Lower growth in one key U.S. metric could hurt Apple's most profitable unit

As iPhone sales turn sluggish, Apple is counting more and more on the installed base of iPhones for revenue growth. To make this transition from hardware sales to work, Apple has aggressively expanded its Services unit by adding Apple News+, Apple TV+ and the upcoming Apple Arcade to its offerings. The Services segment is Apple's second largest division and is it's most profitable. Besides the previously mentioned additions, under the Services umbrella, you'll find Apple Music, the App Store, iTunes, AppleCare, Apple Pay and more. Apple is looking to expand revenue generated by this division from the $25 billion it collected in 2016 to $50 billion next year. For the fiscal second quarter ended in March, Apple generated $11.45 billion of Services revenue.

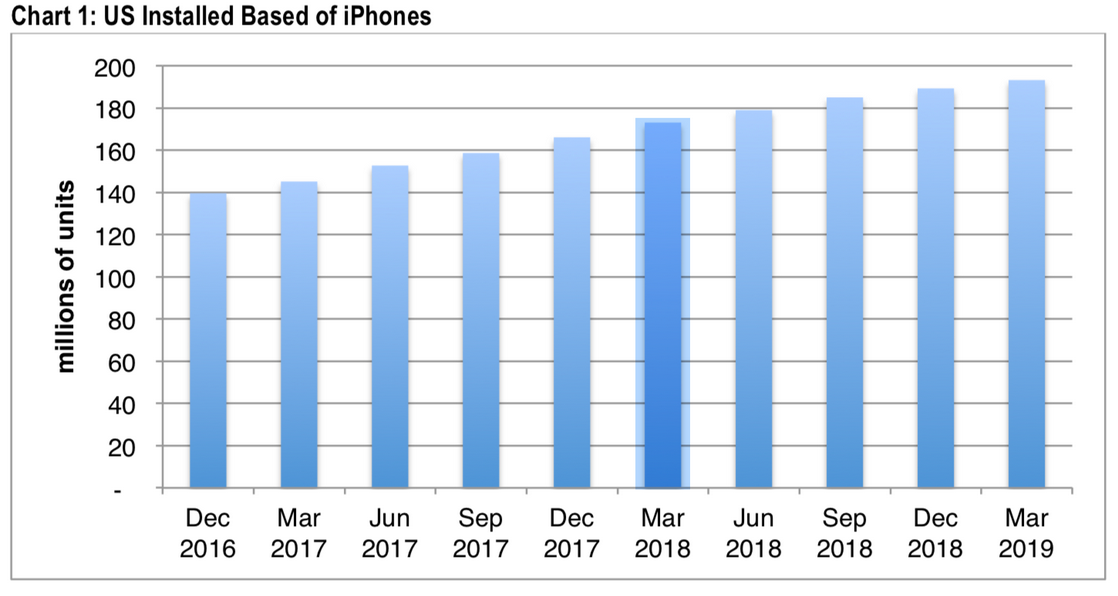

So as we pointed out, Apple really depends on the installed base of iPhones. But there is some bad news for Apple on this front; according to CIRP (via 9to5Mac) growth in the installed base of iPhones in the U.S. barely moved the needle in the first quarter of 2019. CIRP says that this number rose by only 4 million to 193 million at the end of March resulting in just 2.1% growth over the three month period. On a year-over-year basis, the growth in the installed base of iPhones in the states was 12%. To show you how growth in this key metric is slowing, for the first quarter of 2018 the sequential growth was 4% and 19% year-over-year.

Growth in the installed base of Apple iPhones in the states is slowing

The latest figure released by Apple showed that at the end of the company's fiscal first quarter, which ended in December, the global iPhone installed base was 900 million units. That gives Apple a large number of potential subscribers to collect recurring revenue from.

"The U.S. installed base of iPhones continues to plateau. Relative to the most recent quarters, and especially to the past two or three years, slowing unit sales and longer ownership periods mean that the growth in the number of US iPhones has flattened considerably. Of course, 12% growth in a year, after years of much greater growth is still good. However, investors grew accustomed to quarterly growth of 5% or more, and annual growth of almost 20%. This continuing trend prompts investors to wonder if iPhone sales outside of the US will compensate, and places greater pressure on Apple’s determination to sell other products and services to the installed base of iPhone owners."-Josh Lowitz, Partner, and Co-Founder, CIRP

Services revenue could be hurt by the attacks on the so-called "Apple Tax"

While Apple no longer releases the number of iPhone units sold each quarter, it does release revenue figures for the device. During the fiscal first quarter, iPhone revenue declined 15% year-over-year. Things got worse during the fiscal second quarter (January through March) when revenue attributed to the device declined 17% year-over-year. The upgrade cycle has expanded, but if current members of the installed base don't replace their currently used iPhone with a newer iPhone model, the installed base could start to decline.

And Apple's Services segment could face some pressure from companies and the courts fighting back at what is known as the "Apple Tax." This is the 30% cut that Apple takes on revenue generated in the App Store for subscriptions, paid apps and in-app payments. Back in January, AB Bernstein analyst Toni Sacconaghi worried what would happen to Apple's Services revenue if there were to be a big rebellion against this "tax." And sure enough, this has already started to happen with music streamer Spotify making complaints to the European Commission (EC). Now, the EC's competition commission will investigate the claim and could fine Apple as much as $26.6 billion. And last week, the U.S. Supreme Court ruled that Apple is a direct seller of apps in the App Store and can be sued by consumers claiming that app prices are higher than they should be because of the "Apple Tax."

Things that are NOT allowed: