Android, iOS wins are Symbian, BlackBerry's losses in Q1 2012

The first quarter of 2012 was a turning point - Symbian sales dropped catastrophically and BlackBerry continued sliding on the downward spiral. On the flipside of things, Android and iOS capitalized on the losses of the two platforms and gained market share in Q1 2012, according to the latest report by IDC.

In the first three months of the year, 8 out of 10 smartphones sold shipped with either Android or iOS. With a combined market share of 82%, Android and iOS are definitely in a two-horse race with no third contender in sight.

"The popularity of Android and iOS stems from a combination of factors that the competition has struggled to keep up with. Neither Android nor iOS were the first to market with some of these features, but the way they made the smartphone experience intuitive and seamless has quickly earned a massive following," IDC analyst Ramos Llamas said.

When it comes to Windows Phone, the most outspoken contender for a third mobile platform, IDC expects only slow growth throughout the year, at least until more carriers adopt WP handsets.

If you’re following the big four rating agencies, you’d notice that IDC is giving a much higher estimate of Android sales than say Strategy Analytics. IDC estimates 89.9 million Androids sold while Strategy Analytics estimates show 81 million. With the Galaxy S III launch this quarter, we expect excellent growth for Google’s platform. What are your projections, though? Let us know how you think the mobile landscape will change in Q2 in the comments below.

Android- and iOS-Powered Smartphones Expand Their Share of the Market in the First Quarter, According to IDC

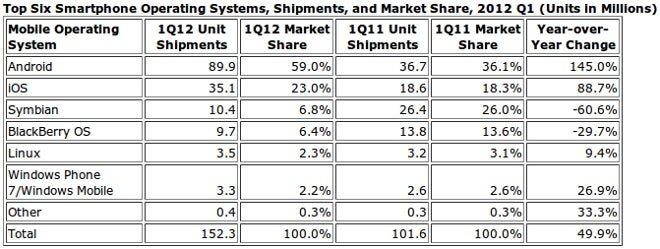

FRAMINGHAM, Mass. May 24, 2012 – Smartphones powered by the Android and iOS mobile operating systems accounted for more than eight out of ten smartphones shipped in the first quarter of 2012 (1Q12). According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, the mobile operating systems held shares of 59.0% and 23.0% respectively of the 152.3 million smartphones shipped in 1Q12. During the first quarter of 2011, the two operating systems held a combined share of 54.4%. The share gains mean that Android and iOS have successfully distanced themselves from previous market leaders Symbian and BlackBerry, as well as Linux and Windows Phone 7/Windows Mobile.

“The popularity of Android and iOS stems from a combination of factors that the competition has struggled to keep up with,” said Ramon Llamas, senior research analyst with IDC’s Mobile Phone Technology and Trends program. “Neither Android nor iOS were the first to market with some of these features, but the way they made the smartphone experience intuitive and seamless has quickly earned a massive following.”

“In order for operating system challengers to gain share, their creators and hardware partners need to secure developer loyalty,” said Kevin Restivo, senior research analyst with IDC’s Worldwide Mobile Phone Tracker program. “This is true because developer intentions or enthusiasm for a particular operating system is typically a leading indicator of hardware sales success.”

Operating System Highlights

Android finished the quarter as the overall leader among the mobile operating systems, accounting for more than half of all smartphone shipments. In addition, Android boasted the longest list of smartphone vendor partners. Samsung was the largest contributor to Android’s success, accounting for 45.4% of all Android-based smartphone shipments. But beyond Samsung was a mix of companies retrenching themselves or slowly growing their volumes.

iOS recorded strong year-over-year growth with sustained demand for the iPhone 4S following the holiday quarter and the addition of numerous mobile operators offering the iPhone for the first time. Although end-user demand remains high, the iPhone’s popularity brings additional operational pressures for mobile operators through subsidy and data revenue sharing policies.

Symbian posted the largest year-over-year decline, a result driven by Nokia’s transition to Windows Phone. But even as Symbian volumes have decreased, there continues to be demand for the OS from the most ardent of users. In addition, Nokia continues to support Symbian, as evidenced by the PureView initiative on the Nokia 808. Still, as Nokia emphasizes Windows Phone, IDC expects further declines for Symbian for the rest of this year.

BlackBerry continued on its downward trajectory as demand for older BlackBerry devices decreased and the market awaits the official release of BB 10 smartphones later this year. In addition, many companies now permit users to bring their own smartphones, allowing competitor operating systems to take away from BlackBerry’s market share. Although RIM has not officially released BB 10, initial glimpses of the platform have shown improvement.

Linux maintained its small presence in the worldwide smartphone market, thanks in large part to Samsung’s continued emphasis on bada. By the end of the quarter, Samsung accounted for 81.6% of all Linux-powered smartphones, a 3.6% share gain versus the prior-year period. Other vendors, meanwhile, have been experimenting with Android to drive volume. Still, Linux’s fortunes are closely tied to Samsung’s strategy, which already encompasses Android, Windows Phone, and later this year, Tizen.

Windows Mobile/Windows Phone has yet to make significant inroads in the worldwide smartphone market, but 2012 should be considered a ramp-up year for Nokia and Microsoft to boost volumes. Until Nokia speeds the cadence of its smartphone releases or more vendors launch their own Windows Phone-powered smartphones, IDC anticipates slow growth for the operating system.

Top Six Smartphone Operating Systems, Shipments, and Market Share, 2012 Q1 (Units in Millions)

1Q12 Mobile Operating 1Q12 Unit Market

System Shipments Share

Android 89.9 59.0% iOS 35.1 23.0% Symbian 10.4 6.8% BlackBerry OS 9.7 6.4% Linux 3.5 2.3% Windows Phone

7/Windows Mobile 3.3 2.2% Other 0.4 0.3%

T otal 152.3 100.0%

1Q11 Unit Shipments

36.7 18.6 26.4 13.8

3.2

2.6 0.3

101.6

1Q11 Market Share

36.1% 18.3% 26.0% 13.6%

3.1%

2.6% 0.3%

100.0%

Year-over- Year Change

145.0% 88.7% -60.6% -29.7% 9.4%

26.9% 33.3%

49.9%

Source: IDC Worldwide Mobile Phone Tracker, May 24, 2012

Notes: Smartphone OS shipments are branded shipments and exclude OEM sales for all vendors. Unbranded phones, also referred to as “White Phones”, are included.

Things that are NOT allowed: