake is now valued at $2.5 billion. Cajoling companies that he invests in to buy back stock or take other moves to push up the stock price is how Icahn makes his money. So far though, Apple has refused to follow the investor's game plan and there is no indication that it will. Icahn has told a television audience on Thursday afternoon that he would consider asking shareholders to vote on his plan via a proxy vote which would force Apple executives to buy back the stock. Stay tuned!

The lengthy open letter from Carl Icahn appears below.

"Dear Tim:

It was a pleasure meeting you for dinner at the end of September. When we met, my affiliates and I owned 3,875,063 shares of Apple. As of this morning, we owned 4,730,739 shares of Apple, an increase of 22% in position size, reflecting our belief the market continues to dramatically undervalue the company, even when taking into account the recent market appreciation, which in turn makes our proposal unchanged with respect to a $150 Billion buyback. We were pleased to hear at our dinner that you appreciated our input and that you would speak to us again in three weeks to continue the dialogue. In anticipation of doing so soon, we aim to reiterate in this letter the point of view already expressed to you directly with the hope of effectively summarizing it for the company's board of directors and our fellow shareholders.

From our perspective, Apple is the world's greatest consumer product innovator and has one of the strongest and most respected brand names in history. We consider Apple to be our most compelling investment. I first informed my followers on Twitter on August 13, 2013 of my "large position." I also expressed to you my opinion that "a larger buyback should be done now." At that time, we owned 3,448,663 shares and the stock price was $467. Since then we have purchased an incremental 1,282,076 shares (bringing the total value of my position to $2.5 Billion) and we currently intend to buy more.

We want to be very clear that we could not be more supportive of you, the existing management team, the culture at Apple and the innovative spirit it engenders. The criticism we have as shareholders has nothing to do with your management leadership or operational strategy. Our criticism relates to one thing only: the size and timeframe of Apple's buyback program. It is obvious to us that it should be much bigger and immediate.

When we met, you agreed with us that the shares are undervalued. In our view, irrational undervaluation as dramatic as this is often a short term anomaly. The timing for a larger buyback is still ripe, but the opportunity will not last forever. While the board's actions to date ($60 billion share repurchase over three years) may seem like a large buyback, it is simply not large enough given that Apple currently holds $147 billion of cash on its balance sheet, and that it will generate $51 billion of EBIT next year (Wall Street consensus forecast).

The S&P 500 trades at roughly 14x forward earnings. After backing off net cash, Apple trades at just 9x (not factoring into account that the company has a significantly lower cash tax rate than the rate Wall Street analysts use). This discount (cash adjusted) becomes even more compelling given our confidence that Apple will grow earnings per share at a rate well in excess of the S&P 500 for the foreseeable future. With such an enormous valuation gap and such a massive amount of cash on the balance sheet, we find it difficult to imagine why the board would not move more aggressively to buy back stock by immediately announcing a $150 Billion tender offer (financed with debt or a mix of debt and cash on the balance sheet).

While this would certainly be unprecedented because of its size, it is actually appropriate and manageable relative to the size and financial strength of your company. Apple generates more than enough cash flow to service this amount of debt and has $147 billion of cash in the bank. As we proposed at our dinner, if the company decided to borrow the full $150 billion at a 3% interest rate to commence a tender at $525 per share, the result would be an immediate 33% boost to earnings per share, translating into a 33% increase in the value of the shares, which significantly assumes no multiple expansion. Longer term (in three years) if you execute this buyback as proposed, we expect the share price to appreciate to $1,250, assuming the market rewards EBIT growth of 7.5% per year with a more normal market multiple of 11x EBIT.

It is our belief that a company's board has a responsibility to recognize opportunities to increase shareholder value, which includes allocating capital to execute large and well-timed buybacks. Apple's Board of Directors does not currently include an individual with a track record as an investment professional. In my opinion, any further delay in executing the buyback we hereby propose will reflect this lack of expertise on the board. My firm's success and my expertise as an investor would be difficult for anyone to argue. Per my investment thesis, commencing this buyback immediately would ultimately result in further stock appreciation of 140% for the shareholders who choose not to sell into the proposed tender offer. Furthermore, to invalidate any possible criticism that I would not stand by this thesis in terms of its long term benefit to shareholders, I hereby agree to withhold my shares from the proposed $150 Billion tender offer. There is nothing short term about my intentions here.

Sincerely,

Carl Icahn

Chairman, Icahn Enterprises (IEP)"

It was a pleasure meeting you for dinner at the end of September. When we met, my affiliates and I owned 3,875,063 shares of Apple. As of this morning, we owned 4,730,739 shares of Apple, an increase of 22% in position size, reflecting our belief the market continues to dramatically undervalue the company, even when taking into account the recent market appreciation, which in turn makes our proposal unchanged with respect to a $150 Billion buyback. We were pleased to hear at our dinner that you appreciated our input and that you would speak to us again in three weeks to continue the dialogue. In anticipation of doing so soon, we aim to reiterate in this letter the point of view already expressed to you directly with the hope of effectively summarizing it for the company's board of directors and our fellow shareholders.

From our perspective, Apple is the world's greatest consumer product innovator and has one of the strongest and most respected brand names in history. We consider Apple to be our most compelling investment. I first informed my followers on Twitter on August 13, 2013 of my "large position." I also expressed to you my opinion that "a larger buyback should be done now." At that time, we owned 3,448,663 shares and the stock price was $467. Since then we have purchased an incremental 1,282,076 shares (bringing the total value of my position to $2.5 Billion) and we currently intend to buy more.

We want to be very clear that we could not be more supportive of you, the existing management team, the culture at Apple and the innovative spirit it engenders. The criticism we have as shareholders has nothing to do with your management leadership or operational strategy. Our criticism relates to one thing only: the size and timeframe of Apple's buyback program. It is obvious to us that it should be much bigger and immediate.

When we met, you agreed with us that the shares are undervalued. In our view, irrational undervaluation as dramatic as this is often a short term anomaly. The timing for a larger buyback is still ripe, but the opportunity will not last forever. While the board's actions to date ($60 billion share repurchase over three years) may seem like a large buyback, it is simply not large enough given that Apple currently holds $147 billion of cash on its balance sheet, and that it will generate $51 billion of EBIT next year (Wall Street consensus forecast).

The S&P 500 trades at roughly 14x forward earnings. After backing off net cash, Apple trades at just 9x (not factoring into account that the company has a significantly lower cash tax rate than the rate Wall Street analysts use). This discount (cash adjusted) becomes even more compelling given our confidence that Apple will grow earnings per share at a rate well in excess of the S&P 500 for the foreseeable future. With such an enormous valuation gap and such a massive amount of cash on the balance sheet, we find it difficult to imagine why the board would not move more aggressively to buy back stock by immediately announcing a $150 Billion tender offer (financed with debt or a mix of debt and cash on the balance sheet).

While this would certainly be unprecedented because of its size, it is actually appropriate and manageable relative to the size and financial strength of your company. Apple generates more than enough cash flow to service this amount of debt and has $147 billion of cash in the bank. As we proposed at our dinner, if the company decided to borrow the full $150 billion at a 3% interest rate to commence a tender at $525 per share, the result would be an immediate 33% boost to earnings per share, translating into a 33% increase in the value of the shares, which significantly assumes no multiple expansion. Longer term (in three years) if you execute this buyback as proposed, we expect the share price to appreciate to $1,250, assuming the market rewards EBIT growth of 7.5% per year with a more normal market multiple of 11x EBIT.

It is our belief that a company's board has a responsibility to recognize opportunities to increase shareholder value, which includes allocating capital to execute large and well-timed buybacks. Apple's Board of Directors does not currently include an individual with a track record as an investment professional. In my opinion, any further delay in executing the buyback we hereby propose will reflect this lack of expertise on the board. My firm's success and my expertise as an investor would be difficult for anyone to argue. Per my investment thesis, commencing this buyback immediately would ultimately result in further stock appreciation of 140% for the shareholders who choose not to sell into the proposed tender offer. Furthermore, to invalidate any possible criticism that I would not stand by this thesis in terms of its long term benefit to shareholders, I hereby agree to withhold my shares from the proposed $150 Billion tender offer. There is nothing short term about my intentions here.

Sincerely,

Carl Icahn

Chairman, Icahn Enterprises (IEP)"

source: AppleInsider

Things that are NOT allowed: